FuelCell Energy (FCEL, Financial) announced its financial results for the second quarter, revealing revenue of $37.4 million, surpassing the market forecast of $32.42 million. The company highlighted a successive increase in revenue while maintaining strict cost management measures developed in late 2024 in response to evolving energy sector dynamics.

FuelCell Energy reiterated its strategic focus on advancing its carbonate platform to address the rising demand fueled by AI data centers. This strategy also emphasizes distributed power generation solutions and carbon capture and utilization technologies.

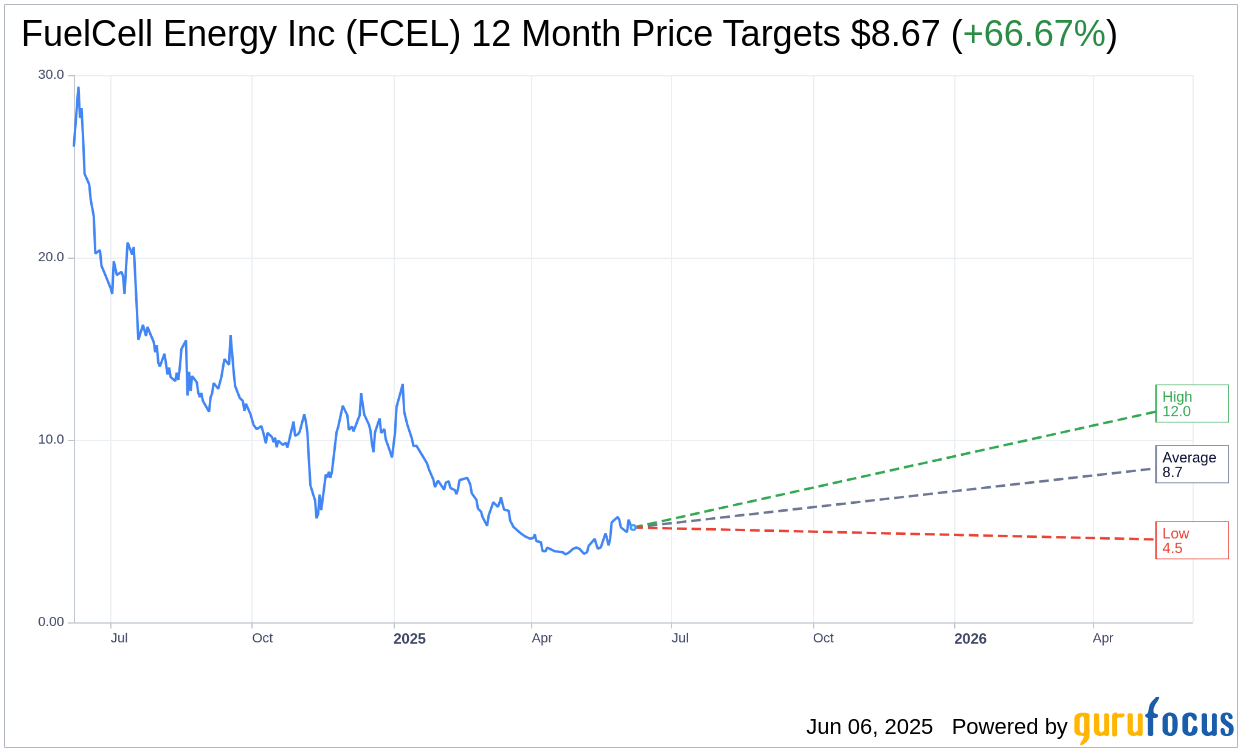

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for FuelCell Energy Inc (FCEL, Financial) is $8.67 with a high estimate of $12.00 and a low estimate of $4.50. The average target implies an upside of 66.67% from the current price of $5.20. More detailed estimate data can be found on the FuelCell Energy Inc (FCEL) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, FuelCell Energy Inc's (FCEL, Financial) average brokerage recommendation is currently 3.3, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FuelCell Energy Inc (FCEL, Financial) in one year is $38.62, suggesting a upside of 642.69% from the current price of $5.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FuelCell Energy Inc (FCEL) Summary page.

FCEL Key Business Developments

Release Date: March 11, 2025

- Total Revenue: $19 million, up from $16.7 million in the prior year quarter.

- Loss from Operations: $32.9 million, improved from $42.5 million in the first quarter of fiscal year 2024.

- Net Loss Attributable to Common Stockholders: $29.1 million, compared to $20.6 million in the first quarter of fiscal year 2024.

- Net Loss Per Share: $1.42, compared to $1.37 in the first quarter of fiscal year 2024.

- Adjusted EBITDA: Negative $21.1 million, compared to negative $29.1 million in the first quarter of fiscal year 2024.

- Cash, Restricted Cash, Cash Equivalents, and Short-term Investments: Over $270 million as of January 31, 2025.

- Product Revenues: $0.1 million, compared to no product revenue in the prior year period.

- Service Agreement Revenues: Increased to $1.8 million from $1.6 million.

- Generation Revenues: Increased 8.1% to $11.3 million from $10.5 million.

- Advanced Technology Contract Revenues: Increased to $5.7 million from $4.6 million.

- Gross Loss: $5.2 million, improved from $11.7 million in the prior year quarter.

- Operating Expenses: Decreased to $27.6 million from $30.8 million in the first quarter of fiscal 2024.

- Backlog: Increased to $1.31 billion from $1.03 billion as of January 31, 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FuelCell Energy Inc (FCEL, Financial) successfully reduced expenses and narrowed operating losses through a global restructuring plan, setting the stage for future growth.

- The company announced a significant partnership with Diversified Energy and TESIAC to deliver up to 360 megawatts of electricity to data centers, positioning FCEL at the forefront of powering the digital economy.

- FCEL expanded its global presence by signing a joint development agreement with Malaysia Marine and Heavy Engineering to co-develop hydrogen production systems across Asia, New Zealand, and Australia.

- The company reported an increase in backlog to $1.31 billion, reflecting new agreements and long-term service contracts, which indicates strong future revenue potential.

- FCEL demonstrated strong progress in cost management, with a significant drop in operating expenses and improved loss from operations year-over-year.

Negative Points

- Despite revenue growth, FCEL reported a net loss attributable to common stockholders of $29.1 million, an increase from the previous year's loss.

- The net loss per share increased to $1.42, primarily due to decreased net loss attributable to non-controlling interests.

- The company is not yet EBITDA positive, with ongoing investment cycles, particularly around solid oxide technology, impacting profitability.

- There is uncertainty in the market due to unclear tax credits and incentives, which may slow down project development and customer decision-making.

- The hydrogen production and clean energy projects face delays and uncertainties, particularly in the domestic market, due to regulatory and incentive-related challenges.