Key Highlights:

- Iron Mountain (IRM, Financial) shares see a 1.5% rise, reaching $102.80.

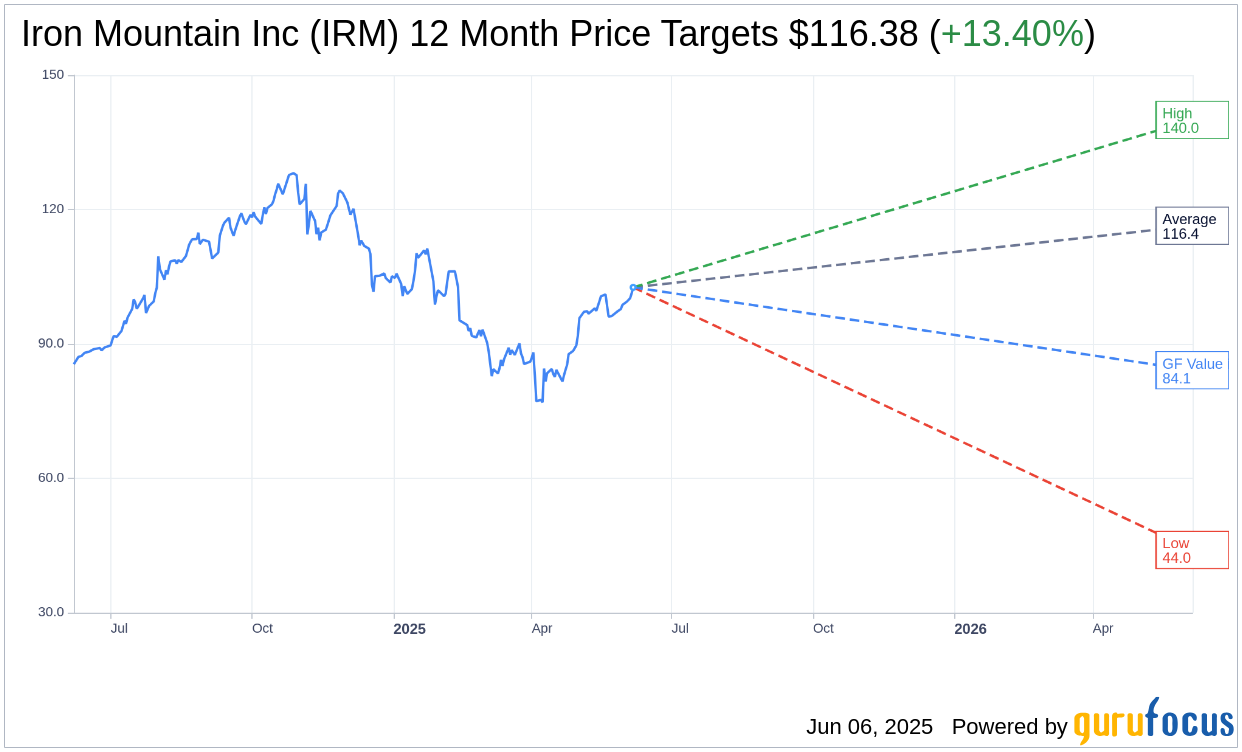

- Analysts predict a potential 13.40% upside, with a target price of $116.38.

- GF Value indicates an 18.02% downside to $84.13.

Iron Mountain (IRM) has experienced a 1.5% uptick, reaching $102.80, marking an impressive seven-session winning streak. Although the stock has decreased by 2.7% year-to-date, contrasting the S&P 500's 1% increase, it has surged 6% in the past month. This upward momentum is largely credited to the company's robust Q1 results and an optimistic full-year outlook that have significantly elevated investor confidence.

Wall Street Analysts Forecast

According to the projections from eight analysts, Iron Mountain Inc (IRM, Financial) is anticipated to reach an average price target of $116.38 over the next year, with estimates ranging from a high of $140.00 to a low of $44.00. This average projection implies a potential upside of 13.40% from the current trading price of $102.63. For more in-depth estimates, please visit the Iron Mountain Inc (IRM) Forecast page.

Moreover, consensus from ten brokerage firms rates Iron Mountain Inc (IRM, Financial) with an average recommendation score of 2.2, reflecting an "Outperform" status. The rating spectrum ranges from 1 (Strong Buy) to 5 (Sell).

GuruFocus Value Estimate

According to GuruFocus, Iron Mountain Inc (IRM, Financial) is estimated to have a one-year GF Value of $84.13, suggesting a potential downside of 18.02% from its current price of $102.625. The GF Value, a reflection of the stock's fair trading price, is derived from historical trading multiples, past business performance, and future growth projections. For additional insights, visit the Iron Mountain Inc (IRM) Summary page.