- Codere Online Luxembourg (CDRO, Financial) continues its Nasdaq listing by fulfilling compliance standards.

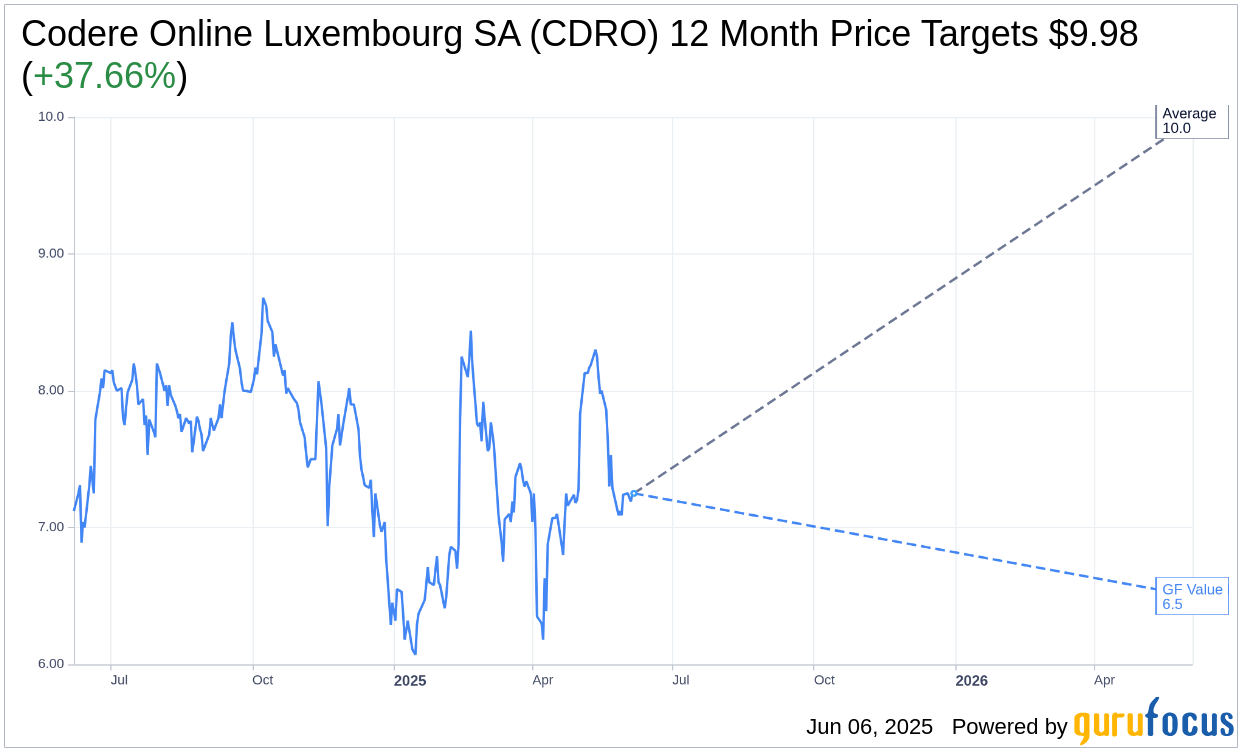

- Analyst consensus suggests a potential 37.66% upside for CDRO based on a $9.98 average price target.

- GuruFocus estimates indicate a slight downside in the stock's GF Value to $6.50.

Codere Online Luxembourg (CDRO) has maintained its listing on the Nasdaq Capital Market by meeting Nasdaq's stringent compliance requirements. This milestone follows official communication from Nasdaq, effectively removing any delisting concerns for the company.

Analyst Price Targets and Ratings

Analysts have set a one-year price target for Codere Online Luxembourg SA (CDRO, Financial) at an average of $9.98, with both the high and low estimates also standing at $9.98. This projection suggests a substantial potential increase of 37.66% from the current trading price of $7.25. For those interested in delving deeper into these estimates, further details are available on the Codere Online Luxembourg SA (CDRO) Forecast page.

Examining the consensus among 4 brokerage firms, Codere Online Luxembourg SA (CDRO, Financial) currently holds an average brokerage recommendation of 2.0, categorized as "Outperform." On the rating scale, 1 corresponds to a Strong Buy, while 5 indicates a Sell, placing CDRO in a positive light from an investment perspective.

GuruFocus Evaluation of GF Value

According to GuruFocus, the GF Value for Codere Online Luxembourg SA (CDRO, Financial) is estimated to be $6.50 for the next year. This valuation reflects a potential downside of 10.34% from its current price of $7.25. The GF Value is a proprietary calculation by GuruFocus to assess the stock's fair trading value, considering its historical trading multiples, past growth patterns, and future business performance forecasts. For more detailed analysis, investors can visit the Codere Online Luxembourg SA (CDRO) Summary page.