StealthGas (GASS, Financial) is executing its plans with discipline. It has upgraded its fleet, managed to secure dependable charter agreements and decreased its total debt, all of which have improved its financial position. Though spot exposure has slightly reduced earnings, this decision could provide greater profits if interest rates improve. Although insiders are not active, financial gurus have taken a careful approach, keeping their positions near breakeven which implies no immediate rush to leave. Nevertheless, the company is still trading at a lower value compared to its sector's average and this disconnect is definitely a lucrative buying opportunity for value investors.

Company overview and smart growth moves

StealthGas mainly offers seaborne transportation services by ship to the LPG industry across the world. Its vessels transport various types of petroleum and petrochemical gas products.

In 2024, StealthGas focused on growth and fleet modernization. It acquired two Medium Gas Carriers (MGCs) that are built on the latest technology and are eco-friendly. It also entered into multiple lease arrangements including new leases and extending some for LPG carriers. This has led StealthGas to secure 65% of its fleet days for 2025 under term charters. The combined revenue from all these contracts will bring in more than $220 million (not including joint vessels), which is huge.

Meanwhile, StealthGas is set to become the sole owner of Eco Lucidity and Gas Haralambos by buying the rest of the shares from its JV company. These two freighters will become the property of Port of Bristol Freeports by June. This process is beneficial as cash is created without taking any debt and the company's assets are managed efficiently.

Additionally, StealthGas has started employing a different strategy. It is now considering to expand to other shipping segments by broadening its fleet. I feel that the company is making full use of the positive situation in the LPG transportation market.

StealthGas Q1 2025: Strength beneath the surface

At a quick look, the Q1 2025 results from StealthGas seem underwhelming. Still, when we examine it closely, the company is managing its business according to a strict plan in the face of a tight market. In reality, what GASS continues to build over time is just what long-term investors are after.

Revenue stability masks a tactical spot market move: StealthGas earned $42 million in revenue in Q1 2025 which was higher than Q1 2024's $41.6 million but not as high as Q4's $43.5 million. Still, the company decided to take a different approach at this point. It moved five ships to the spot market. Due to this move, voyage costs increased from $2.9 million to $5.1 million which led to a 4.6% drop in net revenues to $36.9 million. Even so, the strategy exposes it to the current market rates in Europe and the Med, but 70% of its ships are still tied to long-term charters for the rest of the year.

Earnings dip? Yes. Cause for concern? Not really.: This year's adjusted net income totaled $16.1 million which is a 16% decrease from last year's $19.1 million. Meanwhile, adjusted EPS was 44 cents, less than last year's 53 cents. The drop in earnings was caused by higher operating expenses which went up by 17.7% YOY. This happened due to expenses for crew and maintenance, plus drydocking charges and a non-cash impairment of $0.9 million, the latter items not being seen in Q1 2024. However, despite these difficulties, the company's profits were the same as in Q4 and EBITDA stayed strong at $23.5 million (adjusted). It is important to note that interest costs declined by more than half from the previous year, thanks to debt repayments which improved the company's ability to handle expenses.

Net debt-free and almost fully unencumbered: StealthGas has avoided major problems that regularly hit the shipping industry due to over-borrowing. In 2025, the company paid off $54 million of debt and since 2023, it has repaid a total of $315 million. Among the fleet, just one vessel is financed, so the company enjoys full freedom in its use of assets. The company's cash and short-term investments are $77 million and this is more than the $50.9 million in debt it holds, making it net cash positive. Lowering the yearly debt payments to $2.2 million has made it unlikely for the company to face financial troubles.

Favorable market tailwinds are quietly building: Global LPG exports surged 4.4% YOY and US propane exports went up 8%. As soon as PDH plants in China are built and US terminals start working by late 2025, the expected rise in cargo shipments will fuel demand for charters into 2026. At the same time, the number of LPG trucks is limited. Almost one-third of vessels are older than 20 years and newbuild activity is limited. Orderbooks for vessels used in pressurized services are still small and scrapping activity has not improved. This means there are plenty of buyers for new and efficient freight vessels which includes all of GASS's vessels, built in Japan and Korea.

Simply put, this wasn't a quarter full of big events and that's exactly my point. The company is working on margins, streamlining its capital and preparing itself for a shipping cycle that could work in its favor.

Numbers don't lie: StealthGas is going cheap

Anyone looking for hidden outperformers among low-key stocks might find GASS to be a good choice.

