Key Highlights:

- Trane Technologies (TT, Financial) maintains a quarterly dividend at $0.94 per share, yielding 0.87%.

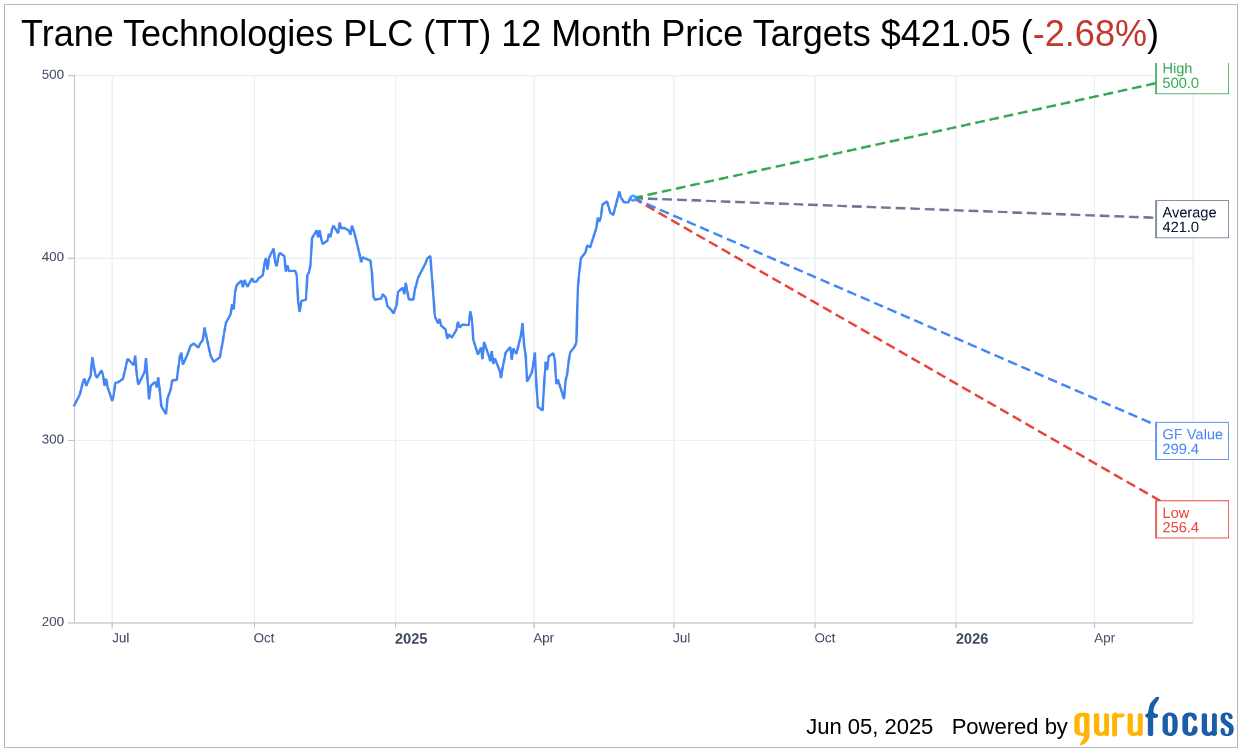

- Analyst consensus suggests a modest downside potential with an average price target of $421.05.

- GuruFocus estimates indicate a significant downside in the stock's value over the next year.

Trane Technologies (TT) has reaffirmed its quarterly dividend, with shareholders set to receive $0.94 per share. This decision underscores the company's ongoing dedication to providing consistent returns to its investors, promising a forward yield of 0.87%. The dividend is scheduled for payment on September 30, with September 5 as the record date for entitlement.

Analyst Projections and Price Targets

According to insights from 18 Wall Street analysts, Trane Technologies PLC (TT, Financial) has an average one-year price target of $421.05, with projections ranging from a high of $500.00 to a low of $256.45. This average forecast implies a potential downside of 2.68% from the current trading price of $432.62. Investors seeking more detailed estimates can refer to the Trane Technologies PLC (TT) Forecast page.

Brokerage Ratings and Recommendations

The stock enjoys an "Outperform" consensus rating from 26 brokerage houses, with an average brokerage recommendation score of 2.5. On the rating scale, 1 equates to "Strong Buy" and 5 to "Sell," reflecting optimism among analysts about the stock's potential.

GuruFocus Valuation Analysis

GuruFocus' valuation model, the GF Value, estimates Trane Technologies PLC (TT, Financial) could be significantly overvalued, with a fair value pegged at $299.44. This suggests a potential downside of 30.78% relative to the current market price of $432.62. The GF Value is derived from historical trading multiples, past business growth, and projected business performance. Comprehensive data is accessible on the Trane Technologies PLC (TT) Summary page.

Also check out: (Free Trial)