Key Highlights:

- Volaris announces a 9% increase in ASM capacity for May 2025.

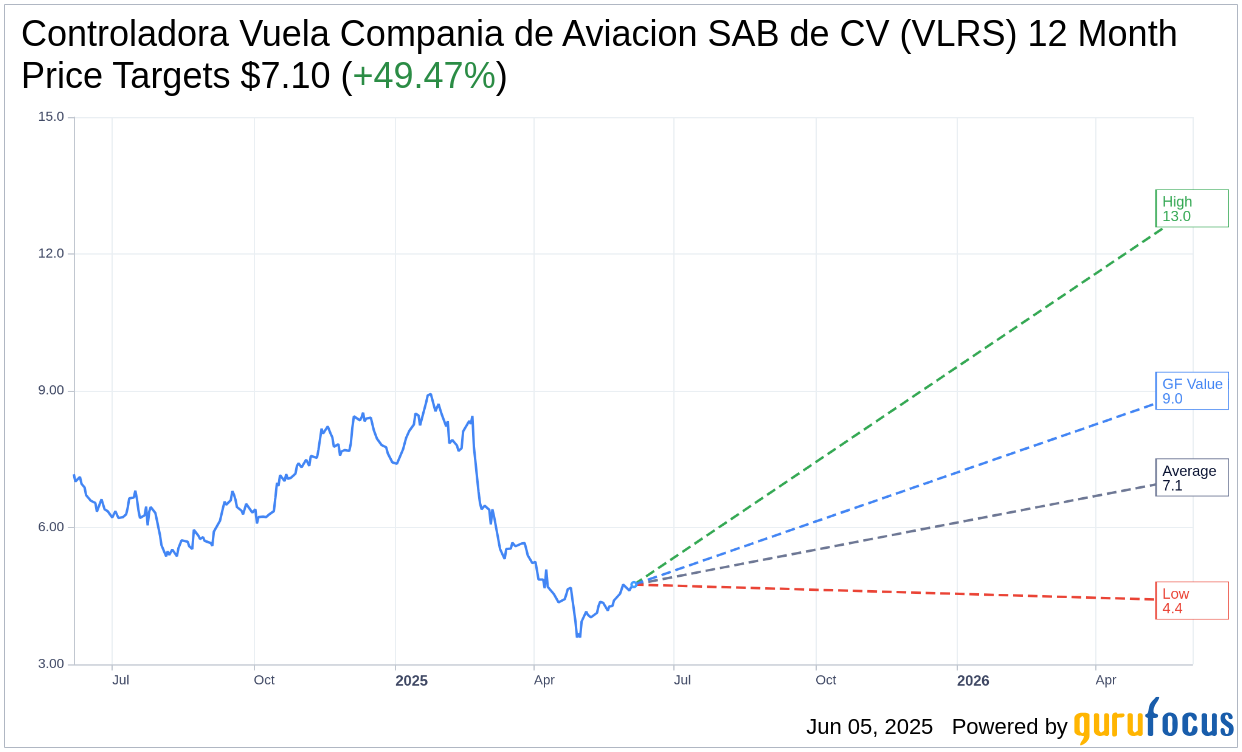

- Analysts forecast an average price target of $7.10, implying a 49.47% upside.

- GF Value suggests a potential 89.47% upside from the current price of $4.75.

Volaris Shows Capacity Expansion in May 2025

Volaris (VLRS, Financial) has reported a significant expansion in its capacity, with Available Seat Miles (ASM) increasing by 9% for May 2025. This growth is complemented by a 3.5% year-over-year rise in Revenue Passenger Miles (RPMs). Despite the overall positive trajectory, the load factor saw a decline of 4.3 percentage points, settling at 81.8%. While domestic RPMs experienced a healthy 5.7% growth, international RPMs remained unchanged. Notably, the airline successfully transported 2.5 million passengers throughout the month.

Wall Street Analysts Forecast

Market analysts have provided compelling insights into Controladora Vuela Compania de Aviacion SAB de CV (VLRS, Financial), offering one-year price targets from 12 experts. The average estimate stands at $7.10, with projections ranging from a high of $13.00 to a low of $4.40. This suggests a notable potential upside of 49.47% from the current stock price of $4.75. For a more comprehensive analysis, visit the Controladora Vuela Compania de Aviacion SAB de CV (VLRS) Forecast page.

Brokerage Recommendations and GuruFocus Insights

Controladora Vuela Compania de Aviacion SAB de CV (VLRS, Financial) enjoys a favorable consensus recommendation from 13 brokerage firms, with an average rating of 2.1, signaling an "Outperform" status. The rating spectrum ranges from 1 (Strong Buy) to 5 (Sell), indicating positive sentiment towards the stock.

According to GuruFocus estimates, the GF Value for VLRS in a year is projected at $9.00. This implies a remarkable upside potential of 89.47% from the current price level of $4.75. The GF Value is calculated by considering the historical trading multiples of the stock, past business growth, and projected future performance. For detailed insights, reference the Controladora Vuela Compania de Aviacion SAB de CV (VLRS, Financial) Summary page.