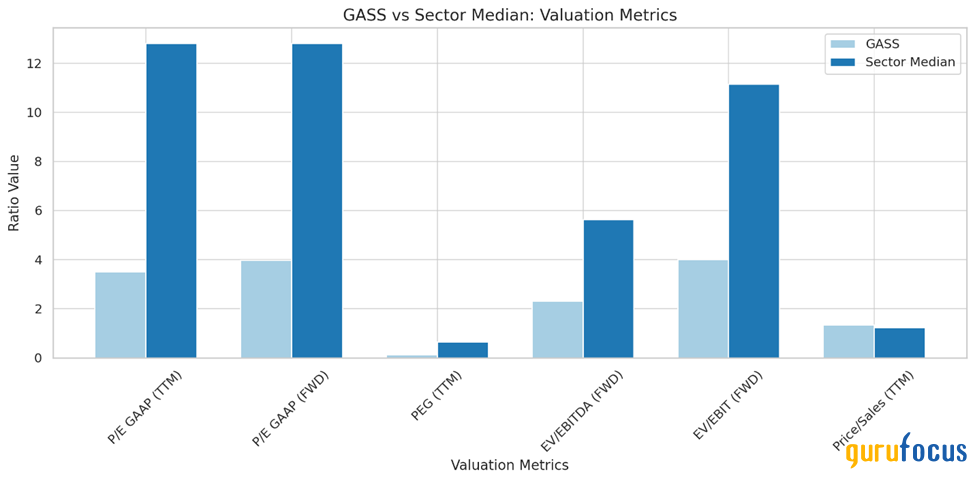

Source: Author generated based on data

The first thing to notice is that GASS's P/E GAAP for the past twelve months stands at 3.50x which is 72% lower than the industry's average of 12.8x. Moreover, the forward P/E ratio is only 3.97x for the company, compared to an average of 12.81x in its sector. Simply put, investors are receiving more value per dollar GASS earns than the industry's average. Meanwhile, if you look at the PEG TTM ratio in the same way, it is only 0.12x which is 80% less than the sector median of 0.65x and implies the market is ignoring the company's growth chances.

Even among enterprise value metrics which are important for industries that require a lot of money like shipping, GASS remains at the top. Its EV to EBITDA forward multiple is 2.31x, which is 59% cheaper than the industry median of 5.63x. Since its forward EV to EBIT of 4.01x is also under the sector average of 11.04x, GASS excels at making profits from its assets after adjusting for depreciation. This proves that the company's basic business is reliable, despite what the market believes about it.

In addition, GASS's Price/Sales measure stands at 1.33x on a TTM basis which is almost in line with the sector's median of 1.24x. Actually, this doesn't provide as much insight as earnings and enterprise value in shipping. Still, investors should remember that GASS has a moderate valuation on the revenue side too.

The company has been a low price-to-book ratio player with an average of 0.2x to 0.4x compared to the sector median of around 1.5x. It has not paid a dividend in 15 years and its per-share book value has not changed too much. That being the case, you may be wondering what makes this time any different.

The difference this time is that the company is much stronger overall. It is almost debt-free, is very cash-positive, and almost entirely owns its fleet as well. Such vessels are not large LPG carriers, but pressurized ones designed to deliver gas to small ports lacking the infrastructure to accommodate the big refrigerated vessels. These vessels are significant in the distribution of gas in the regional gas distribution, particularly in Europe and Asia.

Interestingly, it is not an increase in demand but rather a confined supply that slowly moves the market in favor of StealthGas. Many older vessels are being phased out and there is very limited new shipment activity in the pressurized segment. This is providing StealthGas with firmer control of its operations, better charter rates, and more robust margins, even when the entire market demand remains flat. It is a small change, yet it may be one that may enable the company to escape its decades-long valuation range.

To sum up, the company is valued like a business in trouble, yet it functions smoothly and efficiently. Value investors should see this gap as a discounted ticket before the price goes up with the rest of the market.

Decoding Price Trends with Insider and Guru Moves

The last year has seen StealthGas shares fall by about 27.5%, from being worth more than $8 to its present level of $6.07. The decline is not due to a weaker foundation but to costs such as extra journey and labor expenses, along with the company's shift toward the spot market deals that cause brief ups and downs. Such decisions were made to get the most out of a tight shipping market.

