Commvault (CVLT, Financial) has rolled out improvements to its post-quantum cryptography (PQC) solutions. These enhancements aim to secure customers' critical long-term data against emerging and unpredictable cyber threats. By integrating these advancements, Commvault provides an additional protective layer for sensitive information, helping enterprises stay prepared for future security challenges.

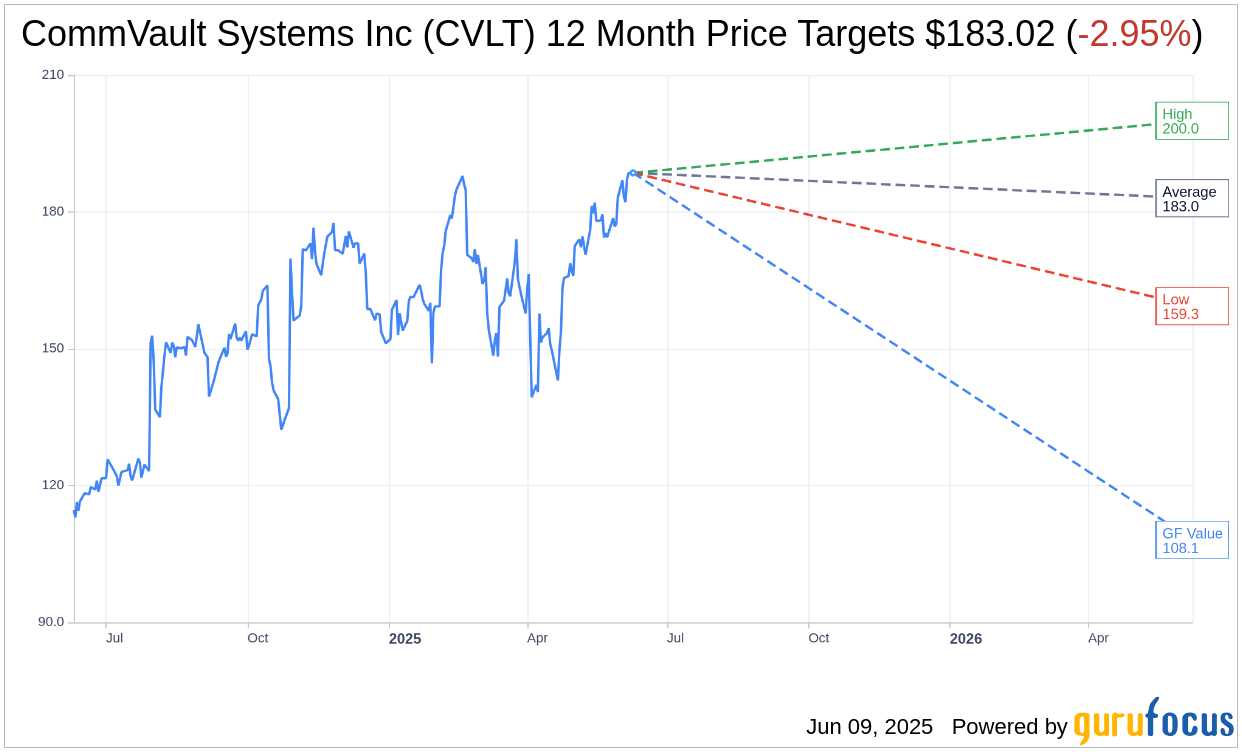

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for CommVault Systems Inc (CVLT, Financial) is $183.02 with a high estimate of $200.00 and a low estimate of $159.34. The average target implies an downside of 2.95% from the current price of $188.57. More detailed estimate data can be found on the CommVault Systems Inc (CVLT) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, CommVault Systems Inc's (CVLT, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CommVault Systems Inc (CVLT, Financial) in one year is $108.10, suggesting a downside of 42.67% from the current price of $188.57. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CommVault Systems Inc (CVLT) Summary page.

CVLT Key Business Developments

Release Date: April 29, 2025

- Total Revenue: Increased 23% to $275 million.

- Subscription Revenue: Grew 45% to $173 million.

- Total ARR: Improved 21% to $930 million.

- SaaS ARR: Jumped 68% to $281 million.

- Gross Margin: 83.1% for fiscal Q4.

- Operating Expenses: $168 million, representing 61% of total revenue.

- Non-GAAP EBIT: Grew 31% to $59 million, with margins up 130 basis points to 21.5%.

- Free Cash Flow: $76 million for Q4 and $204 million for the full year.

- Cash Position: Ended the quarter with $302 million in cash.

- Stock Repurchase: $165 million, representing 81% of free cash flow.

- Q1 Fiscal '26 Revenue Guidance: Total revenue expected to be $266 million to $270 million.

- Fiscal '26 Total ARR Growth Guidance: Expected to grow 16% to 17% year-over-year.

- Fiscal '26 Total Revenue Guidance: Expected to be $1.13 billion to $1.14 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CommVault Systems Inc (CVLT, Financial) reported a 23% increase in total revenue, reaching $275 million, with subscription revenue growing by 45%.

- The company achieved a 68% increase in SaaS ARR, totaling $281 million, indicating strong growth in their SaaS offerings.

- CommVault Systems Inc (CVLT) successfully integrated two acquisitions, expanding their platform's capabilities, particularly with AWS workloads.

- The company added nearly 3,000 new subscription customers, demonstrating strong customer acquisition and growth in their land business.

- CommVault Systems Inc (CVLT) achieved a Rule of 40 score of 41 for the fiscal year, indicating a healthy balance of growth and profitability.

Negative Points

- Despite strong revenue growth, the operating margin guidance remains flat year-over-year, indicating limited margin expansion.

- The macroeconomic environment remains uncertain, which could impact future demand and sales cycles.

- The company faces competition from other vendors like Rubrik and Cohesity, which are perceived to be stronger in cybersecurity.

- CommVault Systems Inc (CVLT) is transitioning to a cash taxpayer status, which may impact future cash flow.

- The company's growth strategy involves significant investment, which could pressure profitability if not managed carefully.