William Blair, a renowned financial services company, has initiated coverage on Allstate (ALL, Financial), providing investors with fresh insights into the company's market potential. Analyst Adam Klauber has assigned a "Sector Outperform" rating to Allstate, indicating a positive outlook for the insurance giant within its sector.

The rating of "Sector Outperform" suggests that Allstate (ALL, Financial) is expected to perform better than the average stock within its market sector. This new coverage by William Blair marks the commencement of their analysis and evaluation of Allstate's business operations and growth prospects. It's important to note that no specific price target has been disclosed at this time.

Investors often rely on such analyst ratings to make informed decisions, as they provide valuable insights into a company's future performance potential. Allstate (ALL, Financial), known for its comprehensive range of insurance products and services, will now be under scrutiny from this well-regarded financial institution.

The initiation of coverage by William Blair and the assignment of a favorable "Sector Outperform" rating could potentially capture the attention of investors looking for robust opportunities within the insurance sector. Stakeholders will keenly observe any further analysis or updates that William Blair might provide concerning Allstate (ALL, Financial).

Wall Street Analysts Forecast

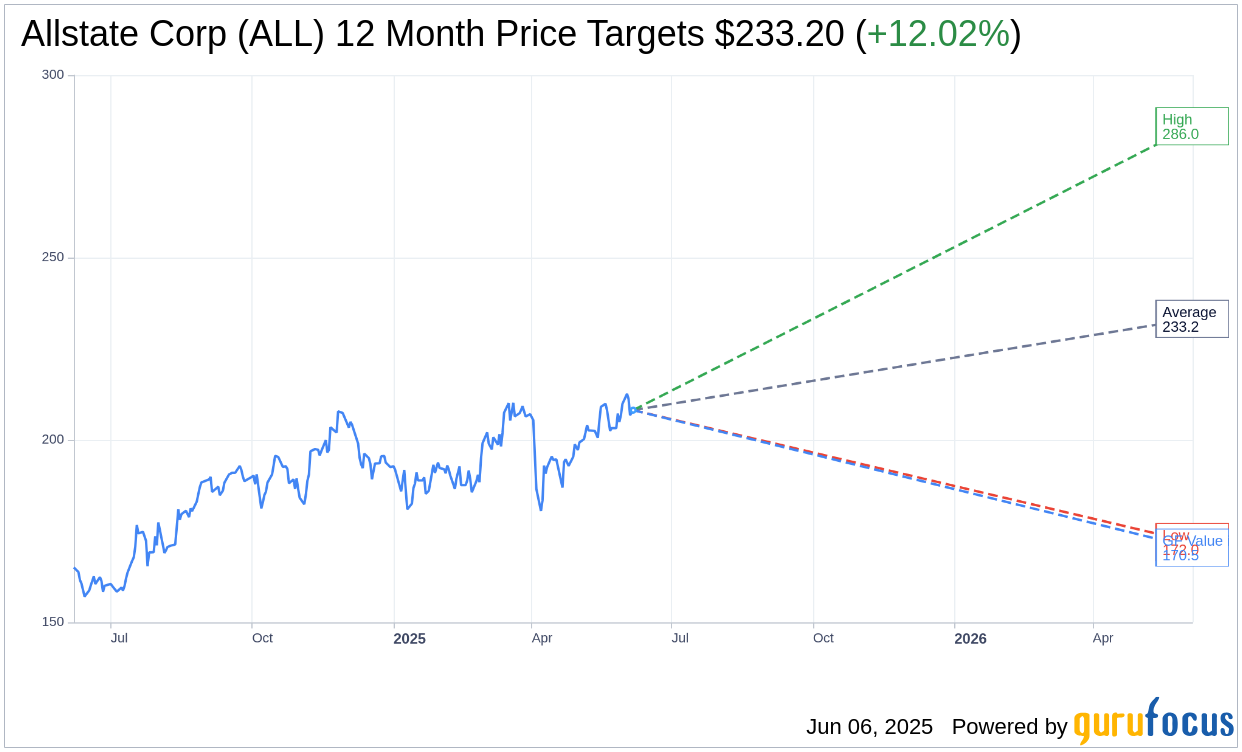

Based on the one-year price targets offered by 15 analysts, the average target price for Allstate Corp (ALL, Financial) is $233.20 with a high estimate of $286.00 and a low estimate of $172.00. The average target implies an upside of 12.02% from the current price of $208.18. More detailed estimate data can be found on the Allstate Corp (ALL) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Allstate Corp's (ALL, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Allstate Corp (ALL, Financial) in one year is $170.49, suggesting a downside of 18.1% from the current price of $208.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Allstate Corp (ALL) Summary page.