The story becomes more interesting when the attention turns to the five-year results. Since 2020, when it was trading for less than $3, StealthGas's share price has soared, giving more than 130% return as of now. This was achieved by reducing financial leverage, increasing charter reliability and making stricter capital control. Even though prices have dropped recently, the long-term trend is still up. Basically, the reasons behind the market's strength are still present and the stock is just consolidating after a robust run.

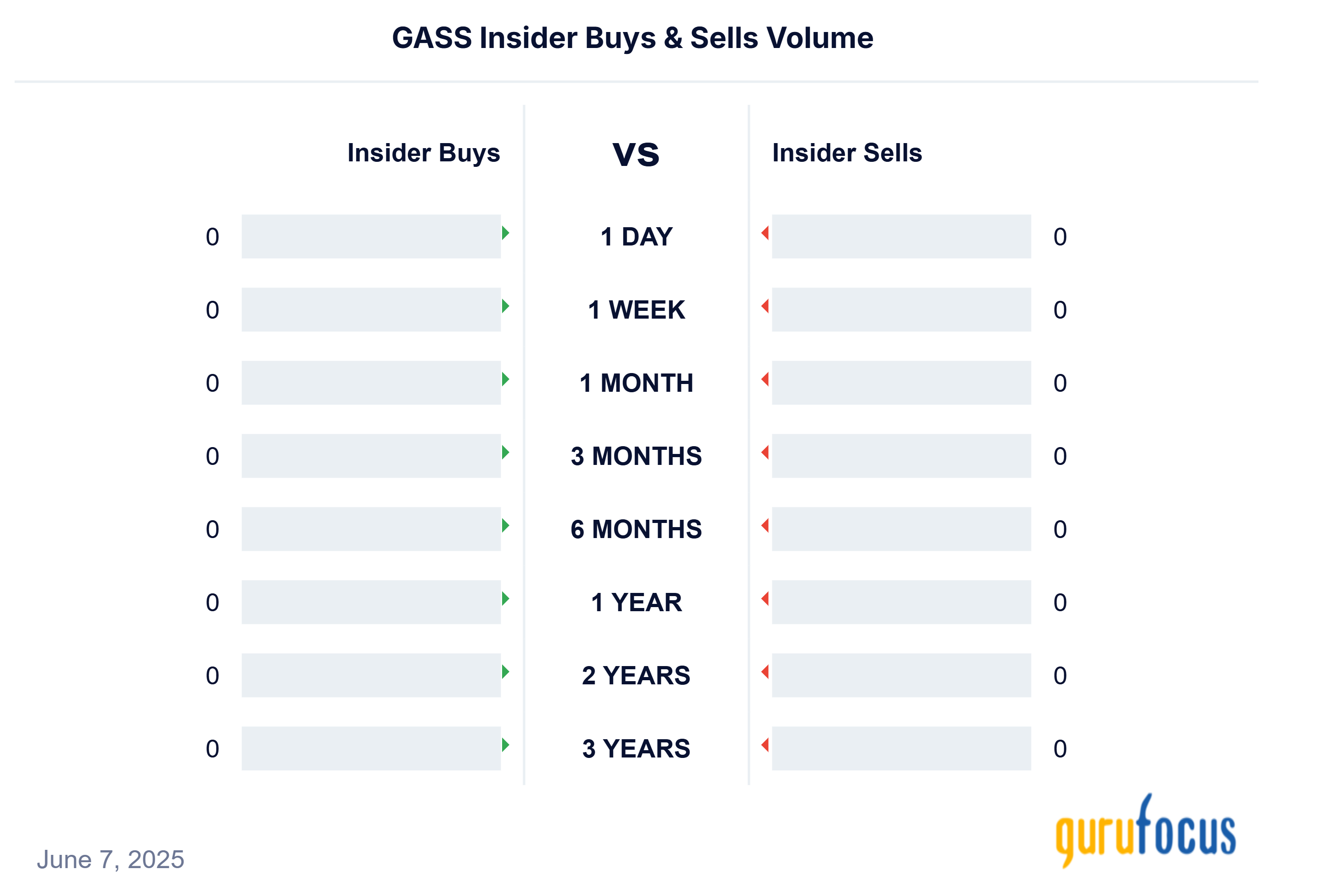

Insider trading: A quiet signal of confidence: Remarkably, no insider activity has been reported during the past three years.

In many cases, insiders sell their shares, it often happens with wider concerns or pessimism among investors. Having said that, insiders in this case haven't sold any shares, even through the recent price drop, which seems to indicate they believe the stock will not stop at its current level. To sum up, insiders are relatively calm about recent fluctuations, showing that they are confident about the company's future.

