The European Union has granted approval to AstraZeneca's (AZN, Financial) Calquence, in combination with venetoclax, with or without obinutuzumab, for treating adults with untreated chronic lymphocytic leukemia (CLL). This decision by the European Commission follows a favorable assessment from the Committee for Medicinal Products for Human Use, supported by the successful outcomes of the AMPLIFY Phase III trial. These results, unveiled at the American Society of Hematology 2024 Annual Meeting and published in The New England Journal of Medicine, highlighted significant efficacy.

In the trial, 77% of patients using Calquence plus venetoclax, and 83% using the combination with obinutuzumab, remained progression-free at three years. This contrasts with 67% among those receiving traditional chemoimmunotherapy. The median progression-free survival was not reached in the experimental groups, compared to 47.6 months with standard treatment. Notably, Calquence with venetoclax decreased the risk of disease advancement or death by 35% compared to chemoimmunotherapy. When combined with obinutuzumab, this risk reduction increased to 58%.

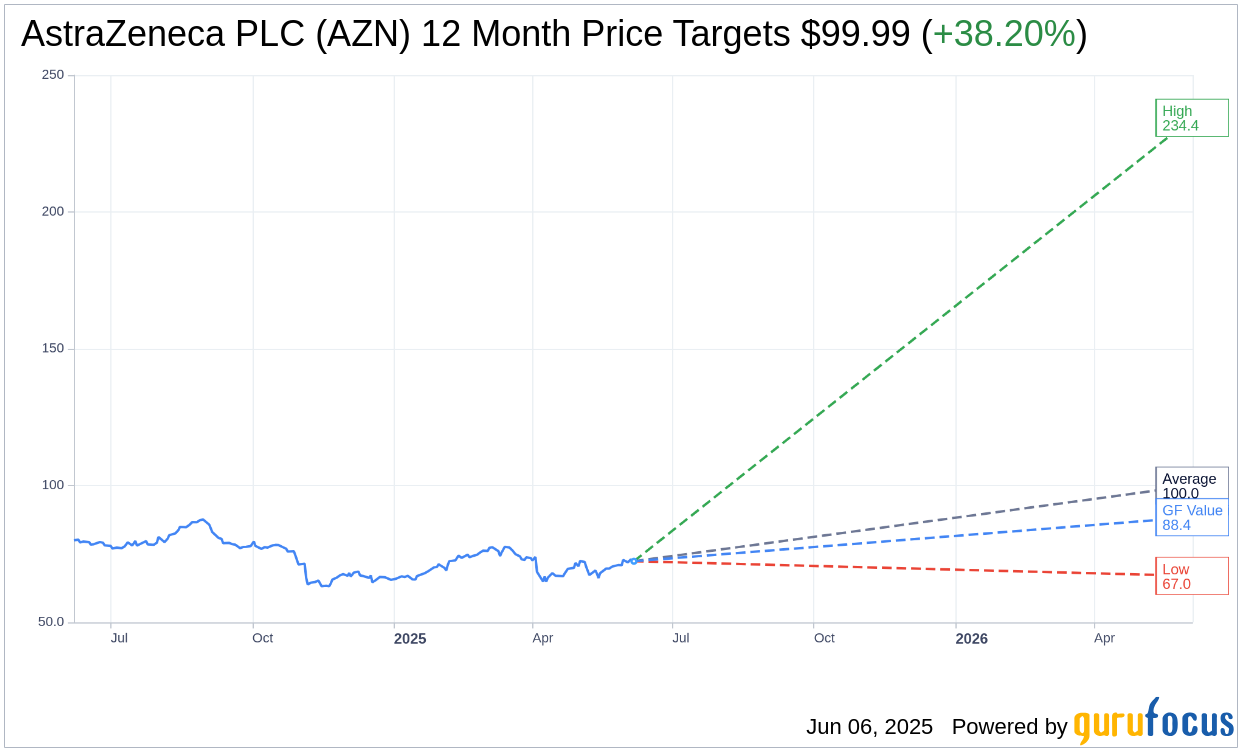

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for AstraZeneca PLC (AZN, Financial) is $99.99 with a high estimate of $234.41 and a low estimate of $67.00. The average target implies an upside of 38.20% from the current price of $72.35. More detailed estimate data can be found on the AstraZeneca PLC (AZN) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, AstraZeneca PLC's (AZN, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for AstraZeneca PLC (AZN, Financial) in one year is $88.44, suggesting a upside of 22.24% from the current price of $72.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the AstraZeneca PLC (AZN) Summary page.

AZN Key Business Developments

Release Date: April 29, 2025

- Total Revenue Growth: 10% in Q1 2025.

- Core Operating Profit Growth: 12% increase.

- Core EPS Growth: 21% increase, benefiting from a lower tax rate.

- Gross Margin: 84% in Q1 2025.

- Core R&D Costs: Increased by 16%, representing 23% of total revenue.

- Core SG&A Costs: Increased by 4%.

- Core Operating Profit Margin: 35%.

- Core Tax Rate: 16% in Q1 2025.

- Cash Inflows from Operating Activities: $3.7 billion.

- CapEx: Approximately $500 million, expected to increase by 50% this year.

- Net Debt: Increased by $1.5 billion to $26.1 billion.

- Oncology Revenue Growth: 13% to $5.6 billion in Q1 2025.

- Biopharmaceuticals Revenue Growth: 12% to $5.6 billion in Q1 2025.

- Rare Disease Revenue: $2 billion, stable year-on-year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- AstraZeneca PLC (AZN, Financial) reported a strong start to 2025 with a 10% increase in total revenue, driven by demand for innovative medicines.

- Core operating profit increased by 12% and core EPS rose by 21%, reflecting effective cost management and operating leverage.

- The company secured 13 approvals in key regions, showcasing the global impact of its diverse portfolio.

- AstraZeneca PLC (AZN) announced five positive Phase III results, including two NMEs, indicating strong pipeline delivery.

- The company is on track to deliver at least 20 NMEs by 2030, with nine novel medicines already approved.

Negative Points

- AstraZeneca PLC (AZN) faces anticipated headwinds, including Medicare Part D redesign in the US, which could impact revenue.

- The company expects a decline in total revenue gross margin by 60 to 70 basis points in 2025 due to various factors, including SOLIRIS biosimilar competition.

- There is a potential impact from VBP inclusion in China, which could affect pricing and revenue for certain products.

- AstraZeneca PLC (AZN) anticipates a lower gross margin in the second half of the year due to seasonal patterns and other factors.

- The company is facing increased competition in the rare disease segment, which could impact growth in this area.