Vireo Growth (VREOF, Financial) has finalized its acquisition of Nevada's Deep Roots Holdings, a firm well-regarded in the state's established cannabis industry. Deep Roots, operating since 2023, boasts a 54,000 square foot facility for cultivation and manufacturing, alongside ten active retail locations. Its strategic positioning, particularly near the Utah-Nevada border, enhances its market performance. The company also holds significant investments in a California retail chain and operations in Ohio and Massachusetts.

The acquisition was valued at $132.7 million, settled by issuing 255.2 million Subordinate Voting Shares of Vireo at $0.52 per share. This price reflects a valuation of 4.175 times the projected 2024 EBITDA of $30 million. A clawback clause is in place if 2026 EBITDA falls short of this benchmark by December 31, 2026. Moreover, the sellers have accepted a phased lock-up of their shares, with release scheduled over 33 months.

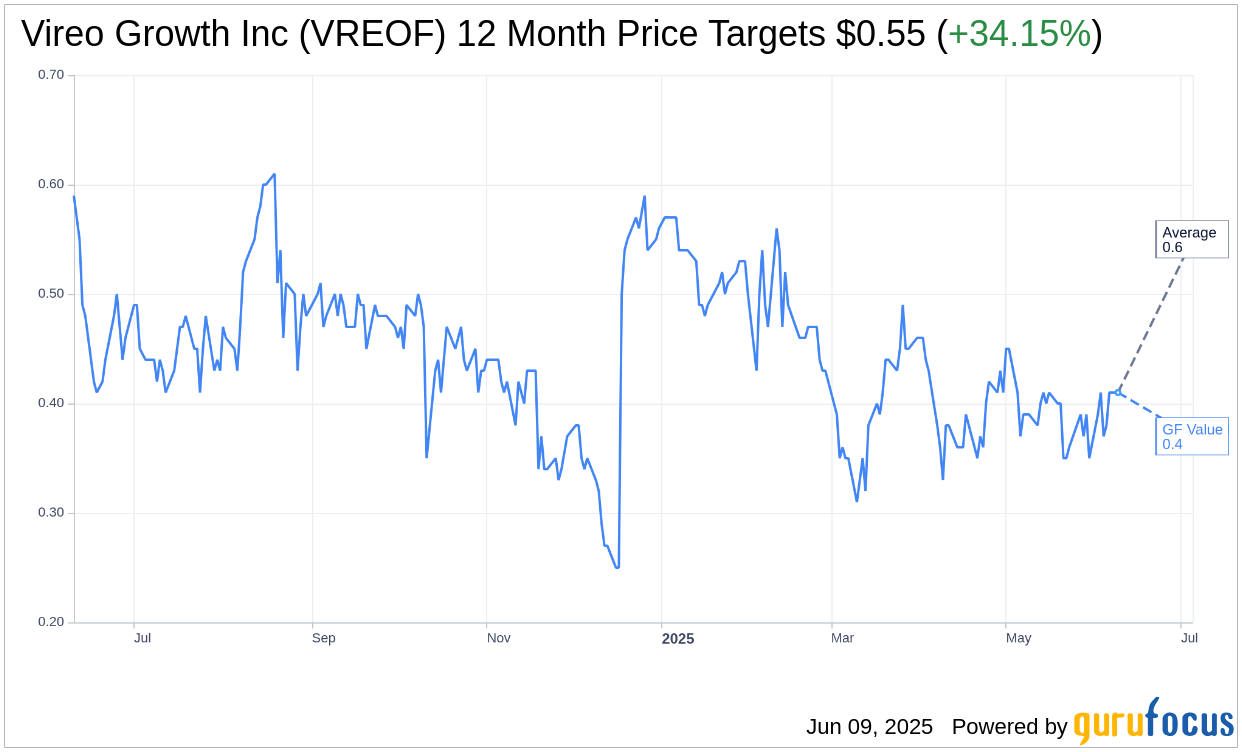

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Vireo Growth Inc (VREOF, Financial) is $0.55 with a high estimate of $0.55 and a low estimate of $0.55. The average target implies an upside of 34.15% from the current price of $0.41. More detailed estimate data can be found on the Vireo Growth Inc (VREOF) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Vireo Growth Inc's (VREOF, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Vireo Growth Inc (VREOF, Financial) in one year is $0.37, suggesting a downside of 9.76% from the current price of $0.41. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Vireo Growth Inc (VREOF) Summary page.

VREOF Key Business Developments

Release Date: May 09, 2025

- Revenue: $24.5 million, increased 1.9% year over year, slightly down sequentially.

- Gross Margin: Roughly flat year over year; excluding one-time fees, improved 120 basis points to 51.8%.

- SG&A Expenses: $7.5 million or 30.5% of sales; flat year over year excluding severance expenses.

- Operating Income: Impacted by one-time transaction expenses; adjusted operating income approximately $3.9 million.

- Property Income: $1.9 million, down from $4.7 million in Q1 of last year.

- Cash on Hand: $86.3 million at the end of Q1.

- Total Current Assets: $128.5 million, excluding New York assets held for sale.

- Total Current Liabilities: $13.3 million, with zero current debt.

- Long-term Debt: $62.6 million, maturing in early 2027.

- Shares Outstanding: 47,278,412 shares on a Treasury method basis.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- First quarter revenue increased 1.9% year over year to $24.5 million, indicating growth in core markets.

- Continued growth was observed in Maryland, with stable performance in Minnesota.

- Sales of wholesale products from the indoor facility in New York commenced in Q1 and are ramping up in Q2.

- The pending merger transactions are expected to enhance profitability with positive net income.

- The company maintains a healthy financial position with $86.3 million in cash on hand and no current debt.

Negative Points

- First quarter revenue was down slightly on a sequential basis compared to the fourth quarter.

- There were expected declines in New York medical sales, impacting overall performance.

- GAAP gross margin performance was flat compared to the previous year, affected by one-time fees.

- Property income decreased significantly from $4.7 million in Q1 of last year to $1.9 million.

- Operating income was impacted by one-time transaction expenses of $1.2 million related to pending mergers.