Key Highlights:

- MarketAxess (MKTX, Financial) reports a 44% surge in average daily trading volume for May year-over-year.

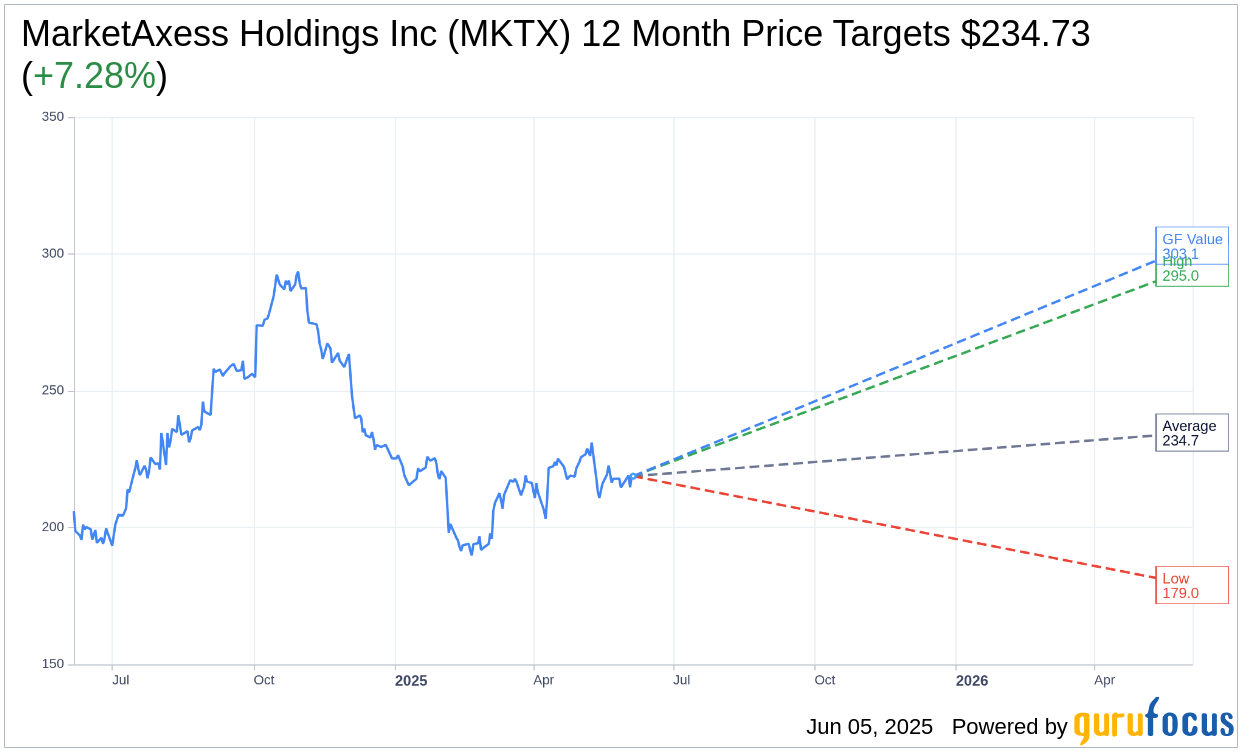

- Wall Street's one-year price target for MKTX averages at $234.73, indicating a potential upside of 7.28%.

- The estimated GF Value suggests a significant upside potential of 38.52% from the current stock price.

MarketAxess Trading Volume Soars

MarketAxess Holdings Inc. (MKTX) has impressed investors with a noteworthy 44% increase in average daily trading volume this May compared to the same period last year. This growth was largely fueled by a 22% rise in credit trading and an even more impressive 59% spike in rates trading. Eurobond trading volumes also experienced substantial growth, thanks to the uptick in block and portfolio trades.

Wall Street Analysts' Projections

According to insights from 11 analysts, the one-year target price for MarketAxess Holdings Inc. (MKTX, Financial) averages $234.73. These projections range from a high of $295.00 to a low of $179.00. With the current stock price at $218.79, the average target suggests a potential upside of 7.28%. For further details on these estimates, visit the MarketAxess Holdings Inc (MKTX) Forecast page.

Brokerage Recommendations

MarketAxess Holdings Inc. (MKTX, Financial) is currently rated at 2.6 based on the consensus recommendation from 14 brokerage firms, equating to a "Hold" status. The rating system ranges from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell.

GuruFocus GF Value Estimation

Utilizing GuruFocus estimates, the projected GF Value for MarketAxess Holdings Inc. (MKTX, Financial) in one year is set at $303.06. This estimation implies a substantial upside of 38.52% from the current trading price of $218.79. The GF Value represents GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples, past business growth, and future business performance projections. For more detailed insights, please refer to the MarketAxess Holdings Inc (MKTX) Summary page.