Key Takeaways

- Cracker Barrel (CBRL, Financial) launches a $275 million convertible senior notes offering, impacting their share price significantly.

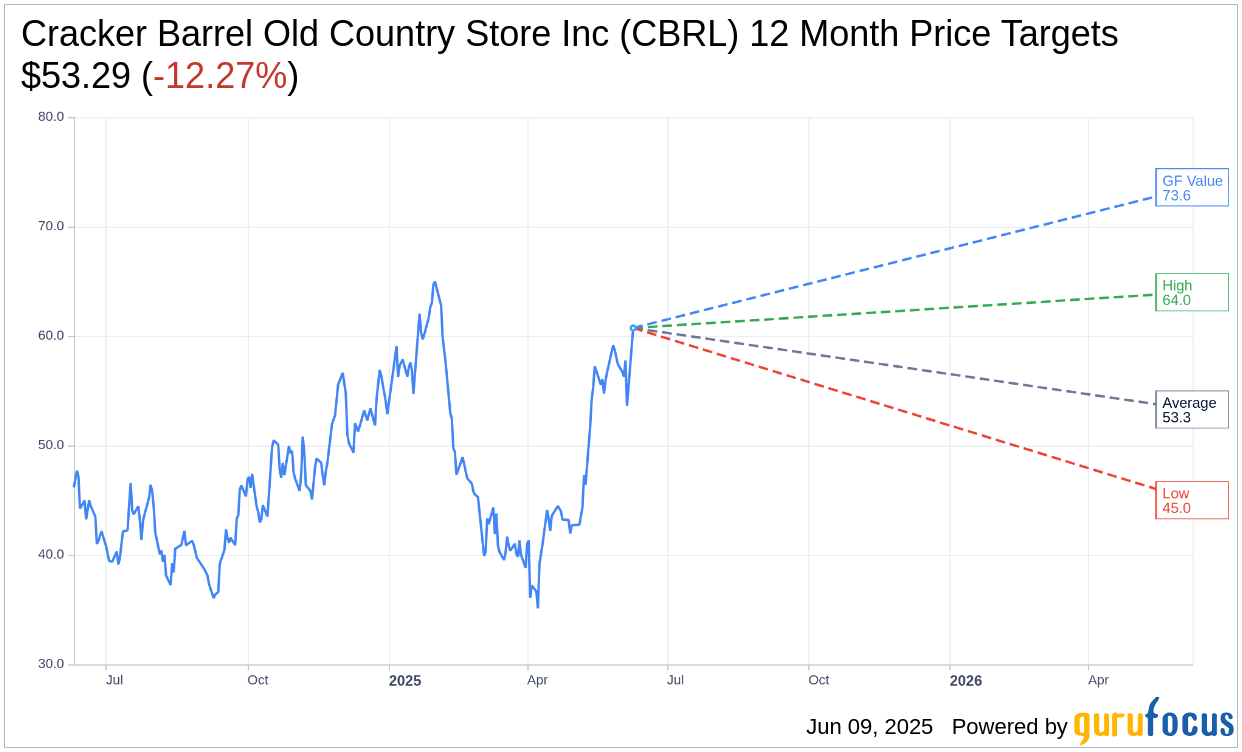

- Analysts provide a mixed outlook with a "Hold" status and price targets reflecting potential volatility.

- GuruFocus estimates suggest a notable upside potential, indicating a long-term positive outlook.

Cracker Barrel's Convertible Senior Notes Offering

Cracker Barrel Old Country Store Inc. (CBRL) has announced a substantial financial move by issuing $275 million in convertible senior notes due 2030. This offering, conducted via a private placement aimed at institutional investors, includes an option to increase by an additional $41.25 million. This strategic financial maneuver is primarily geared towards funding capped call transactions and addressing general corporate needs. However, the announcement led to an 8% decline in CBRL shares during after-hours trading, reflecting investor caution.

Analysts' Price Targets and Recommendations

Wall Street analysts have provided a range of price targets for Cracker Barrel, with insights based on evaluations from seven analysts. The average target price is set at $53.29, with the highest estimate reaching $64.00 and the lowest at $45.00. This average target suggests a potential downside of 12.27% from the current trading price of $60.74. Investors can explore more comprehensive forecasts on the Cracker Barrel Old Country Store Inc (CBRL, Financial) Forecast page.

The consensus from ten brokerage firms places Cracker Barrel at an average brokerage recommendation of 3.2, signaling a "Hold" status. This ranking falls on a scale of 1 to 5, where 1 represents a Strong Buy and 5 suggests a Sell, underscoring a neutral stance among analysts.

GuruFocus's Long-Term Valuation Insight

According to GuruFocus estimates, Cracker Barrel's one-year GF Value stands at $73.59, indicating a potential upside of 21.16% from the current price of $60.74. The GF Value represents GuruFocus' assessment of a stock's fair trading value, based on historical trading multiples, past business growth, and projected future business performance. Investors seeking detailed valuation metrics can visit the Cracker Barrel Old Country Store Inc (CBRL, Financial) Summary page.