Key Highlights:

- United Microelectronics (UMC, Financial) announces attractive dividend payout with a forward yield of 6.24%.

- Analysts' average price target for UMC suggests a moderate downside from current levels.

- UMC holds a "Hold" status from brokerage firms, reflecting cautious investor sentiment.

United Microelectronics (UMC) has declared an annual dividend of $0.476 per share, translating to a forward yield of 6.24%. This dividend is slated for distribution on July 23 to shareholders on record as of June 24. The ex-dividend date is also marked for June 24.

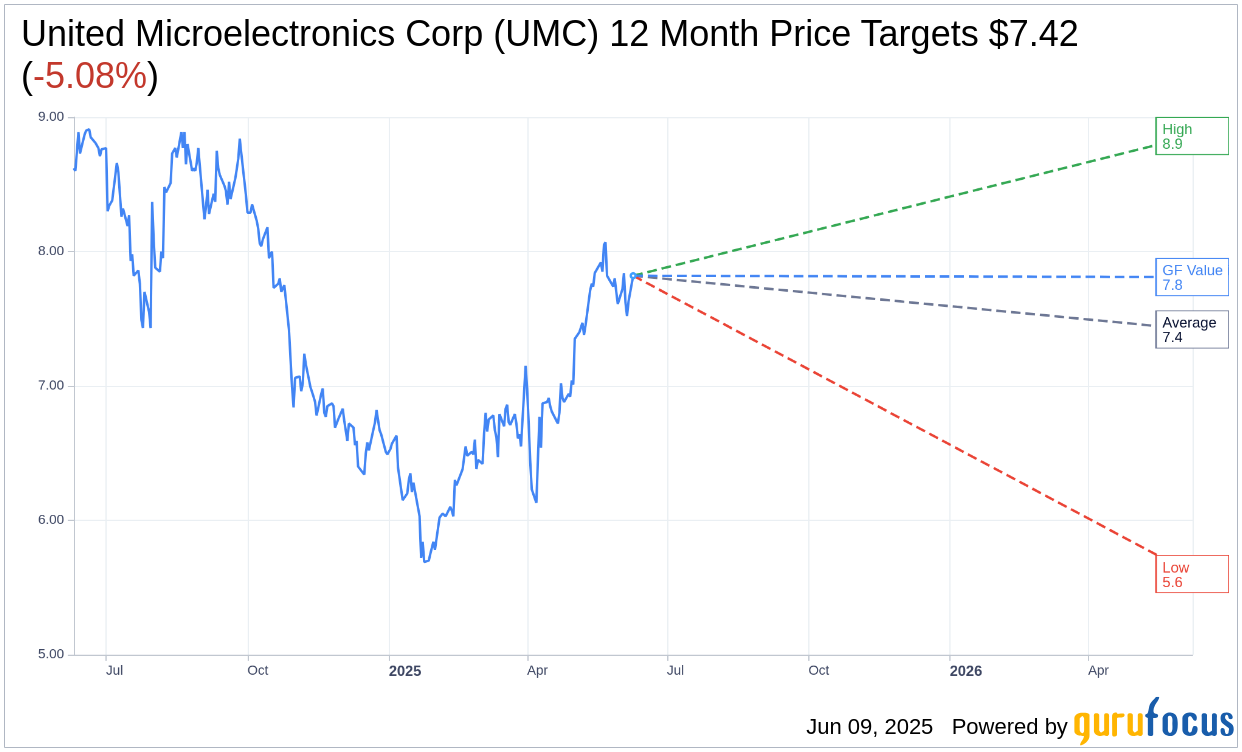

Wall Street Analysts Forecast

Wall Street analysts have shared their insights with one-year price targets for United Microelectronics Corp (UMC, Financial). The average target price stands at $7.42, with projections ranging from a high of $8.86 to a low of $5.60. This average target price implies a potential downside of 5.08% from UMC's current price of $7.82. For more comprehensive estimate data, visit the United Microelectronics Corp (UMC) Forecast page.

Brokerage Recommendations

According to consensus from six brokerage firms, United Microelectronics Corp's (UMC, Financial) average brokerage recommendation is currently 3.2, aligning with a "Hold" status. This rating is based on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates Sell. This positioning reflects a cautious stance among brokerage firms regarding UMC's market performance.

GuruFocus Valuation Metrics

Analyzing GuruFocus's proprietary metrics, the estimated GF Value for United Microelectronics Corp (UMC, Financial) in the next year is pegged at $7.81. This suggests a minimal downside of 0.06% from the current price of $7.815. The GF Value represents GuruFocus' assessment of the fair value at which the stock should be traded, calculated based on historical trading multiples, previous business growth, and projected future performance. More detailed insights are available on the United Microelectronics Corp (UMC) Summary page.