Five Below (FIVE, Financial) delivers a stellar first-quarter performance.

- Comparable sales soared by 7.1%, with a revenue surge of 19.5% to $970.5 million.

- EPS exceeded forecasts, reaching $0.86—3 cents above expectations.

- Despite CFO transition, outlook remains optimistic for Q2.

Impressive First-Quarter Financial Results

Five Below (FIVE, Financial) has set the stage for potential growth with its impressive first-quarter performance. The company reported a 7.1% increase in comparable sales, demonstrating its ability to capture consumer interest and drive sales. Revenue climbed an impressive 19.5%, reaching $970.5 million, showcasing strong operational capabilities. The earnings per share (EPS) of $0.86 not only met but surpassed analysts’ expectations by 3 cents, marking a significant financial achievement.

Wall Street Analysts Forecast

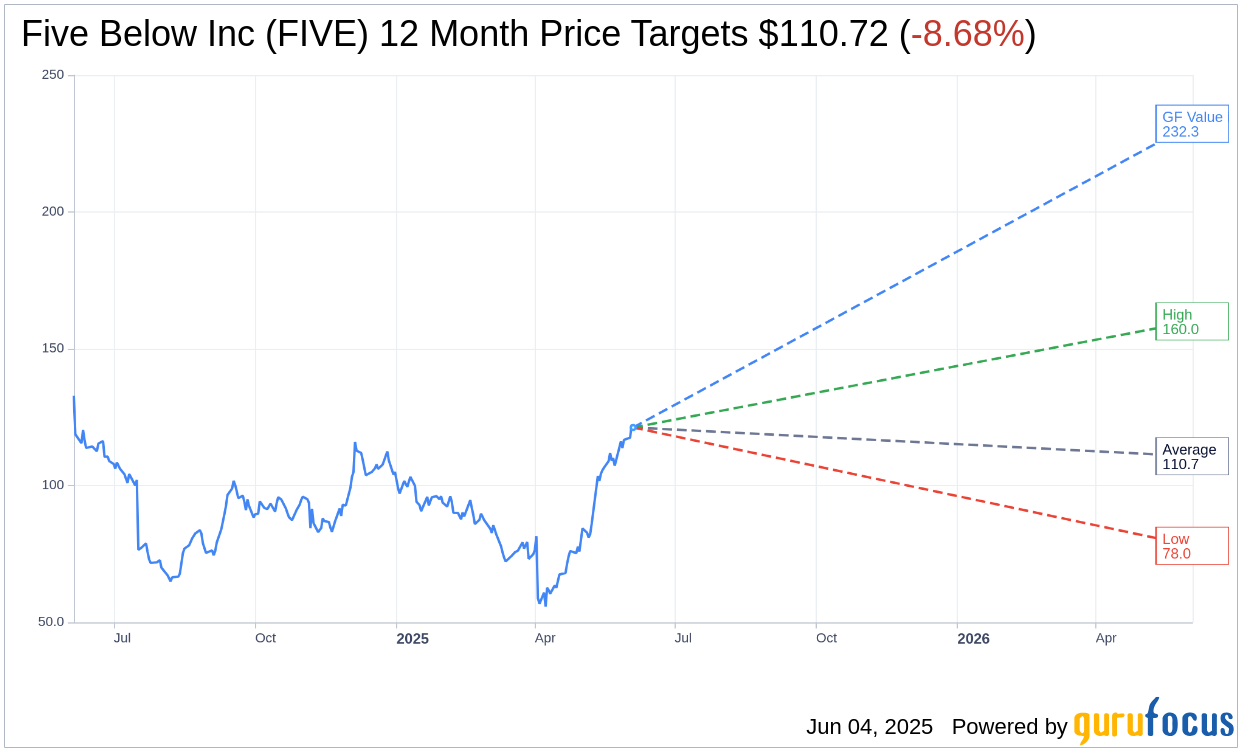

According to projections from 18 analysts, Five Below Inc (FIVE, Financial) holds an average price target of $110.72 for the next year, with estimates ranging between $78.00 and $160.00. Currently trading at $121.24, this average target suggests a potential downside of 8.68%. For a comprehensive look at these projections, visit the Five Below Inc (FIVE) Forecast page.

Analyst Ratings and GF Value

Consensus from 22 brokerage firms positions Five Below Inc (FIVE, Financial) with an average brokerage recommendation of 2.5, which translates to an "Outperform" status. This rating is part of a 1 to 5 scale where 1 signals a Strong Buy, and 5 indicates a Sell recommendation.

GuruFocus estimates suggest the GF Value for Five Below Inc (FIVE, Financial) in the coming year to be $232.25. This valuation hints at a promising upside of 91.56% from its current trading price of $121.24. GF Value is GuruFocus’ proprietary metric, providing a fair value estimate based on the stock's historical trading multiples, past business growth, and future performance projections. For further details, explore the Five Below Inc (FIVE) Summary page.

In summary, Five Below's strong financial performance coupled with optimistic analyst forecasts and a robust GF Value estimation suggests that the company is well-positioned for potential growth, despite the recent CFO change. Investors may find these insights valuable when considering their portfolio strategies.

- CEO Buys, CFO Buys: Stocks that are bought by their CEO/CFOs.

- Insider Cluster Buys: Stocks that multiple company officers and directors have bought.

- Double Buys: Companies that both Gurus and Insiders are buying

- Triple Buys: Companies that both Gurus and Insiders are buying, and Company is buying back.