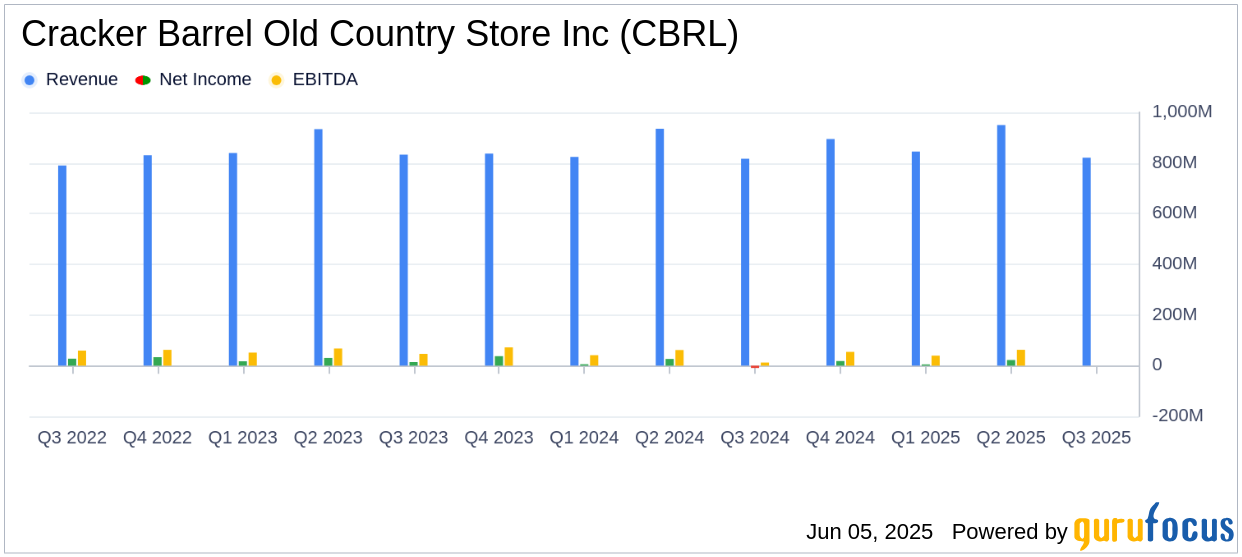

On June 5, 2025, Cracker Barrel Old Country Store Inc (CBRL, Financial) released its 8-K filing detailing its financial performance for the third quarter of fiscal 2025, which ended on May 2, 2025. The company, known for its full-service restaurants offering home-style country food across the United States, reported a total revenue of $821.1 million, slightly below the analyst estimate of $824.30 million. However, the company exceeded earnings expectations with a GAAP earnings per diluted share of $0.56, surpassing the estimated $0.33 per share.

Performance Highlights and Challenges

Cracker Barrel's third-quarter revenue increased by 0.5% compared to the same period last year. This growth was driven by a 1.0% increase in comparable store restaurant sales, despite a 3.8% decline in comparable store retail sales. The company's ability to maintain positive restaurant sales growth for the fourth consecutive quarter is a testament to its effective execution of its transformation plan. However, the decline in retail sales poses a challenge that could impact overall revenue growth if not addressed.

Financial Achievements and Industry Context

The company's GAAP net income for the quarter was $12.6 million, a significant improvement from the previous year's net loss of $9.2 million. Adjusted EBITDA was $48.1 million, marking a slight increase from the prior year's $47.9 million. These financial achievements are crucial for Cracker Barrel as they reflect the company's resilience and ability to generate profit in a competitive restaurant industry.

Key Financial Metrics

Cracker Barrel's earnings per diluted share of $0.56 exceeded the analyst estimate of $0.33, showcasing the company's strong financial performance. The adjusted earnings per diluted share were $0.58, compared to $0.88 in the prior year quarter. The company's adjusted EBITDA margin remained steady at 5.9% of total revenue, highlighting its operational efficiency.

| Metric | Q3 Fiscal 2025 | Q3 Fiscal 2024 |

|---|---|---|

| Total Revenue | $821.1 million | 0.5% increase |

| GAAP Net Income | $12.6 million | ($9.2) million |

| Adjusted EBITDA | $48.1 million | $47.9 million |

| GAAP EPS | $0.56 | ($0.41) |

Analysis and Outlook

Cracker Barrel's performance in the third quarter of fiscal 2025 demonstrates its ability to navigate challenges and capitalize on growth opportunities. The company's focus on its transformation plan has resulted in consistent restaurant sales growth, although the decline in retail sales remains a concern. The updated fiscal 2025 outlook projects total revenue between $3.45 billion and $3.50 billion, indicating stable expectations for the remainder of the year.

Commenting on the third quarter results, Cracker Barrel President and Chief Executive Officer Julie Masino said, “Our third quarter performance exceeded our expectations and represents the fourth consecutive quarter of positive comparable store restaurant sales growth. We remain focused on executing our transformation plan and believe we are well-positioned to deliver a strong finish to the fiscal year.”

Cracker Barrel's strategic initiatives and financial discipline position it well within the restaurant industry, but continued attention to retail sales and operational efficiencies will be crucial for sustained success.

Explore the complete 8-K earnings release (here) from Cracker Barrel Old Country Store Inc for further details.