Truist has increased its target price for COPT Defense Properties (CDP, Financial) from $29 to $30, maintaining a Hold rating on the stock. The forecast anticipates a consolidated occupancy rate of 91.9% by the end of 2025, slightly down from 92.3% reported in the first quarter. Additionally, expectations include a modest positive growth in GAAP rent spread. The analyst has also adjusted their 2025 funds from operations estimate for CDP upward by one cent, aligning it with the midpoint of the company's guidance.

Wall Street Analysts Forecast

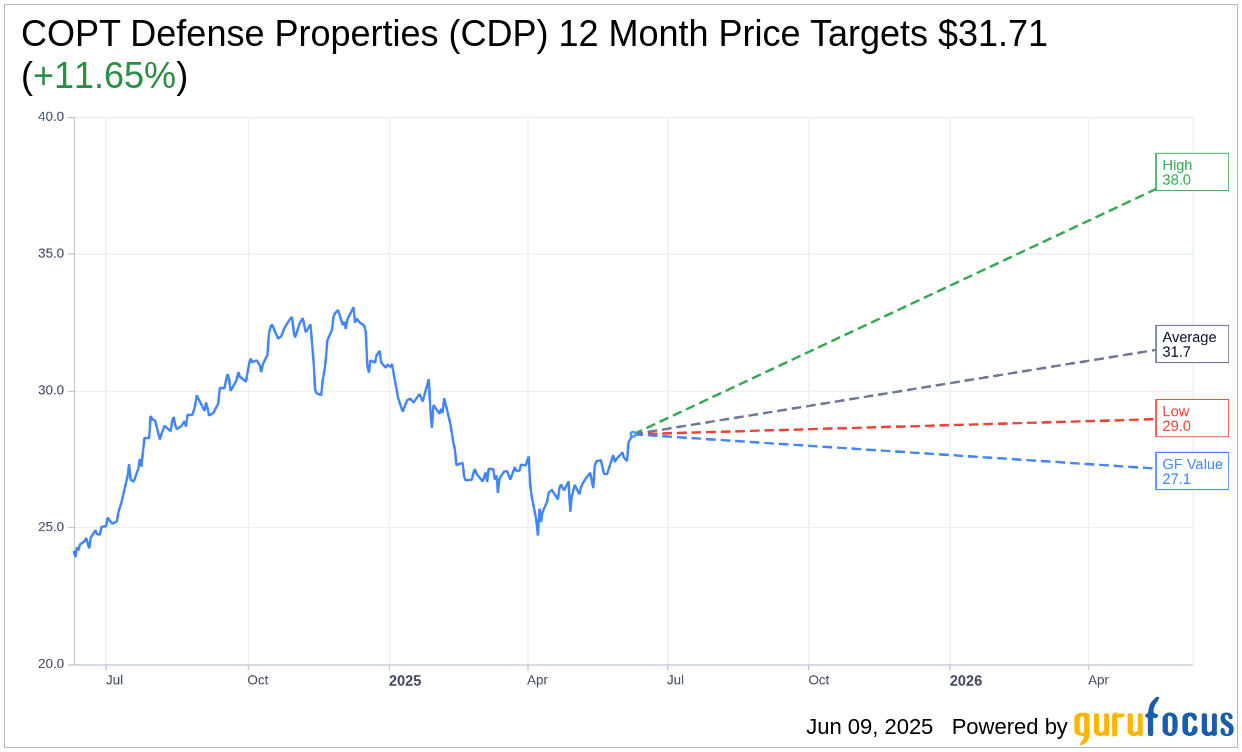

Based on the one-year price targets offered by 7 analysts, the average target price for COPT Defense Properties (CDP, Financial) is $31.71 with a high estimate of $38.00 and a low estimate of $29.00. The average target implies an upside of 11.65% from the current price of $28.41. More detailed estimate data can be found on the COPT Defense Properties (CDP) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, COPT Defense Properties's (CDP, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for COPT Defense Properties (CDP, Financial) in one year is $27.07, suggesting a downside of 4.7% from the current price of $28.405. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the COPT Defense Properties (CDP) Summary page.

CDP Key Business Developments

Release Date: April 29, 2025

- FFO per Share: $0.65, a 4.8% year-over-year increase.

- Same Property Cash NOI: Increased 7.1% year-over-year.

- Leasing Activity: 179,000 square feet of vacancy leasing signed year-to-date, 45% of the full-year target.

- Tenant Retention: 75% during the quarter.

- Portfolio Occupancy: Total portfolio at 93.6%, defense IT portfolio at 95.3%.

- Dividend Increase: Annual dividend increased by $0.04, maintaining a 65% AFFO payout ratio.

- Development Leasing Pipeline: 1.2 million square feet of opportunities considered 50% likely to win or better within two years.

- Debt Profile: 98% of debt at fixed rates, planning a $400 million bond issuance in Q4 2025.

- 2025 FFO per Share Guidance: Maintained at $2.66 at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- COPT Defense Properties (CDP, Financial) increased its annual dividend by $0.04, marking the third consecutive year of dividend increases.

- The company reported a 4.8% year-over-year increase in FFO per share, reaching $0.65, which is at the midpoint of guidance.

- Same property cash NOI increased by 7.1% year-over-year, indicating strong operational performance.

- CDP achieved 179,000 square feet of vacancy leasing year-to-date, which is 45% of its full-year target, with significant activity in defense IT locations.

- The company maintains a strong balance sheet with 98% of its debt at fixed rates, positioning it well for future opportunities.

Negative Points

- Concerns about potential impacts from defense spending reallocations and Doge initiatives, although CDP has not seen direct effects yet.

- The company faces challenges with power availability for its data center development in Iowa, potentially delaying projects.

- There is uncertainty in the macroeconomic environment, including interest rate volatility, which could impact future bond issuances.

- CDP's stock performance has not met expectations, possibly due to market fears despite strong business fundamentals.

- The company has a conservative underwriting period of 18 months to two years for backfilling non-renewed spaces, which could impact short-term occupancy rates.