Key Takeaways:

- Merck gains a positive outlook in its patent battle over Keytruda with Halozyme Therapeutics.

- Analysts predict robust growth potential with a significant upside for Merck's stock.

- Merck's stock is considered "Outperform" by brokerage firms, suggesting a promising investment opportunity.

Merck's Legal Victory Strengthens Keytruda's Market Position

Merck & Co. Inc. (MRK, Financial) recently received encouraging news from the U.S. Patent and Trademark Office regarding its legal skirmish with Halozyme Therapeutics. The USPTO has indicated a high probability that Merck will demonstrate certain Halozyme patents are unpatentable, particularly those integral to the Mdase technology employed in an injectable form of the cancer treatment Keytruda. This development could potentially bolster Merck's competitive advantage in the oncology market.

Wall Street Analysts' Forecast for Merck

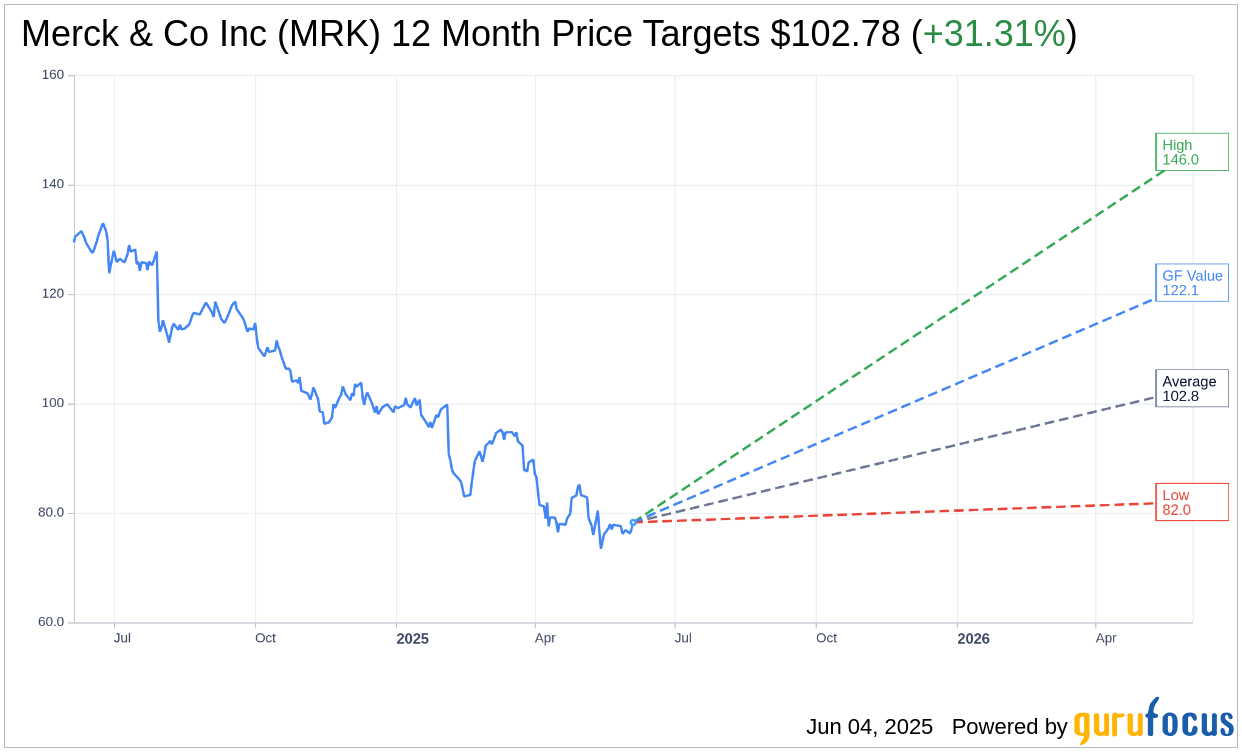

Based on insights from 23 analysts, the average one-year price target for Merck & Co. Inc. (MRK, Financial) is set at $102.78, with projections ranging from a high of $146.00 to a low of $82.00. This average target suggests a promising 31.31% upside from the current share price of $78.27. Investors can view more detailed estimate data on the Merck & Co Inc (MRK) Forecast page.

The consensus recommendation from 28 brokerage firms rates Merck & Co Inc (MRK, Financial) with an average score of 2.2, classifying it as "Outperform." The rating scale, which goes from 1 to 5, indicates that a score of 1 is a Strong Buy while 5 suggests a Sell.

Merck's GF Value and Investment Potential

GuruFocus estimates project a GF Value for Merck & Co. Inc. (MRK, Financial) of $122.10 in one year, marking a considerable 56% upside from its current market price of $78.27. The GF Value represents GuruFocus' assessment of Merck's fair trading price, calculated from historical trading multiples, past business growth, and future business performance forecasts. For more comprehensive data, visit the Merck & Co Inc (MRK) Summary page.

With positive legal outcomes and strong analyst support, Merck appears to provide a compelling opportunity for investors seeking growth in the pharmaceutical sector.