Key Highlights:

- Qualcomm (QCOM, Financial) acquires Autotalks, enhancing its V2X technology prowess.

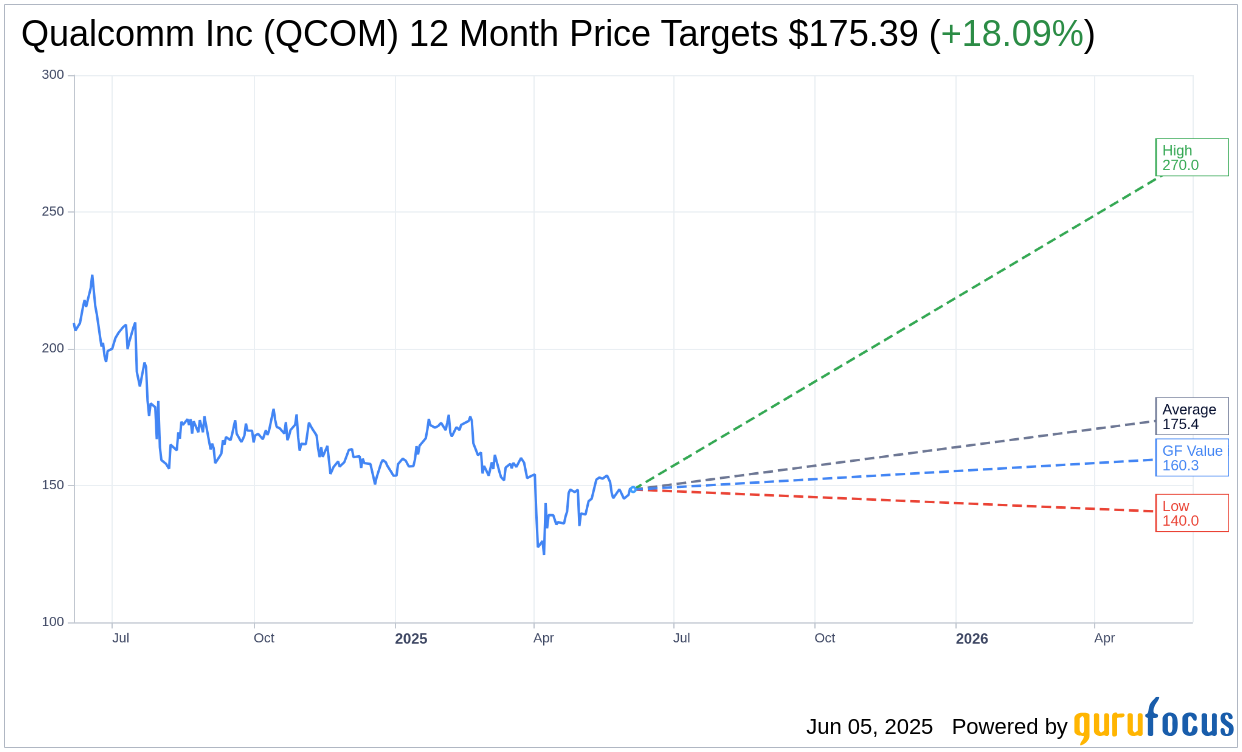

- Wall Street analysts predict an average price target of $175.39 for Qualcomm.

- GuruFocus estimates suggest a 7.9% upside, valuing the stock at $160.27 in a year.

Qualcomm (QCOM) has strategically enhanced its portfolio by acquiring Autotalks, a pioneer in vehicle-to-everything (V2X) communication technology. This acquisition, finalized after overcoming objections from the U.S. Federal Trade Commission, aims to bolster Qualcomm's Snapdragon Digital Chassis offerings. While the financial terms of the acquisition remain undisclosed, the strategic benefits are clear, positioning Qualcomm at the forefront of automotive communication advancements.

Wall Street Analysts Forecast

According to the insights provided by 30 financial analysts, Qualcomm Inc (QCOM, Financial) has been given an average one-year price target of $175.39. This includes a high estimate reaching $270.00 and a low of $140.00. With the current trading price at $148.53, the average target suggests an impressive potential upside of 18.09%. For a comprehensive view of these projections, visit the Qualcomm Inc (QCOM) Forecast page.

In addition, a consensus from 42 brokerage firms has rated Qualcomm Inc's (QCOM, Financial) stock with an average recommendation of 2.4, categorizing it as "Outperform." This rating is part of a scale that ranges from 1 to 5, where 1 indicates a Strong Buy and 5 denotes a Sell recommendation.

According to GuruFocus estimates, the GF Value for Qualcomm Inc (QCOM, Financial) over the next year is pegged at $160.27. This translates to a projected upside of 7.9% from the present market price of $148.53. The GF Value is a metric that assesses the fair trading value of a stock, factoring in historical trade multiples, past business growth trajectories, and future performance forecasts. For further details, refer to the Qualcomm Inc (QCOM) Summary page.