Travelers (TRV, Financial) has recently submitted a filing for an automatic mixed securities shelf. This move enables the company to offer a variety of securities to the public more efficiently when market conditions are favorable. By establishing this shelf registration, Travelers aims to enhance its flexibility in capital raising, allowing for better financial maneuverability in the future.

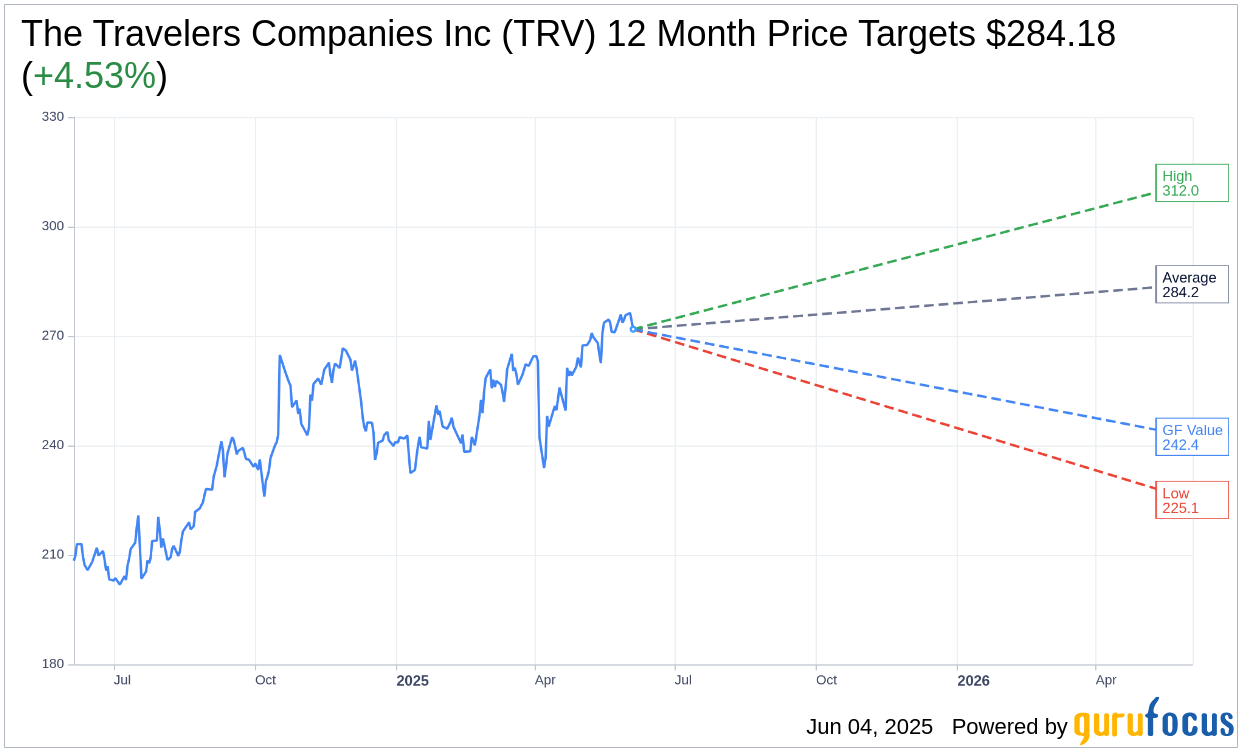

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for The Travelers Companies Inc (TRV, Financial) is $284.18 with a high estimate of $312.00 and a low estimate of $225.11. The average target implies an upside of 4.53% from the current price of $271.86. More detailed estimate data can be found on the The Travelers Companies Inc (TRV) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, The Travelers Companies Inc's (TRV, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Travelers Companies Inc (TRV, Financial) in one year is $242.40, suggesting a downside of 10.84% from the current price of $271.86. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Travelers Companies Inc (TRV) Summary page.

TRV Key Business Developments

Release Date: April 16, 2025

- Core Income: $443 million or $1.91 per diluted share.

- Core Return on Equity: 14.5% over the last four quarters.

- Underlying Underwriting Income: $1.6 billion pre-tax, up over 30% year-over-year.

- Net Earned Premiums: $10.7 billion.

- Consolidated Underlying Combined Ratio: Improved by 2.9 points to 84.8%.

- Catastrophe Losses: $1.7 billion pre-tax from California wildfires.

- Operating Cash Flows: $1.4 billion.

- Net Investment Income: $763 million after tax.

- Shareholder Capital Return: Nearly $600 million, including $358 million in share repurchases.

- Adjusted Book Value Per Share: Increased by 11% year-over-year.

- Net Written Premiums: $10.5 billion.

- Business Insurance Net Written Premiums: $5.7 billion, a 2% increase.

- Bond & Specialty Insurance Net Written Premiums: Grew by 6% to $1 billion.

- Personal Insurance Net Written Premiums: Grew by 5% to $3.8 billion.

- Expense Ratio: 28.3%, improved by 40 basis points year-over-year.

- Net Favorable Prior Year Reserve Development: $378 million pre-tax.

- Adjusted Book Value Per Share: $138.99 at quarter end.

- Quarterly Dividend Increase: 5% to $1.10 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Travelers Companies Inc (TRV, Financial) reported a substantial profit for the quarter with core income of $443 million, despite significant catastrophe losses from the California wildfires.

- The company achieved a core return on equity of 14.5% over the last four quarters, demonstrating strong underlying fundamentals.

- Net earned premiums reached $10.7 billion, with a consolidated underlying combined ratio improving by 2.9 points to 84.8%.

- The company returned nearly $600 million of excess capital to shareholders, including $358 million in share repurchases.

- The Board of Directors declared a 5% increase in the quarterly cash dividend, marking 21 consecutive years of dividend increases.

Negative Points

- Catastrophe losses from the California wildfires amounted to $1.7 billion pre-tax, significantly impacting the quarter's results.

- The personal insurance segment reported a loss of $374 million, with a combined ratio of 115.2% due to the wildfires.

- The company faces potential impacts from tariffs, which could lead to a mid single-digit increase in personal auto severity.

- Workers' compensation pricing remains under pressure, with continued pricing declines impacting growth.

- The company is managing constraints in property capacity, particularly in high-risk geographies, which affects growth in the personal insurance segment.