JPMorgan has adjusted its price target for FedEx (FDX, Financial), bringing it down from $280 to $260, while maintaining an Overweight rating. The firm expresses caution ahead of FedEx's upcoming earnings announcement on June 24, citing concerns about stagnant demand and ongoing tariff uncertainties which could negatively impact fiscal Q4 projections.

Despite these concerns, the bank acknowledges that ongoing business-to-business challenges may be better accounted for in future forecasts. JPMorgan remains optimistic about FedEx's longer-term prospects, noting the potential benefits of the Freight spin-off and the ongoing Network 2.0 integration.

Overall, while JPMorgan anticipates near-term challenges for FedEx, it views the company as appealing on a discounted sum-of-the-parts basis, suggesting a mix of caution and optimism for investors considering (FDX, Financial) in their portfolios.

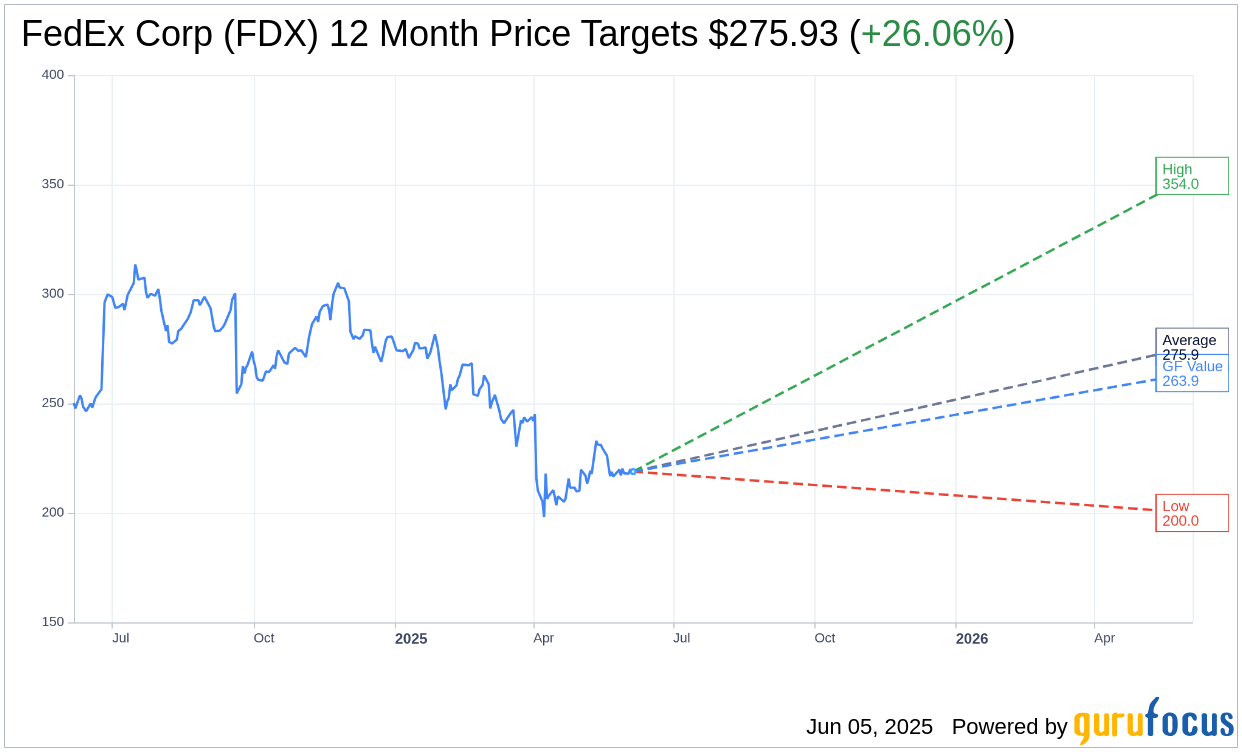

Wall Street Analysts Forecast

Based on the one-year price targets offered by 27 analysts, the average target price for FedEx Corp (FDX, Financial) is $275.93 with a high estimate of $354.00 and a low estimate of $200.00. The average target implies an upside of 26.06% from the current price of $218.89. More detailed estimate data can be found on the FedEx Corp (FDX) Forecast page.

Based on the consensus recommendation from 32 brokerage firms, FedEx Corp's (FDX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FedEx Corp (FDX, Financial) in one year is $263.93, suggesting a upside of 20.58% from the current price of $218.89. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FedEx Corp (FDX) Summary page.

FDX Key Business Developments

Release Date: March 20, 2025

- Revenue Growth: Increased by 2% year-over-year.

- Adjusted Operating Income Growth: Up 12% compared to last year.

- Drive Savings: Achieved $600 million in savings for the quarter.

- Federal Express Adjusted Operating Income: Increased by 17% year-over-year.

- Adjusted EPS Growth: Increased by 17% year-over-year.

- FedEx Freight Revenue Decline: Decreased by 5% due to lower volumes and fuel surcharges.

- International Export Package Volumes: Increased by 8% in the quarter.

- US Domestic Express Freight Pounds: Declined significantly due to the Postal Service contract expiration.

- Capital Expenditures: $997 million for Q3, with FY25 CapEx planned at $4.9 billion.

- Share Repurchases: Approximately $500 million in Q3, totaling $2.5 billion year-to-date.

- FY25 Adjusted EPS Outlook: Lowered to $18 to $18.60.

- Health Care Revenue: Expected to reach approximately $9 billion by the end of FY25.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FedEx Corp (FDX, Financial) achieved a 12% growth in adjusted operating income year-over-year, driven by revenue growth and cost savings.

- The company realized $600 million in DRIVE savings during the quarter, contributing to structural cost reductions.

- FedEx Corp (FDX) reported a 17% increase in adjusted operating income at Federal Express Corporation despite headwinds.

- The company is on track to achieve $2.2 billion in DRIVE savings for FY25, with a total target of $4 billion from the FY23 baseline.

- FedEx Corp (FDX) expanded its Sunday residential coverage to nearly two-thirds of the US population, enhancing service capabilities.

Negative Points

- FedEx Corp (FDX) lowered its FY25 adjusted EPS outlook to $18 to $18.60 due to uncertain demand and inflationary pressures.

- The expiration of the US Postal Service contract resulted in a $180 million headwind to adjusted operating income.

- Weakness in the industrial economy continued to pressure higher-margin B2B volumes, affecting overall performance.

- FedEx Freight experienced a 5% revenue decline due to lower volumes, fuel surcharges, and weight per shipment.

- Inflationary pressures on the cost base are expected to be higher than planned, impacting the full-year outlook.