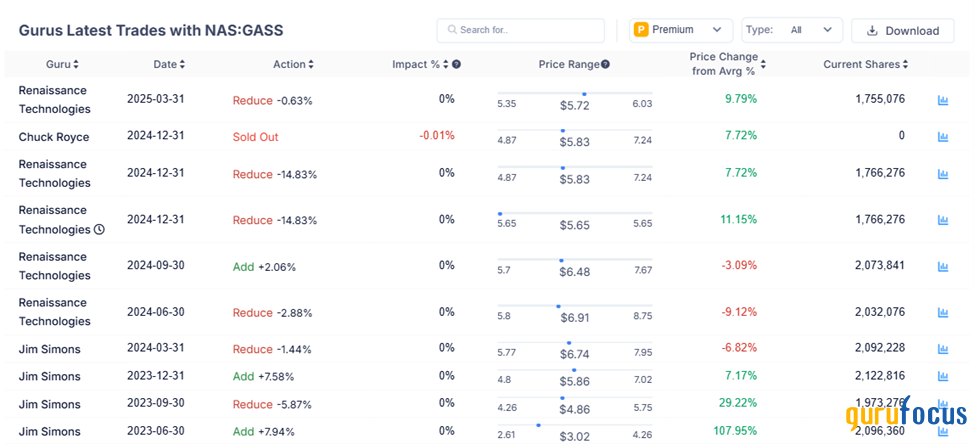

Guru trades reflect cautious confidence and steady positioning: While the inside operation was more subtle, guru activity gave stronger clues.

In 2025, Renaissance Technologies (Trades, Portfolio) made small trims in its portfolio, like a 0.63% reduction in March, probably a normal portfolio management. In addition, the majority of the fund's assets were gathered in 2023, largely between $4.80 and $6.00 which syncs with GASS's early recovery phase. Even though Chuck Royce (Trades, Portfolio) has exited completely as of late 2024, this doesn't seem to indicate a loss of conviction, but rather a rotational strategy. Currently, most guru funds remain near breakeven or showing minimal gains which reduces the possibility of major sell-offs unless the market changes a lot.

A realistic price outlook: Following the current state and values from the past, I predict a price range of 7.00 to 7.50 during the next 6 to 12 months. I don't need to make aggressive forecasts, as what I foresee is simply reflected by the company's earnings power and a modest positivity in sentiment.

My perspective is also backed by the Analysts, who assign GASS stock an ‘outperform' rating with a 2.0 rating and anticipate more than 59.24% upside for the company. Therefore, the path to re-rating is well established.

Risks to my thesis

Although StealthGas is in good financial shape and runs its operations well, there are still significant risks that could temper its immediate growth.

About 30% of the company's ships are exposed to the spot market. The fluctuating nature of spot freight rates is due to geopolitical issues, re-directed trade routes and any problems at ports. A decline in these rates or an increase in their variability could affect the company's earnings and squeeze its short-term profits.

In addition, the cost burden is piling up. Increasing wages for crews, regular maintenance and drydocking are apparent and if charter rates do not rise, the margins might decrease. At the moment, StealthGas manages these costs. However, if inflation in general continues, it could eventually start to impact the company's profits, especially with any extra costs from higher interest or regulatory compliance costs.

Furthermore, Bunker expenses create a major challenge. Since energy markets are unpredictable, the surge in bunker prices has made the voyage costs go up. Such additional expenses which may go uncovered by contracts, can cause ships to earn less on each voyage and dampen the earnings of the company.

Last but not least, geopolitical developments are now affecting trade routes more than before. As the EU has put a ban on Russian LPG imports, it has become more uncertain and challenging for the region's cargo flows, especially logistics around shipping. Hence, StealthGas must handle additional logistical issues and understand how global LPG shipping can change due to new regulations.

Your takeaway

StealthGas is efficient without attracting much attention while blending financial control with flexibility. Thanks to its robust fundamentals and supply backdrop that is acting in its favor, this time the overall story is lucrative.

Even though some institutions have reduced their holdings, insider selling is not taking place which suggests that confidence remains. Still, the stock is valued well below its industry's median which could interest value investors. Even though earnings in the short term may be affected by market changes, the company seems to be holding its position brilliantly in the long run. Therefore, those who concentrate on the fundamentals can benefit from StealthGas's stability, variety of choices and being undervalued in a volatile sector.