Key Takeaways:

- McDonald's introduces McCrispy Strips, but faces criticism and a stock downgrade.

- Analyst targets suggest modest upside potential for McDonald's stock.

- Current consensus gives MCD an "Outperform" rating amidst mixed sentiment.

McDonald's Menu Update and Market Reaction

McDonald's Corp. (NYSE: MCD) has recently launched McCrispy Strips as a permanent addition to its menu. However, not all feedback has been positive, with criticisms emerging around both taste and perceived value. Reflecting these concerns, Loop Capital has downgraded McDonald's stock to a "Hold". Their primary worries are centered on the sluggish recovery of U.S. sales and varied customer reactions, prompting a revision of the stock's price target from $346 to $315.

Wall Street Analysts Forecast

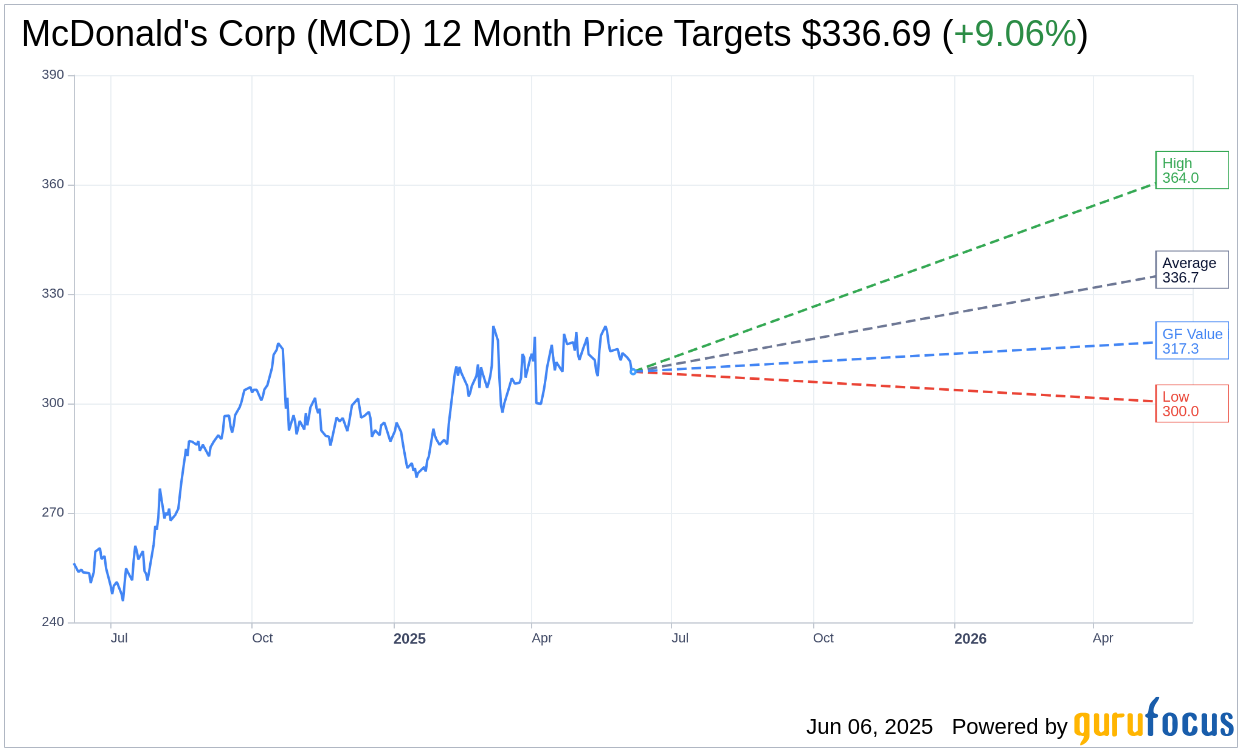

Despite current market challenges, a collection of 29 financial analysts have set a one-year average price target for McDonald's Corp (MCD, Financial) at $336.69. This forecast includes a high estimate of $364.00 and a low of $300.00, suggesting a potential upside of 9.06% from the present share price of $308.72. For further insights, refer to the McDonald's Corp (MCD) Forecast page for comprehensive data analysis.

Analyst Recommendations and GF Value

The consensus among 38 brokerage firms currently positions McDonald's Corp (MCD, Financial) with an average recommendation rating of 2.2, indicating an "Outperform" status. On this evaluation scale, a score of 1 equates to a Strong Buy, while 5 represents a Sell.

According to GuruFocus' projections, the GF Value for McDonald's Corp (MCD, Financial) over the year is estimated at $317.30. This suggests a potential upside of 2.78% from the current trading price of $308.715. The GF Value represents an assessment based on historical trading multiples, past business growth, and future performance estimates. For a detailed overview, visit the McDonald’s Corp (MCD) Summary page.