A prominent event is scheduled to take place in Minneapolis on June 17-18, hosted by Craig-Hallum. This meeting aims to provide valuable insights for investors with a focus on confident decision-making strategies. Attendees will have the opportunity to delve into company performances using innovative tools for smarter investment decisions.

Investors interested in identifying undervalued stocks that exhibit resilience in the market can benefit from specialized newsletters that offer curated information directly to their inboxes.

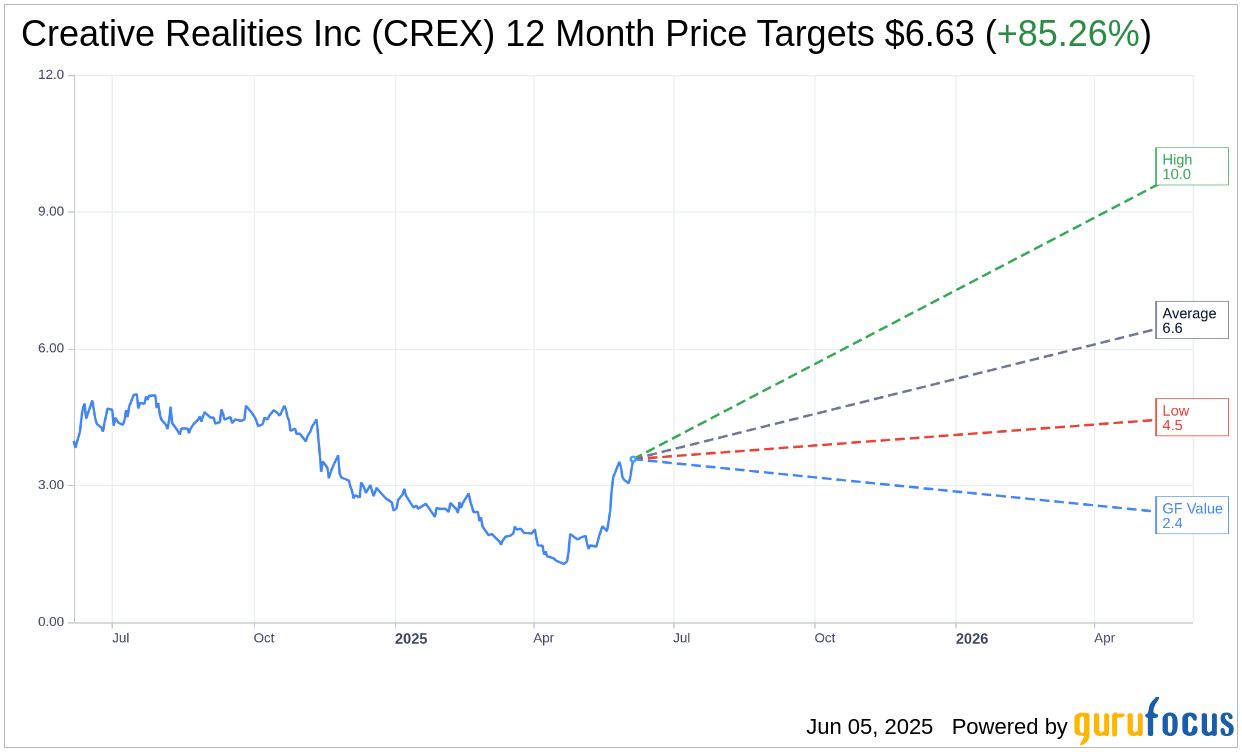

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Creative Realities Inc (CREX, Financial) is $6.63 with a high estimate of $10.00 and a low estimate of $4.50. The average target implies an upside of 85.26% from the current price of $3.58. More detailed estimate data can be found on the Creative Realities Inc (CREX) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Creative Realities Inc's (CREX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Creative Realities Inc (CREX, Financial) in one year is $2.35, suggesting a downside of 34.28% from the current price of $3.576. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Creative Realities Inc (CREX) Summary page.

CREX Key Business Developments

Release Date: May 14, 2025

- Revenue: $9.7 million in Q1 2025, down from $12.3 million in Q1 2024.

- Gross Profit: $4.5 million in Q1 2025, compared to $5.8 million in Q1 2024.

- Gross Margin: 46%, consistent with the prior year period.

- Annual Recurring Revenue (ARR): $17.3 million at the end of Q1 2025, up from $16.8 million at the start of 2025.

- Adjusted EBITDA: $0.5 million, nominal change from the previous year and quarter.

- SG&A Expenses: Reduced by 11% to $5.2 million in Q1 2025 from $5.8 million in Q1 2024.

- Operating Costs: Decreased sequentially from $5.6 million in Q4 2024.

- Cash on Hand: Approximately $1.1 million as of March 31, 2025.

- Gross Debt: $23.2 million at the end of Q1 2025, up from $13 million at the start of 2025.

- Net Debt: $22.1 million at the end of Q1 2025.

- Leverage Ratio: Gross leverage at 4.91% and net leverage at 4.67% as of Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Creative Realities Inc (CREX, Financial) secured a significant contract with a well-known upscale quick service restaurant chain, which is expected to enhance their market credibility and lead to additional large wins.

- The company achieved a reduction in SG&A expenses by 11% compared to the previous year, indicating effective cost management.

- Creative Realities Inc (CREX) resolved a $12.8 million contingent liability for $7 million, providing long-term financial visibility and flexibility.

- The introduction of the Ad Logic CPM platform has been well-received, with potential clients showing interest in its capabilities for targeted high-performance campaigns.

- The company is on track to achieve SOC 2 Type 2 compliance by year-end, enhancing the trustworthiness and credibility of its products to enterprise customers.

Negative Points

- Revenue for the first quarter decreased to $9.7 million from $12.3 million in the same period last year, primarily due to installation timing issues on several large projects.

- Gross profit declined to $4.5 million from $5.8 million in the previous year, reflecting the impact of delayed project deployments.

- Debt levels increased to $23.2 million from $13 million at the start of 2025, largely due to the settlement of a contingent liability.

- The BCTV project experienced slower progress in the first two quarters of 2025, impacting expected revenue generation.

- The company faces potential risks from global trade uncertainties and tariffs, which could affect the cost of materials and project timelines.