DA Davidson has increased the price target for Guidewire (GWRE, Financial) from $226 to $246 while maintaining a Neutral rating. This adjustment follows the release of the company's impressive third-quarter results, which surpassed forecasts in both total revenue and operating income. Analysts highlighted the company's significant strides in enhancing margins, noting a 280 basis points improvement in non-GAAP gross margins, reaching 65.4% during the quarter. These developments reflect Guidewire's ongoing success in strengthening its financial performance.

Wall Street Analysts Forecast

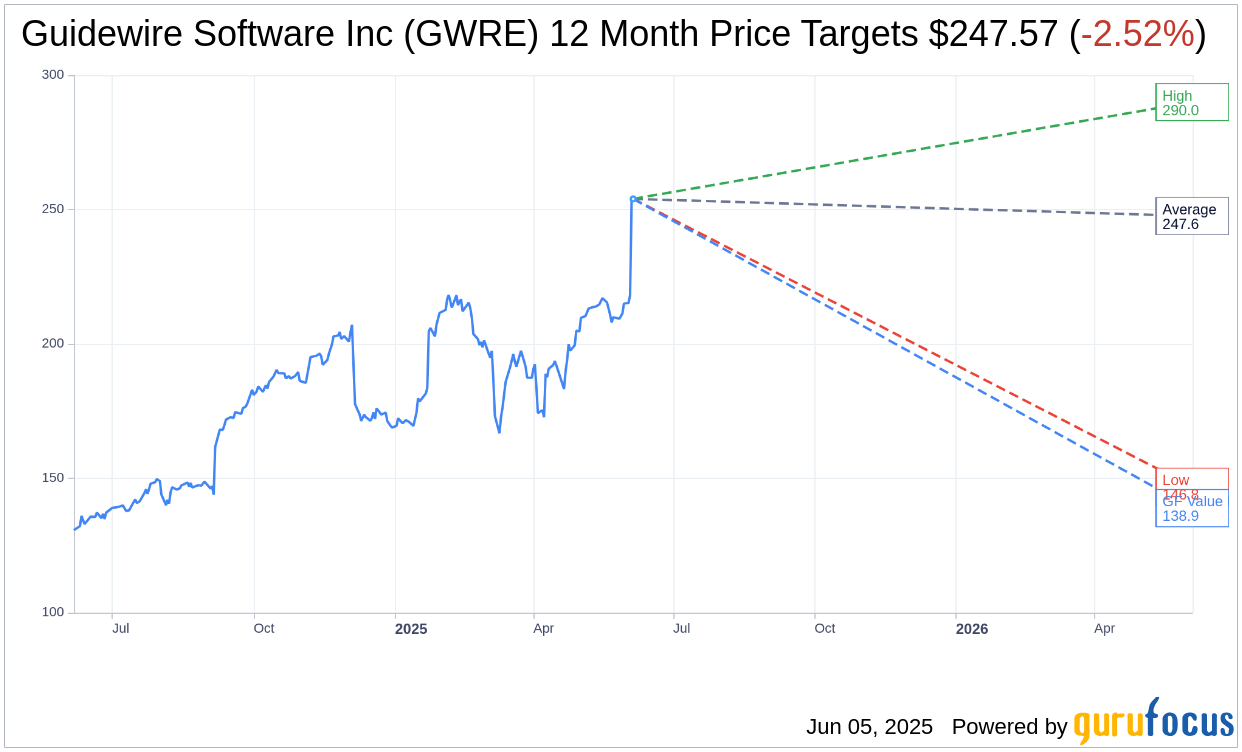

Based on the one-year price targets offered by 12 analysts, the average target price for Guidewire Software Inc (GWRE, Financial) is $247.57 with a high estimate of $290.00 and a low estimate of $146.84. The average target implies an downside of 2.52% from the current price of $253.98. More detailed estimate data can be found on the Guidewire Software Inc (GWRE) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Guidewire Software Inc's (GWRE, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Guidewire Software Inc (GWRE, Financial) in one year is $138.88, suggesting a downside of 45.32% from the current price of $253.98. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Guidewire Software Inc (GWRE) Summary page.

GWRE Key Business Developments

Release Date: June 03, 2025

- ARR (Annual Recurring Revenue): $960 million, with a full-year outlook raised to exceed $1 billion.

- Total Revenue: $294 million, up 22% year-over-year.

- Subscription and Support Revenue: $182 million, reflecting 32% year-over-year growth.

- Services Revenue: $54 million, benefiting from strong services bookings.

- Gross Profit: $192 million on a non-GAAP basis.

- Subscription and Support Gross Margin: 71%, compared to 66% a year ago.

- Services Gross Margin: 13%, compared to 10% a year ago.

- Operating Profit: $46 million on a non-GAAP basis.

- Operating Cash Flow: $32 million, ahead of expectations.

- Cash Equivalents and Investments: Over $1.2 billion.

- Fiscal Year 2025 Revenue Outlook: Between $1.178 billion and $1.186 billion.

- Fiscal Year 2025 Subscription Revenue Outlook: Approximately $660 million.

- Fiscal Year 2025 Subscription and Support Revenue Outlook: $724 million.

- Fiscal Year 2025 Services Revenue Outlook: Approximately $215 million.

- Fiscal Year 2025 Non-GAAP Operating Income Outlook: Between $187 million and $195 million.

- Fiscal Year 2025 Cash Flow from Operations Outlook: Between $255 million and $275 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Guidewire Software Inc (GWRE, Financial) achieved a record ARR of $960 million, indicating strong market demand and allowing the company to raise its full-year outlook.

- The company closed 17 cloud deals, including significant wins with tier 1 and tier 2 insurers, showcasing the robustness and maturity of its platform.

- International momentum is building with significant cloud expansions in Canada, APAC, and EMEA, highlighting global growth potential.

- Guidewire Software Inc (GWRE) reported a 22% year-over-year increase in total revenue, with subscription and support revenue growing by 32%, reflecting strong cloud momentum.

- The acquisition of Quanti enhances Guidewire Software Inc (GWRE)'s pricing and rating technology, potentially broadening its product offerings and market reach.

Negative Points

- Despite strong performance, the company acknowledges the risks and uncertainties associated with geopolitical events and market conditions that could impact future results.

- The company's gross margin improvements are partly attributed to temporary credits from cloud service providers, which may not be sustainable long-term.

- Guidewire Software Inc (GWRE) faces challenges in maintaining its momentum, particularly as Q4 is critical for achieving fully ramped ARR results.

- The integration of Quanti and the associated increase in stock-based compensation could impact profitability in the short term.

- The company is still working towards its long-term subscription gross margin target of 80%, indicating room for improvement in operational efficiency.