A recent analysis has indicated that Fannie Mae and Freddie Mac are adjusting their pricing and structure strategies to capture a larger market share, aiming to meet the current year's lending targets. According to data from Recursion, Fannie Mae's loan volumes climbed to $22.8 billion by May, marking a 48% increase compared to the previous year, while Freddie Mac's figures remained steady through April.

This increase in lending volumes by government-sponsored entities is anticipated to positively impact several companies, notably Walker & Dunlop and Arbor Realty (ABR, Financial), among others. Despite macroeconomic uncertainties posing certain risks, the enhanced transactions from these entities present favorable conditions specifically for Arbor Realty (ABR) and its peers in the sector.

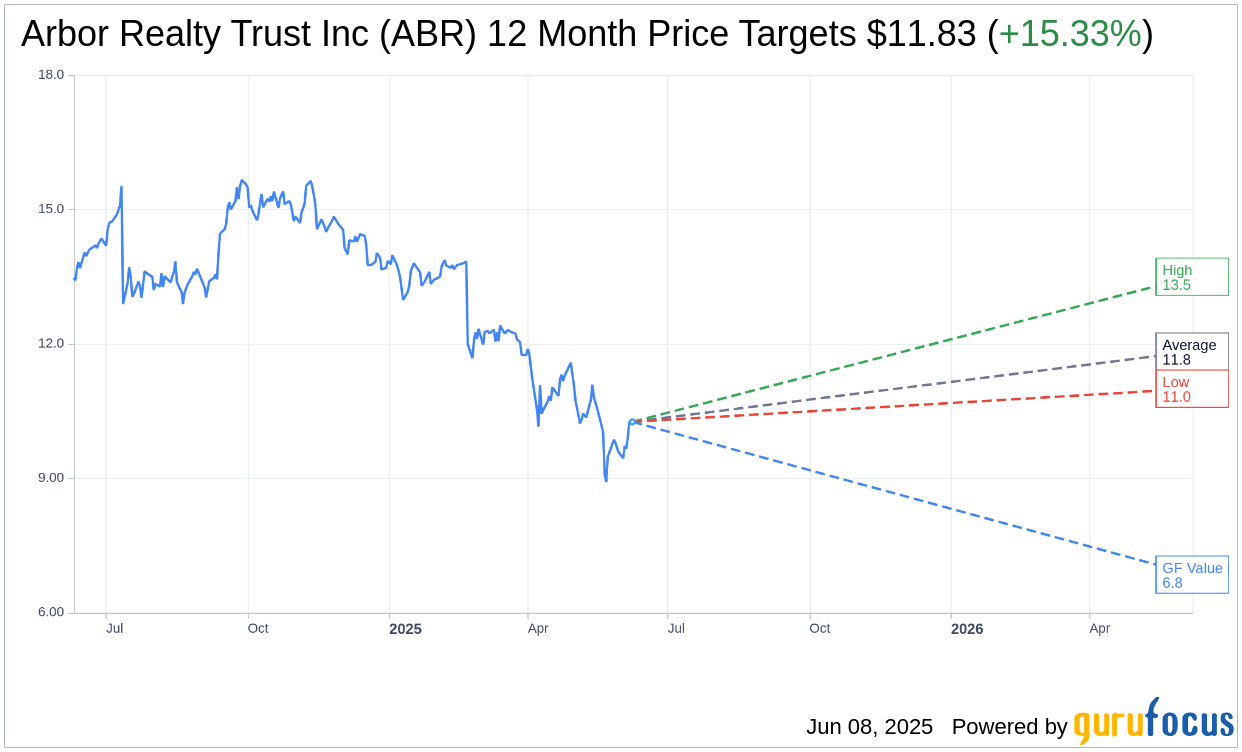

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Arbor Realty Trust Inc (ABR, Financial) is $11.83 with a high estimate of $13.50 and a low estimate of $11.00. The average target implies an upside of 15.33% from the current price of $10.26. More detailed estimate data can be found on the Arbor Realty Trust Inc (ABR) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Arbor Realty Trust Inc's (ABR, Financial) average brokerage recommendation is currently 3.3, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Arbor Realty Trust Inc (ABR, Financial) in one year is $6.85, suggesting a downside of 33.24% from the current price of $10.26. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Arbor Realty Trust Inc (ABR) Summary page.

ABR Key Business Developments

Release Date: May 02, 2025

- Distributable Earnings: $57.3 million or $0.28 per share; $0.31 per share excluding $7 million of onetime realized losses.

- Return on Equity (ROE): Approximately 10% for the first quarter.

- Quarterly Dividend: Reset to $0.30 per share.

- Bridge Loan Originations: $370 million in new bridge loans for the first quarter.

- Agency Loan Originations: $606 million in originations and $731 million in loan sales.

- Agency Loan Margins: 1.75% for the first quarter.

- Mortgage Servicing Rights (MSR) Income: $8.1 million related to $645 million of committed loans.

- Fee-Based Servicing Portfolio: Approximately $33.5 billion with a weighted average servicing fee of 37.5 basis points.

- Investment Portfolio: Grew to $11.5 billion at March 31.

- All-In Yield on Investment Portfolio: 7.85% at March 31.

- Total Debt on Core Assets: Approximately $9.5 billion at March 31.

- All-In Cost of Debt: Approximately 6.82% at March 31.

- Net Interest Spread on Core Assets: 1.26% for the first quarter.

- Spot Net Interest Spread: 1.03% at March 31.

- Leverage Ratio: Delevered to 2.8:1 from a peak of around 4.0:1 over two years ago.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Arbor Realty Trust Inc (ABR, Financial) entered into a $1.1 billion repurchase facility with JPMorgan, enhancing liquidity by approximately $80 million.

- The company successfully modified $38 million of loans, with $39 million becoming fully performing again.

- Arbor Realty Trust Inc (ABR) originated $370 million in new bridge loans in the first quarter, aligning with their annual target of $1.5 billion to $2 billion.

- The company reported strong demand in the CLO securitization market, which is expected to drive future earnings.

- Arbor Realty Trust Inc (ABR) has a robust pipeline of approximately $2 billion, indicating confidence in meeting 2025 guidance despite a slower start.

Negative Points

- The company experienced additional delinquencies of approximately $109 million, bringing total delinquencies to $654 million as of March 31.

- Arbor Realty Trust Inc (ABR) anticipates a challenging 2025 due to the drag on earnings from REO assets and delinquencies.

- The higher interest rate environment has negatively impacted the origination business, contributing to a slower first quarter.

- The company recorded an additional $16 million in specific reserves in the first quarter due to the current economic environment.

- Arbor Realty Trust Inc (ABR) reset its quarterly dividend to $0.30 per share, reflecting the challenging environment and revised guidance.