Progress Software (PRGS, Financial) has unveiled significant updates to its software platform, Progress ShareFile, specifically aimed at improving client collaboration and workflow automation for accounting professionals. These updates are designed to enhance client interactions and lessen the administrative burdens that accounting firms face, particularly amid growing client expectations and staff shortages.

The new features include AI-driven document insights, streamlined client communication, and automated tasks that simplify complex workflows. These advancements enable accounting firms to save valuable time, cutting up to 4.25 hours from each tax-related task. Moreover, these AI capabilities allow firms to extract crucial insights from financial documents up to 96% faster. This efficiency boost enables firms to manage a larger client base more effectively, without the need to expand their workforce.

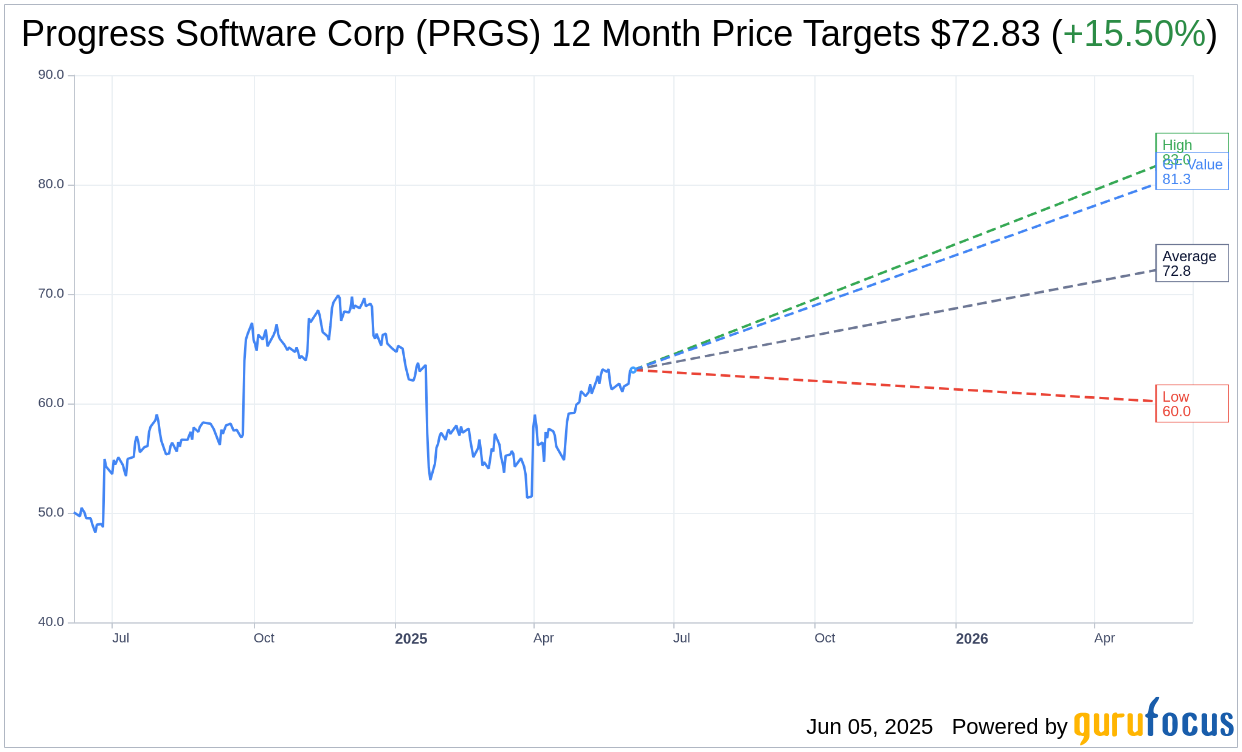

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Progress Software Corp (PRGS, Financial) is $72.83 with a high estimate of $83.00 and a low estimate of $60.00. The average target implies an upside of 15.50% from the current price of $63.06. More detailed estimate data can be found on the Progress Software Corp (PRGS) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Progress Software Corp's (PRGS, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Progress Software Corp (PRGS, Financial) in one year is $81.25, suggesting a upside of 28.85% from the current price of $63.06. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Progress Software Corp (PRGS) Summary page.

PRGS Key Business Developments

Release Date: March 31, 2025

- Annualized Recurring Revenue (ARR): $836 million, representing 48% year-over-year growth.

- Revenue: $238 million, up 30% in constant currency, at the high end of guidance.

- Earnings Per Share (EPS): $1.31, significantly exceeding the upper end of the guidance range.

- Operating Margin: 39%, indicative of effective expense management and execution.

- Net Retention Rate: Surpassed 100%, reflecting strong customer retention.

- Debt Repayment: Paid down $30 million on the revolving line of credit.

- Share Repurchase: $30 million of stock repurchased.

- Unlevered Free Cash Flow: $88 million, an increase of $10 million over the prior year quarter.

- Cash and Cash Equivalents: $124 million at the end of the quarter.

- Total Debt: $1.51 billion, resulting in a net debt position of $1.39 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Annualized recurring revenue (ARR) increased by 48% year-over-year, driven by the ShareFile acquisition and other business contributions.

- Revenues for the quarter reached $238 million, at the high end of guidance, with a 30% increase in constant currency.

- Earnings per share of $1.31 exceeded the upper end of the guidance range, indicating strong financial performance.

- Operating margins were at 39%, reflecting effective expense management and successful integration of ShareFile.

- The company repurchased $30 million of its stock and paid down $30 million on its revolver, demonstrating a commitment to capital allocation and debt reduction.

Negative Points

- The renewal timing of multi-year subscription contracts can create revenue lumpiness, impacting quarterly results.

- Despite strong Q1 performance, the company maintained its full-year guidance, indicating caution due to potential uncertainties.

- ARR experienced a slight decline quarter-over-quarter, attributed to seasonal dips in maintenance contract renewals.

- The company faces challenges in acquiring AI-focused companies due to high valuations, limiting immediate revenue impact from AI initiatives.

- Geopolitical forces and macroeconomic uncertainties could potentially impact international operations, although no significant effects have been observed yet.