Barclays analyst Nicholas Campanella has revised his outlook for OGE Energy (OGE, Financial), elevating the rating from Equal Weight to Overweight. The price target is now set at $47, an increase from the previous $45. The analyst highlights that since OGE's first-quarter report, notable positive developments have emerged, particularly following the SB 998 legislation. This law significantly influences OGE's capacity to expedite its capital expenditure initiatives, reducing the need for frequent rate filings and enhancing the cash recovery process for substantial gas investments later in the decade.

According to Campanella, a recent discussion with OGE's management has bolstered Barclays' confidence in the stock. The firm considers the current stock price as an appealing entry point for investors, signaling potential growth and stability for OGE.

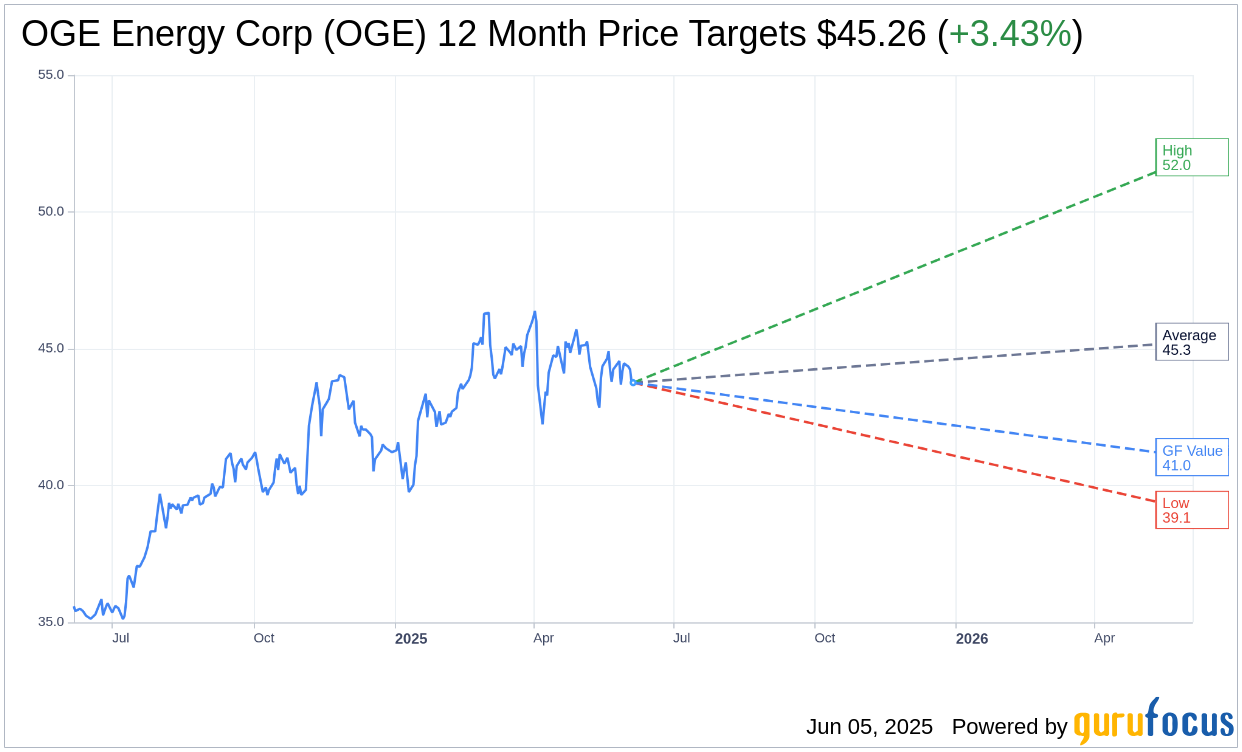

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for OGE Energy Corp (OGE, Financial) is $45.26 with a high estimate of $52.00 and a low estimate of $39.11. The average target implies an upside of 3.43% from the current price of $43.76. More detailed estimate data can be found on the OGE Energy Corp (OGE) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, OGE Energy Corp's (OGE, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for OGE Energy Corp (OGE, Financial) in one year is $41.04, suggesting a downside of 6.22% from the current price of $43.76. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the OGE Energy Corp (OGE) Summary page.

OGE Key Business Developments

Release Date: April 30, 2025

- Consolidated Earnings: $0.31 per diluted share, including $0.35 for OG&E and a holding company loss of $0.04.

- Consolidated Net Income: $63 million compared to $19 million in the same period of 2024.

- Electric Company Net Income: $71 million or $0.35 per diluted share compared to $25 million or $0.12 per share in the same period of 2024.

- Customer Growth: 1% increase compared to the first quarter of 2024.

- Load Growth: 8% increase compared to the first quarter of 2024, with residential and commercial sectors growing at 3% and 28%, respectively.

- Operating Revenues: Increase driven by recovery of capital investments and strong growth.

- Expenses: Lower operation and maintenance expense, offset by higher income tax, depreciation, and interest expense.

- External Financing: Issued $350 million of 30-year debt at the electric company.

- Earnings Per Share Guidance: Affirmed at $2.27 within a range of $2.21 to $2.33 per share for 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- OGE Energy Corp (OGE, Financial) reported strong consolidated earnings of $0.31 per diluted share, showing significant improvement from the previous year.

- The company experienced an 8% year-over-year increase in demand, driven by residential and commercial sectors.

- OGE Energy Corp (OGE) maintains high reliability with a 99.975% reliability rate despite severe weather conditions.

- The company has secured key components like transformers, wire, and cable through 2026, ensuring minimal disruption to planned projects.

- OGE Energy Corp (OGE) has a strong financial position with a high-quality balance sheet and no need for external equity issuances beyond a modest annual drip.

Negative Points

- The holding company reported a loss of $8 million or $0.04 per diluted share, slightly higher than the previous year's loss.

- There was some softness in the industrial and oil field customer classes due to planned and unplanned outages.

- Moody's has placed OGE Energy Corp (OGE) on a negative outlook, with concerns about maintaining the current credit rating.

- The company faces potential regulatory challenges and uncertainties in tariff policies that could impact future operations.

- OGE Energy Corp (OGE) is targeting an FFO to debt ratio of 17%, which is below the downgrade threshold of 18% set by Moody's.