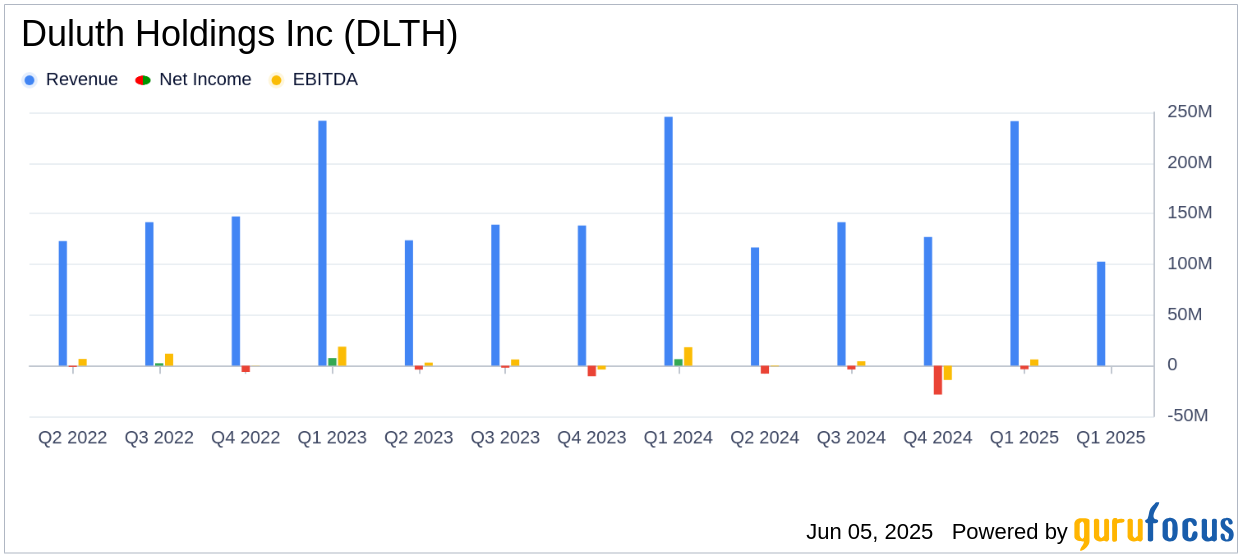

On June 5, 2025, Duluth Holdings Inc (DLTH, Financial), a prominent U.S. apparel brand known for its workwear and casual wear, released its 8-K filing detailing the financial results for the first quarter ended May 4, 2025. The company reported a net loss of $15.3 million, a significant increase from the $7.9 million net loss in the same quarter last year. The adjusted net loss stood at $10.8 million, excluding certain tax and impairment expenses.

Company Overview

Duluth Holdings Inc, operating under the Duluth Trading Co brand, offers a range of apparel, footwear, and hard goods through its direct-to-consumer and retail channels. The company's product lines include popular brands such as Alaskan Hardgear, Armachillo, and Duluthflex, catering to both men and women.

Performance and Challenges

The company's net sales decreased by 12.0% to $102.7 million, falling short of the analyst estimate of $106.49 million. This decline was primarily driven by a 17.1% drop in direct-to-consumer sales, attributed to reduced site traffic, although partially offset by higher average order values. Retail store sales also saw a decline of 2.6% due to slower store traffic.

The gross profit margin decreased by 80 basis points to 52.0%, impacted by higher clearance sales, though somewhat mitigated by improved product costs from direct factory sourcing. The company's efforts to right-size its cost structure are crucial as it navigates these challenges.

Financial Achievements and Industry Context

Despite the challenges, Duluth Holdings Inc managed to reduce its selling, general, and administrative expenses by 6.9% to $65.7 million. However, as a percentage of net sales, these expenses increased to 64.0% from 60.5% in the previous year, reflecting the impact of decreased sales.

In the retail-cyclical industry, maintaining a strong brand and managing costs effectively are vital for sustaining profitability, especially in a challenging economic environment.

Key Financial Metrics

The company reported an EPS of ($0.45), missing the analyst estimate of ($0.30). Adjusted EPS was ($0.32), slightly better than the estimated EPS of ($0.30) but still reflecting a challenging quarter. Adjusted EBITDA decreased by $5.6 million to ($3.8) million, representing (3.7%) of net sales.

On the balance sheet, Duluth Holdings Inc ended the quarter with $8.6 million in cash and cash equivalents and a net liquidity of $44.6 million. The company has $64.0 million in outstanding debt on its $100 million revolving line of credit.

Management Commentary

We are taking decisive actions to simplify our business and enhance our brand enablers," stated the company's management. "Our focus on right-sizing our cost structure is essential as we navigate the current economic landscape."

Analysis and Outlook

Duluth Holdings Inc's performance in the first quarter of 2025 highlights the challenges faced by retail companies in adapting to changing consumer behaviors and economic conditions. The company's efforts to streamline operations and manage costs are critical as it seeks to improve profitability and meet market expectations.

Investors and analysts will be closely monitoring Duluth Holdings Inc's strategic initiatives and their impact on future financial performance, particularly in light of the company's maintained fiscal 2025 guidance amid a dynamic macroeconomic environment.

Explore the complete 8-K earnings release (here) from Duluth Holdings Inc for further details.