- Dynavax Technologies (DVAX, Financial) faces a boardroom dispute as shareholder Deep Track Capital pushes for new board candidates.

- Analysts project a significant upside for DVAX, reflecting confidence in the company's valuation.

- GuruFocus metrics suggest strong potential for stock appreciation in the coming year.

Dynavax Technologies (DVAX) is at the heart of a corporate governance debate, as proxy advisory firm Glass Lewis stands against two board nominees. Despite the governance dispute, Glass Lewis acknowledges the strategic milestones achieved by Dynavax. The opposition comes as Deep Track Capital, a major shareholder with a 15% stake, criticizes the current board's performance, proposing alternative candidates. Shareholders are scheduled to deliberate these decisions at the annual meeting on June 11.

Wall Street's Outlook on Dynavax Technologies

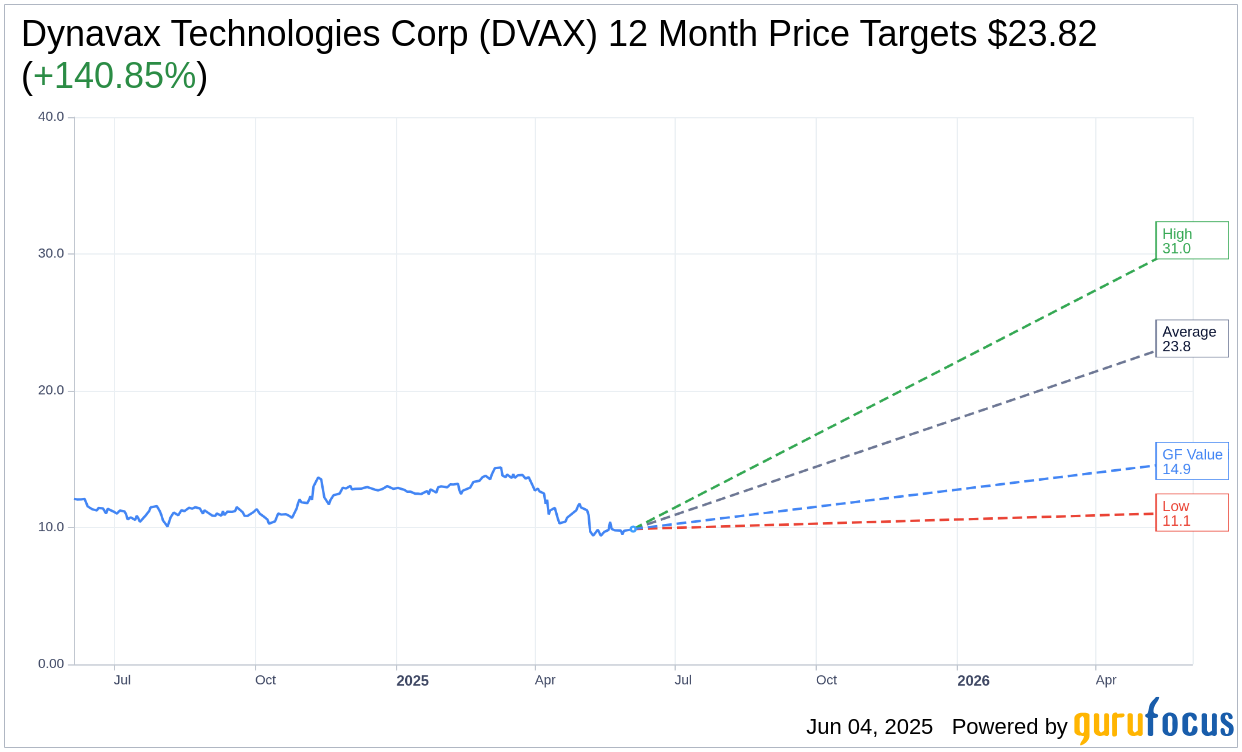

Market analysts offer a promising view for Dynavax Technologies Corp (DVAX, Financial) with one-year price targets from five analysts averaging $23.82. The projections range from a high of $31.00 to a low of $11.10, suggesting a substantial upside of 140.85% from the current stock price of $9.89. To explore detailed estimate data, visit the Dynavax Technologies Corp (DVAX) Forecast page.

Brokerage Recommendations

The consensus from six brokerage firms rates Dynavax Technologies Corp (DVAX, Financial) at 2.2, classifying it as "Outperform." This rating reflects a positive outlook, where 1 is a "Strong Buy" and 5 is a "Sell."

Understanding GF Value

According to GuruFocus estimates, the projected GF Value for Dynavax Technologies Corp (DVAX, Financial) in the upcoming year stands at $14.87. This figure implies a potential upside of 50.35% from the current trading price of $9.89. The GF Value is GuruFocus' assessment of what the stock ought to be valued at, based on historical trading multiples, previous growth, and future business performance expectations. For comprehensive data, refer to the Dynavax Technologies Corp (DVAX) Summary page.