Investment firm Jefferies has revised its rating for Arch Capital (ACGL, Financial), shifting from a Buy to a Hold recommendation. The updated price target has been set at $100, a decrease from the previous target of $106. This adjustment is due to the expected mid-year decline in catastrophe pricing, which is anticipated to impact Arch Capital's growth and profit margins.

Jefferies' analysis highlights increasing competition within the catastrophe and specialty sectors, prompting a reduction in growth forecasts for Arch Capital. Despite these challenges, the firm projects that primary casualty lines may offer some support to the company's revenue streams. Overall, the assessment points to rising competitive pressures for Arch Capital moving forward.

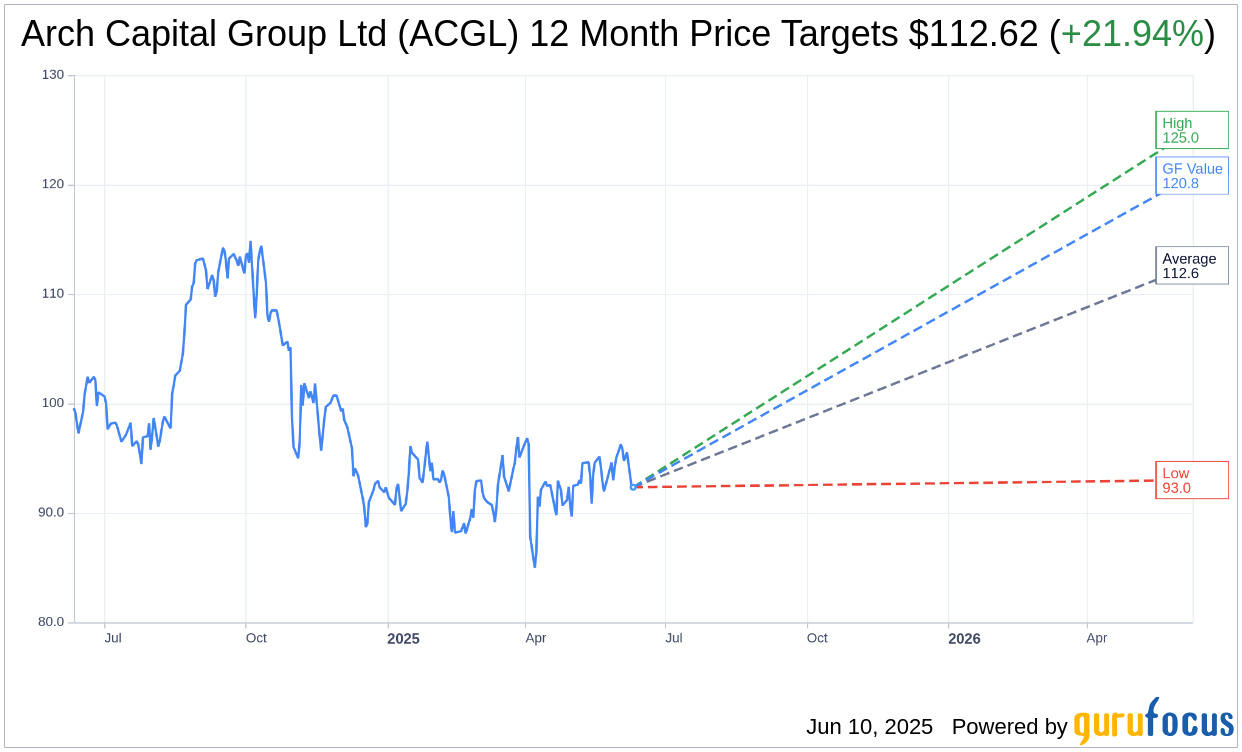

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Arch Capital Group Ltd (ACGL, Financial) is $112.62 with a high estimate of $125.00 and a low estimate of $93.00. The average target implies an upside of 21.94% from the current price of $92.35. More detailed estimate data can be found on the Arch Capital Group Ltd (ACGL) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Arch Capital Group Ltd's (ACGL, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Arch Capital Group Ltd (ACGL, Financial) in one year is $120.83, suggesting a upside of 30.84% from the current price of $92.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Arch Capital Group Ltd (ACGL) Summary page.

ACGL Key Business Developments

Release Date: April 30, 2025

- After-Tax Operating Income: $587 million.

- Operating Earnings Per Share: $1.54.

- Annualized Operating Return on Equity: 11.5%.

- Catastrophe Losses: $547 million, primarily from California wildfires.

- Combined Ratio (Reinsurance): 91.8, inclusive of 18 points of catastrophic losses.

- Net Premium Written (Insurance Segment): $1.9 billion, a 25% increase from Q1 2024.

- Underwriting Income (Mortgage Segment): $252 million.

- Invested Assets: Increased by 4% to $43.1 billion.

- Ex-Cat Accident Year Combined Ratio: 81%.

- Favorable Prior Year Development: $167 million pre-tax, or 4 points on the combined ratio.

- Net Premiums Written (Reinsurance Segment): Growth of 2.2%.

- Delinquency Rate (US MI Business): 1.96%.

- Net Investment Income and Income from Funds: $431 million pre-tax, or $1.13 per share pre-tax.

- Cash Flow from Operations: Approximately $1.5 billion for the quarter.

- Effective Tax Rate on Pretax Operating Income: 11.7%.

- Common Shareholders' Equity: $20.7 billion.

- Debt Plus Preferred to Capital Ratio: 14.7%.

- Share Repurchases: $196 million in Q1, additional $100 million in April.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Arch Capital Group Ltd (ACGL, Financial) reported solid first-quarter results with $587 million of after-tax operating income and an annualized operating return on equity of 11.5%.

- The company achieved a 91.8 combined ratio in its Reinsurance segment, demonstrating strong underlying profitability despite substantial catastrophe losses.

- The Insurance segment saw a 25% increase in net premium written, driven by the integration of the Middle Market Commercial and Entertainment businesses.

- The Mortgage segment contributed $252 million of underwriting income, maintaining a low delinquency rate below 2%.

- Invested assets increased by 4% to $43.1 billion, providing a sustainable contributor to group earnings.

Negative Points

- Arch Capital Group Ltd (ACGL) faced $547 million in catastrophe losses, primarily from California wildfires, impacting the property and casualty segment.

- The PNC market has become increasingly competitive, posing challenges for premium growth.

- Specialty premium writings declined due to non-renewing a large structural transaction and weaker margins in Cyber and parts of the International treaty business.

- Economic uncertainty, including potential impacts of tariffs and inflationary risks, poses challenges for some business segments.

- The company experienced modest growth in net premium written in the Reinsurance segment due to increased competition and more risk retention by ceding companies.