Key Takeaways:

- Opendoor Technologies proposes a reverse stock split, ranging from 1-for-10 to 1-for-50.

- Analysts offer an average price target of $1.15 for OPEN, indicating potential upside.

- GuruFocus estimates suggest a significant upside with a GF Value of $1.50.

Opendoor Technologies Inc. (NASDAQ: OPEN) is making strategic moves to enhance its stock value through a proposed reverse stock split, as outlined in its recent proxy statement. The company is considering a split ratio between 1-for-10 and 1-for-50, impacting its current share price of $0.644. The announcement has led to a 5.26% decline in after-hours trading.

Wall Street Analysts Forecast

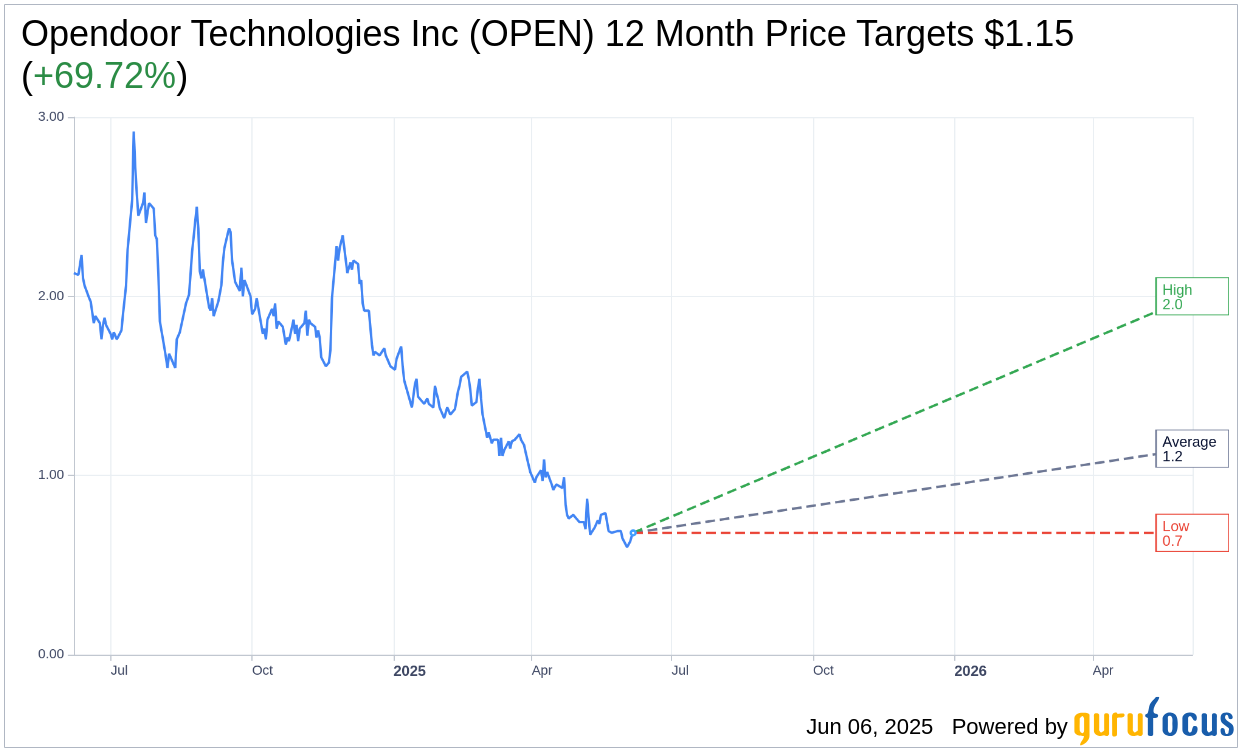

Wall Street analysts have set a range of one-year price targets for Opendoor Technologies, with the average target price being $1.15. This projection includes a high estimate of $2.00 and a low estimate of $0.68, suggesting a potential upside of approximately 69.72% from the current price of $0.68. For more detailed estimates, visit the Opendoor Technologies Inc (OPEN, Financial) Forecast page.

Brokerage Firm Recommendations

The consensus recommendation from 10 brokerage firms rates Opendoor Technologies Inc. as a "Hold," with an average brokerage recommendation score of 3.0. This rating is on a scale from 1 to 5, where 1 indicates a Strong Buy and 5 a Sell.

GuruFocus Valuation Insights

According to GuruFocus metrics, the estimated GF Value for Opendoor Technologies within one year is $1.50. This indicates a substantial upside potential of 120.65% from the current price of $0.6798. The GF Value is determined by evaluating historical trading multiples, past business growth, and future business performance estimations. For more comprehensive data, refer to the Opendoor Technologies Inc (OPEN, Financial) Summary page.