- Uber Technologies (UBER, Financial) teams up with Wayve to test Level 4 autonomous vehicles in London, aiming for urban growth.

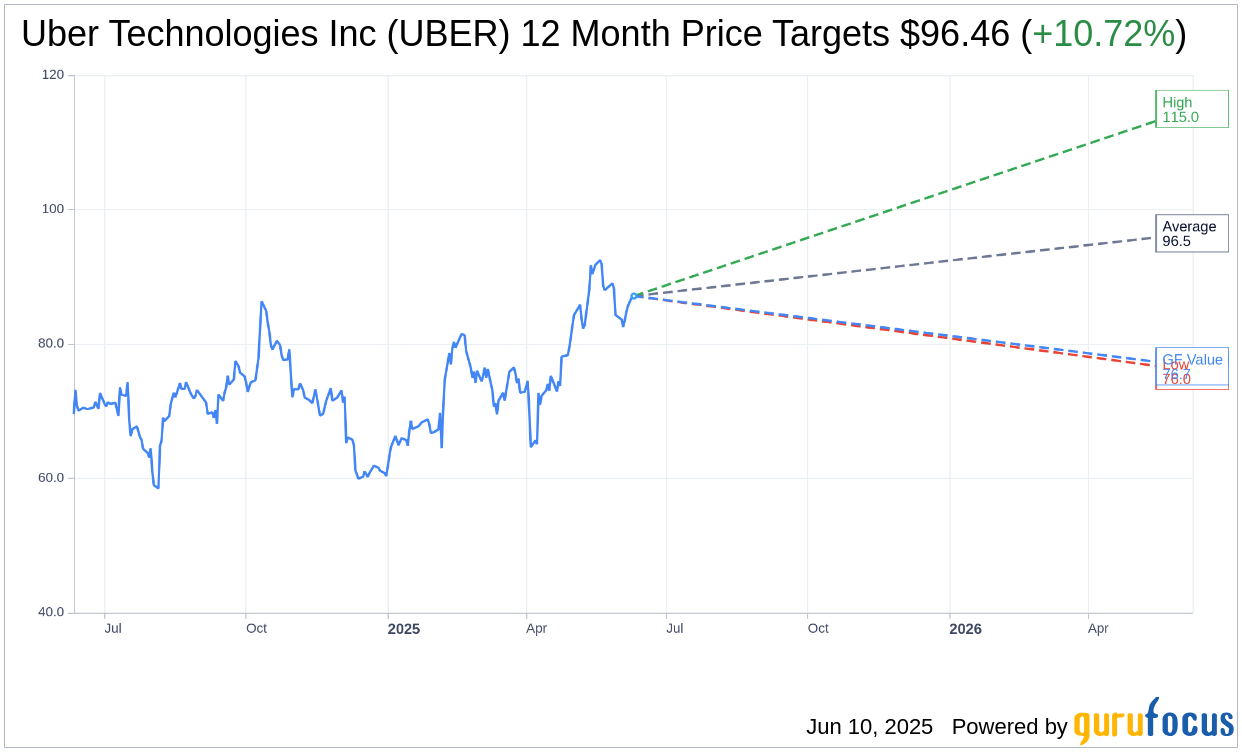

- Analyst target prices suggest a potential upside of 10.72% for Uber stock from its current value.

- GuruFocus estimates present a contrasting view with a predicted downside of 12.01%.

Uber and Wayve: A Strategic Partnership for Autonomous Trials

Uber Technologies (UBER) has embarked on an ambitious partnership with UK-based Wayve to initiate public-road trials of Level 4 autonomous vehicles right in the heart of London. By combining Wayve's advanced AI technology with Uber's extensive global network, this strategic collaboration is designed to tackle the unique challenges of urban environments, which are notably different from those in the U.S. The initiative is set to drive growth and contribute to economic enhancement by 2026.

Wall Street Analysts’ Insights

Offering insights from 44 analysts, the average one-year price target for Uber Technologies Inc (UBER, Financial) stands at $96.46, with estimates ranging from a high of $115.00 to a low of $76.00. This average target indicates a potential upside of 10.72% from the current stock price of $87.12. For more detailed predictions and insights, visit the Uber Technologies Inc (UBER) Forecast page.

The consensus among 53 brokerage firms rates Uber Technologies Inc (UBER, Financial) at an average brokerage recommendation of 2.0, translating to an "Outperform" status. The rating scale extends from 1 (Strong Buy) to 5 (Sell).

GuruFocus Valuation Estimates

According to estimates from GuruFocus, the projected GF Value for Uber Technologies Inc (UBER, Financial) in the coming year is $76.66. This valuation suggests a downside of 12.01% from the current price of $87.12. The GF Value represents GuruFocus' assessment of the stock's fair trading value, calculated through historical trading multiples alongside past business growth and future performance forecasts. For extended data, explore the Uber Technologies Inc (UBER) Summary page.