Recursion Pharmaceuticals (RXRX, Financial) has announced a strategic update involving a reduction in its workforce and infrastructure, aligning with its previously stated streamlined operating approach. This move is set to extend the company's projected cash runway to the last quarter of 2027. The restructuring will result in around a 20% decrease in employees, with an anticipated cost of about $11 million for severance and related expenses, mostly to be incurred by the end of 2025.

For 2025, Recursion aims to keep its cash burn under $450 million, dropping to less than $390 million in 2026, not counting partnership inflows or one-time severance payouts. The company may gain over $100 million in milestone payments from partners by the end of 2026. For the second quarter ending June 30, 2025, RXRX expects to maintain cash reserves exceeding $500 million, slightly down from $509 million at the end of the previous quarter. This projection considers operational streamlining, a $28 million R&D tax credit, partnership funds, and use of its at-the-market program, balanced against severance costs.

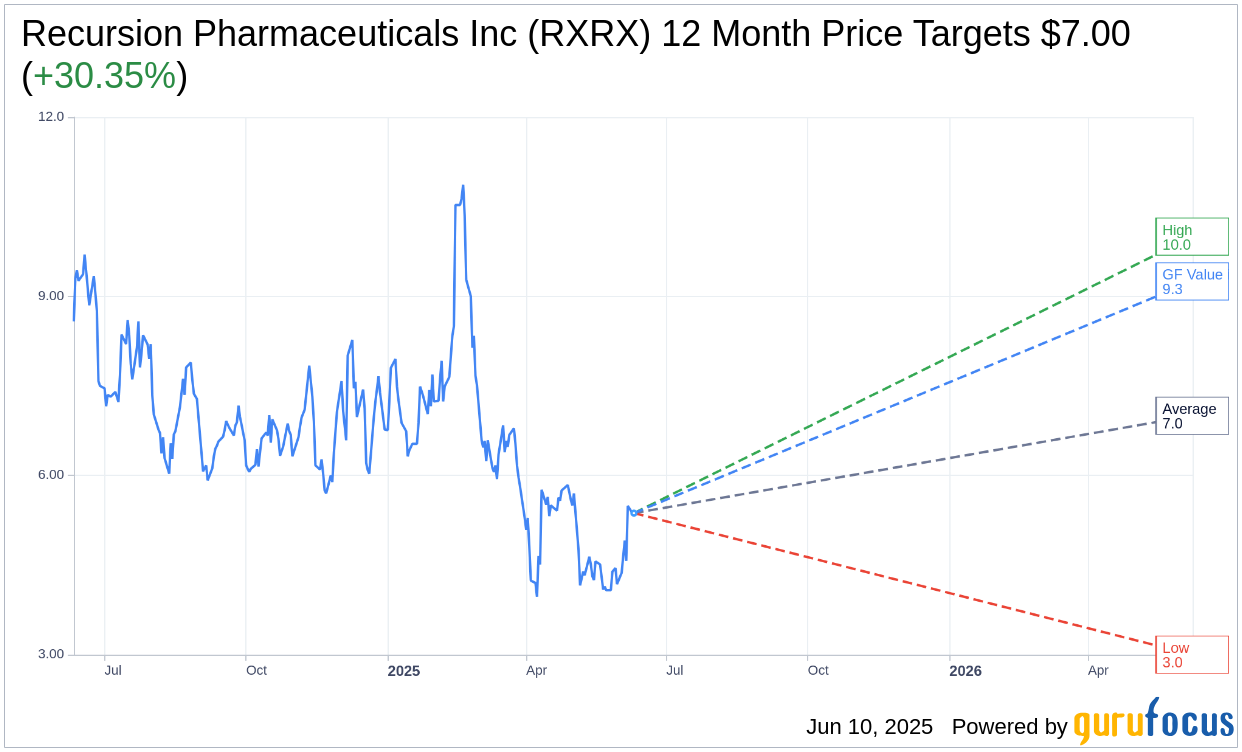

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Recursion Pharmaceuticals Inc (RXRX, Financial) is $7.00 with a high estimate of $10.00 and a low estimate of $3.00. The average target implies an upside of 30.35% from the current price of $5.37. More detailed estimate data can be found on the Recursion Pharmaceuticals Inc (RXRX) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Recursion Pharmaceuticals Inc's (RXRX, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Recursion Pharmaceuticals Inc (RXRX, Financial) in one year is $9.25, suggesting a upside of 72.25% from the current price of $5.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Recursion Pharmaceuticals Inc (RXRX) Summary page.

RXRX Key Business Developments

Release Date: May 05, 2025

- Cash Position: Ended the quarter with $509 million in cash.

- Cash Burn: $118 million during Q1 2025, including cash operating expenses and capital expenditures.

- Cash Runway: Expected to extend into mid-2027.

- Partnership Revenue: Over $450 million earned from collaborations to date.

- Operational Budget: Targeting less than or equal to $450 million for 2025, down from $600 million in 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Recursion Pharmaceuticals Inc (RXRX, Financial) has developed an advanced Recursion 2.0 platform, which integrates multimodal data and AI to enhance drug discovery and development efficiency.

- The company has successfully secured over $450 million through partnerships with major pharmaceutical companies like Sanofi and Roche Genentech, demonstrating strong external validation.

- Recursion Pharmaceuticals Inc (RXRX) is focusing on a more streamlined and strategic R&D portfolio, prioritizing programs with higher probabilities of success.

- The company has unveiled a pipeline with more than five clinical and preclinical programs, including promising candidates like REC-617 and REC1245, which show potential in oncology and rare diseases.

- Recursion Pharmaceuticals Inc (RXRX) is committed to disciplined capital allocation and has a cash runway extending into mid-2027, supported by strategic partnerships and efficient operational adjustments.

Negative Points

- The company has decided to discontinue several programs, including NF2, CCM, and C. diff, due to strategic considerations and lack of differentiation in the current market landscape.

- Recursion Pharmaceuticals Inc (RXRX) faces challenges in the macroeconomic environment, necessitating disciplined and thoughtful decision-making to ensure long-term sustainability.

- The FAP program, while showing some preliminary efficacy, still requires further investigation and data to fully understand its potential and address non-responder issues.

- The company is strategically pausing the development of the LSD1 program to reassess opportunities for a more differentiated target product profile.

- Recursion Pharmaceuticals Inc (RXRX) is navigating a competitive landscape in oncology and rare diseases, requiring continuous innovation and differentiation to maintain its market position.