KeyBanc has initiated coverage on Akamai (AKAM, Financial) with an Underweight rating, reflecting a cautious outlook on the company's future prospects. This assessment comes as part of a broader analysis of select enterprise software businesses. The firm has evaluated Akamai's market position and competitive landscape, which influenced the Underweight rating.

Akamai, known for its cloud services and content delivery network, is facing challenges in maintaining its market share amid growing competition. KeyBanc's initiation signals that while Akamai continues to be a key player in the industry, it may encounter hurdles in expanding its reach and sustaining its growth momentum. The market is closely observing Akamai's strategic moves and how they address these competitive pressures.

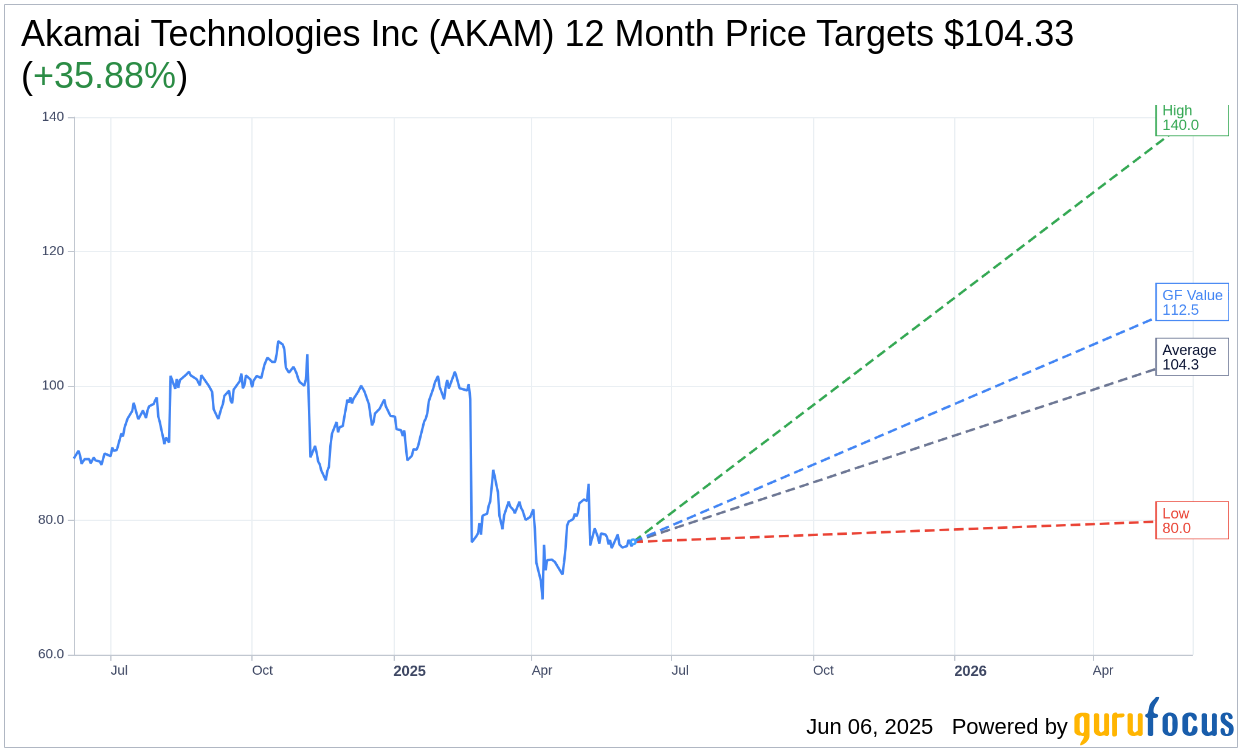

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Akamai Technologies Inc (AKAM, Financial) is $104.33 with a high estimate of $140.00 and a low estimate of $80.00. The average target implies an upside of 35.88% from the current price of $76.78. More detailed estimate data can be found on the Akamai Technologies Inc (AKAM) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Akamai Technologies Inc's (AKAM, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Akamai Technologies Inc (AKAM, Financial) in one year is $112.50, suggesting a upside of 46.52% from the current price of $76.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Akamai Technologies Inc (AKAM) Summary page.

AKAM Key Business Developments

Release Date: May 08, 2025

- Revenue: $1.015 billion, up 3% year over year as reported and 4% in constant currency.

- Non-GAAP Operating Margin: 30%, above guidance.

- Non-GAAP Earnings Per Share (EPS): $1.07, up 4% year over year and 6% in constant currency.

- Security and Compute Revenue: 69% of total revenue, growing 10% year over year as reported and 11% in constant currency.

- Compute Revenue: $165 million, a 14% year-over-year increase as reported and 15% in constant currency.

- Security Revenue: $531 million, growing 8% year over year reported and 10% in constant currency.

- Delivery Revenue: $319 million, down 9% as reported.

- International Revenue: $486 million, up 2% year over year or 5% in constant currency.

- Non-GAAP Net Income: $256 million.

- CapEx: $226 million or 22% of revenue.

- Share Buyback: $500 million spent to buy back approximately 6.2 million shares.

- Cash and Cash Equivalents: Approximately $1.3 billion as of March 31.

- Q2 Revenue Guidance: $1.012 billion to $1.032 billion, up 3% to 5% as reported and in constant currency.

- Full Year 2025 Revenue Guidance: $4.050 billion to $4.2 billion, up 1% to 5% as reported and in constant currency.

- Full Year 2025 Non-GAAP EPS Guidance: $6.10 to $6.40.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Akamai Technologies Inc (AKAM, Financial) reported a solid start to the year with first-quarter revenue of $1.015 billion, up 3% year over year and 4% in constant currency.

- The company's non-GAAP operating margin exceeded guidance at 30%, and non-GAAP earnings per share were well above the high end of guidance at $1.07, up 4% year over year.

- Security and compute segments accounted for 69% of total revenue, growing 10% year over year, highlighting Akamai's transformation into a cybersecurity and cloud computing company.

- Akamai's Guardicore segmentation solution saw strong demand, with significant competitive takeaways and contract expansions in various sectors.

- The company introduced new products, such as the firewall for AI, generating strong customer interest and receiving accolades at industry events.

Negative Points

- Delivery revenue declined by 9% year over year, although it showed better-than-expected results for the quarter.

- Akamai anticipates heightened economic volatility, which could impact revenue growth and margins.

- There are concerns among some international customers about relying on U.S.-based services, which could affect future business.

- The company expects increased operating expenses in the second quarter due to various factors, including marketing expenditures and employee merit cycles.

- Akamai's compute segment growth slowed to 15% year over year, partly due to the exit of legacy revenue streams.