Key Highlights:

- Bowman Consulting Group (BWMN, Financial) announces a $25 million stock repurchase plan.

- Analysts set an average target price of $34.00, predicting significant upside potential.

- BWMN holds an "Outperform" rating with favorable growth forecasts.

Bowman Consulting Group (BWMN) has made a strategic move to boost shareholder value, revealing plans to initiate a stock repurchase program valued at up to $25 million. This new initiative, commencing on June 9, 2025, will take over from the current program ending on June 6, 2025. The announcement has positively impacted investor sentiment, as evidenced by a 1.7% premarket climb in BWMN shares on Friday.

Wall Street Analysts Forecast

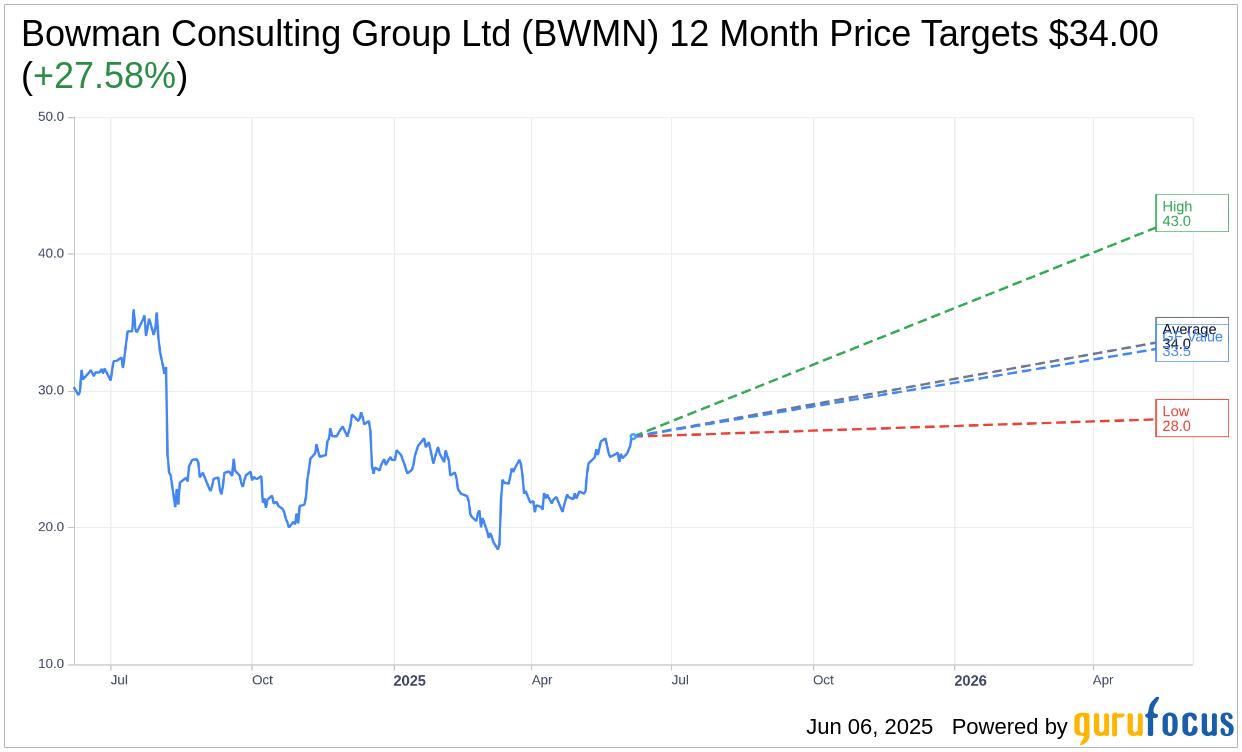

According to insights from six analysts, Bowman Consulting Group Ltd (BWMN, Financial) is projected to reach an average price target of $34.00 within the next year. These projections span from a high of $43.00 to a low of $28.00, indicating a potential upside of 27.58% from its current trading value of $26.65. Investors seeking comprehensive forecast data can explore more on the Bowman Consulting Group Ltd (BWMN) Forecast page.

The broad consensus among six brokerage firms positions Bowman Consulting Group Ltd (BWMN, Financial) at an average recommendation of 1.7, corresponding to an "Outperform" rating. This classification reflects a bullish sentiment, where the rating scale ranges from 1, implying a Strong Buy, to 5, suggesting a Sell.

Furthermore, GuruFocus presents an estimated GF Value for Bowman Consulting Group Ltd (BWMN, Financial) of $33.50 within a year. This figure suggests a 25.7% upside from the stock’s current price of $26.65. The GF Value represents an assessment of fair stock value, derived from historical trading multiples, past business growth patterns, and projected future performance. For deeper insights, visit the Bowman Consulting Group Ltd (BWMN) Summary page.