Article Highlights:

- Five Below (FIVE, Financial) outperforms with a robust first-quarter earnings report.

- Analysts project varied future price targets, reflecting differing market perspectives.

- Significant potential upside noted in GF Value estimates, suggesting considerable growth potential.

Five Below Inc. (FIVE) has reported an outstanding performance in the first-quarter of 2025, exceeding analyst expectations. The company saw sales soar to $971 million, bolstered by a comparable sales increase of 7.1%. This stellar growth was largely fueled by innovative advancements in product categories and the strategic opening of 55 new stores. Additionally, Five Below is making strides to diversify its sourcing, aiming to reduce dependence on Chinese goods.

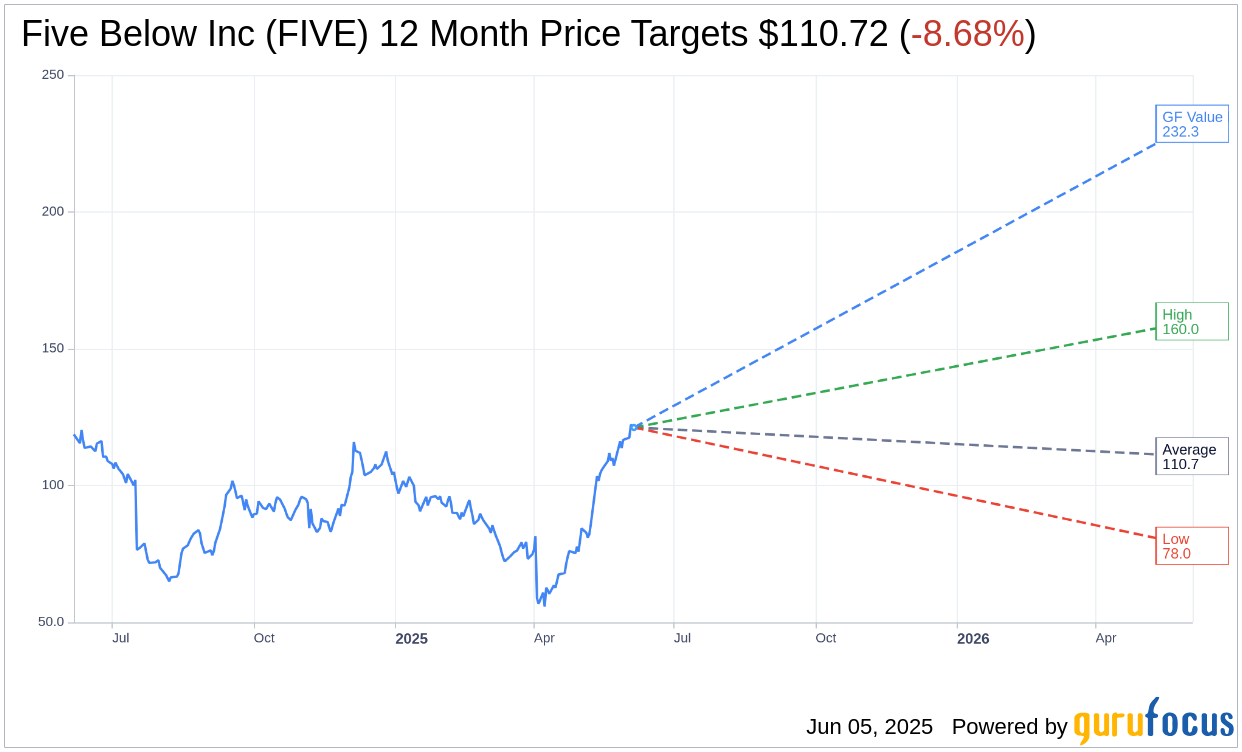

Wall Street Analysts Forecast

Delving into analyst predictions, 18 financial analysts have set a one-year average price target for Five Below Inc (FIVE, Financial) at $110.72. This price projection ranges from a high of $160.00 to a low of $78.00, suggesting a potential downside of 8.68% from the current trading price of $121.24. For a more comprehensive analysis of these estimates, visit the Five Below Inc (FIVE) Forecast page.

The consensus from 22 brokerage firms rates Five Below Inc (FIVE, Financial) with an average recommendation of 2.5, which translates to an "Outperform" status. This rating is derived from a scale where 1 represents a Strong Buy and 5 represents a Sell.

According to GuruFocus' proprietary estimates, the GF Value for Five Below Inc (FIVE, Financial) one year from now is $232.25. This valuation points to a remarkable potential upside of 91.56% from its current trading price of $121.24. The GF Value metric is a reflection of the fair value where the stock should be traded, calculated considering historical trading multiples, past growth, and future business performance estimates. For additional data, check out the Five Below Inc (FIVE) Summary page.