Jefferies has commenced coverage of Excelerate Energy, denoted by the ticker EE, assigning a Buy rating and setting a price target of $39. The firm highlights Excelerate's strategic position in the liquefied natural gas (LNG) sector, underscored by its floating storage and regasification units (FSRU) and related infrastructure. These assets generate stable cash flows through long-term contracts, while maintaining low exposure to commodity risk.

Excelerate Energy is leveraging these strengths by expanding its asset portfolio, integrating new FSRU builds, and securing LNG sales and purchase agreements. Additionally, the company is enhancing its market presence by acquiring LNG-to-power assets from New Fortress Energy in Jamaica. This strategic expansion is positioned to capitalize on the growing demand for LNG, offering significant growth potential for EE shareholders.

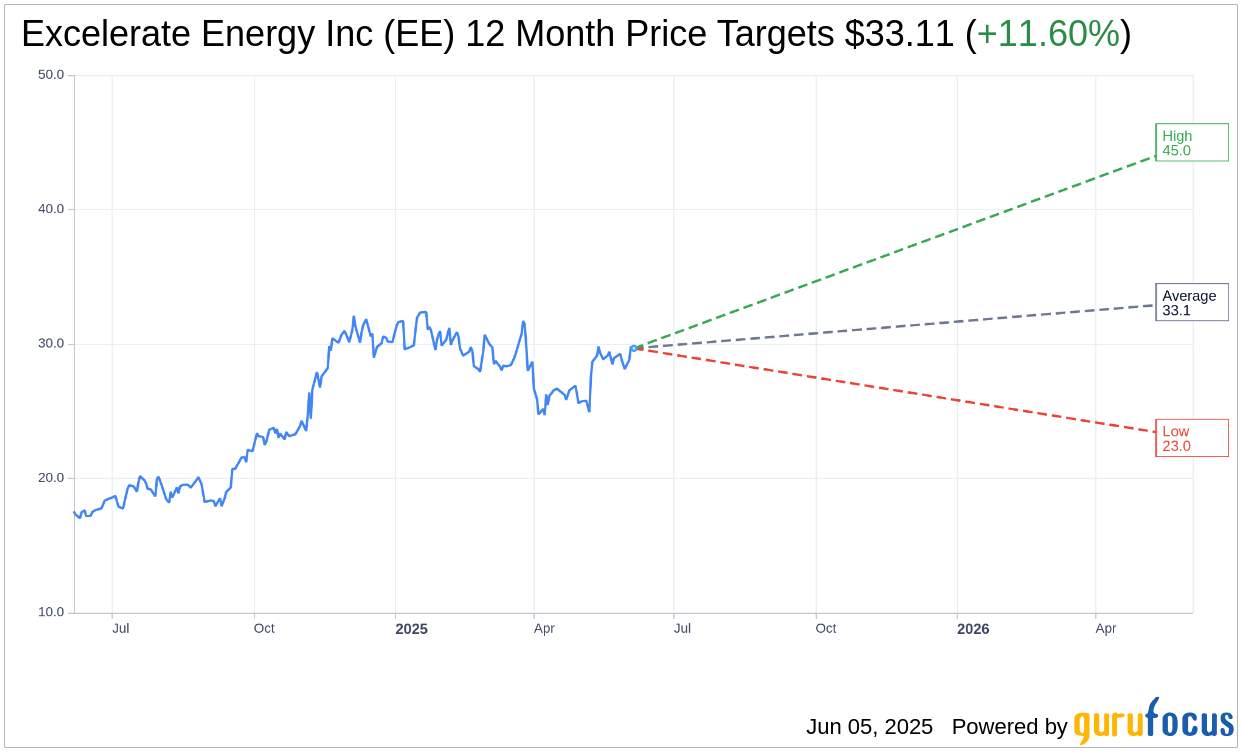

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Excelerate Energy Inc (EE, Financial) is $33.11 with a high estimate of $45.00 and a low estimate of $23.00. The average target implies an upside of 11.60% from the current price of $29.67. More detailed estimate data can be found on the Excelerate Energy Inc (EE) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Excelerate Energy Inc's (EE, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Excelerate Energy Inc (EE, Financial) in one year is $4.43, suggesting a downside of 85.07% from the current price of $29.67. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Excelerate Energy Inc (EE) Summary page.

EE Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Excelerate Energy Inc (EE, Financial) reported a strong financial performance in Q1 2025, with $100 million in adjusted EBITDA and $56 million in adjusted net income.

- The company's business model is supported by take-or-pay contracts, ensuring sustainable earnings regardless of economic cycles.

- Excelerate Energy Inc (EE) is expanding its LNG terminal presence globally, enhancing energy security and supporting the transition to a lower carbon future.

- The acquisition of an integrated LNG infrastructure and power platform in Jamaica is expected to be immediately accretive to EPS and enhance operating cash flow.

- The company has a strong balance sheet with $619 million in cash and cash equivalents and an increased revolving credit facility, providing financial flexibility for growth.

Negative Points

- The acquisition of the Jamaica business requires the completion of routine deliverables and consents, which could pose potential delays.

- There is uncertainty regarding the deployment and gas supply for the new build FSRU, with ongoing discussions but no finalized agreements.

- The company faces potential challenges in integrating the Jamaica assets and ensuring a seamless transition with the Jamaican government.

- Excelerate Energy Inc (EE) operates in a competitive market, and there is pressure to secure contracts and maintain high operational reliability.

- The company's growth strategy involves significant capital expenditures, including the construction of new FSRUs and potential further acquisitions, which could impact financial stability if not managed carefully.