Descartes Systems Group (DSGX, Financial) reported its first-quarter fiscal 2026 earnings, highlighting a revenue of $168.7 million, which fell just short of the estimated $169.87 million. Despite this slight revenue miss, the company demonstrated strong annual growth as per their plans. Edward Ryan, the CEO, acknowledged the challenging economic and trade conditions affecting shippers, carriers, and logistics providers. These entities are dealing with complexities due to changes in global trade dynamics, tariffs, and economic predictions. Descartes continues to focus on aiding these companies by leveraging its expertise and solutions to navigate this intricate environment. The company remains dedicated to expanding its operations through strategic investments and maintaining cost efficiency, aiming to develop a leading network and technology for logistics-driven businesses.

Wall Street Analysts Forecast

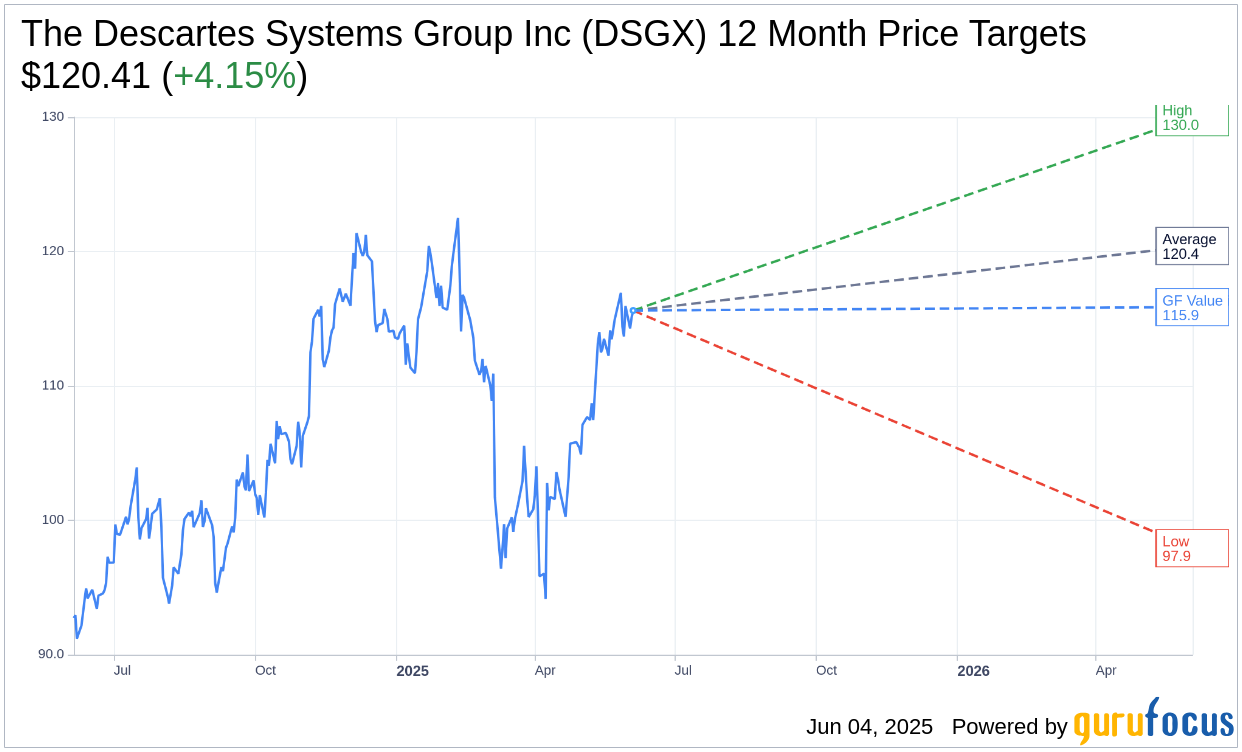

Based on the one-year price targets offered by 12 analysts, the average target price for The Descartes Systems Group Inc (DSGX, Financial) is $120.41 with a high estimate of $130.00 and a low estimate of $97.92. The average target implies an upside of 4.15% from the current price of $115.61. More detailed estimate data can be found on the The Descartes Systems Group Inc (DSGX) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, The Descartes Systems Group Inc's (DSGX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Descartes Systems Group Inc (DSGX, Financial) in one year is $115.87, suggesting a upside of 0.22% from the current price of $115.61. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Descartes Systems Group Inc (DSGX) Summary page.

DSGX Key Business Developments

Release Date: March 05, 2025

- Total Revenue: $167.5 million, up 13% from the previous year.

- Services Revenue: $156.5 million, representing 93% of total revenue, up 15% year-over-year.

- Net Income: $37.4 million, an increase of 18% from the previous year.

- Adjusted EBITDA: $75.0 million, up 14%, with a margin of 44.8%.

- Cash Flow from Operations: $60.7 million, representing 81% of adjusted EBITDA.

- Annual Revenue: $651 million, up 14% year-over-year.

- Annual Net Income: $143.3 million, up 24% from the previous year.

- Cash Reserves: Over $235 million, with an undrawn $350 million line of credit.

- Gross Margin: Consistent at 76% for both the quarter and the fiscal year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Descartes Systems Group Inc (DSGX, Financial) reported record fourth quarter and annual results with strong services revenue and adjusted EBITDA growth.

- Total revenues increased by 13% year-over-year, with services revenues up 15%, and net income rising by 27%.

- The company ended the year with over $235 million in cash and was debt-free with an undrawn $350 million line of credit.

- MacroPoint solutions continue to lead in real-time visibility, providing seamless shipment tracking and contributing significantly to growth.

- Recent acquisitions, including MyCarrierPortal and Sellercloud, have been integrated successfully and are contributing positively to the business.

Negative Points

- The business environment remains challenging due to geopolitical trade tariffs and economic uncertainty, impacting customer decision-making.

- There is a potential risk of reduced transaction volumes if international shipments decrease due to high tariffs.

- Foreign exchange headwinds negatively impacted revenue growth, with a reported $2 million year-over-year compression.

- Professional services and license revenues were lower compared to the previous quarter, partly due to seasonality and reduced hardware revenue.

- The company faces uncertainty in predicting future business conditions, which may affect quarterly financial patterns.