- Rolls-Royce (RYCEY, Financial) stock sees a 2.6% uptick after securing a key nuclear project.

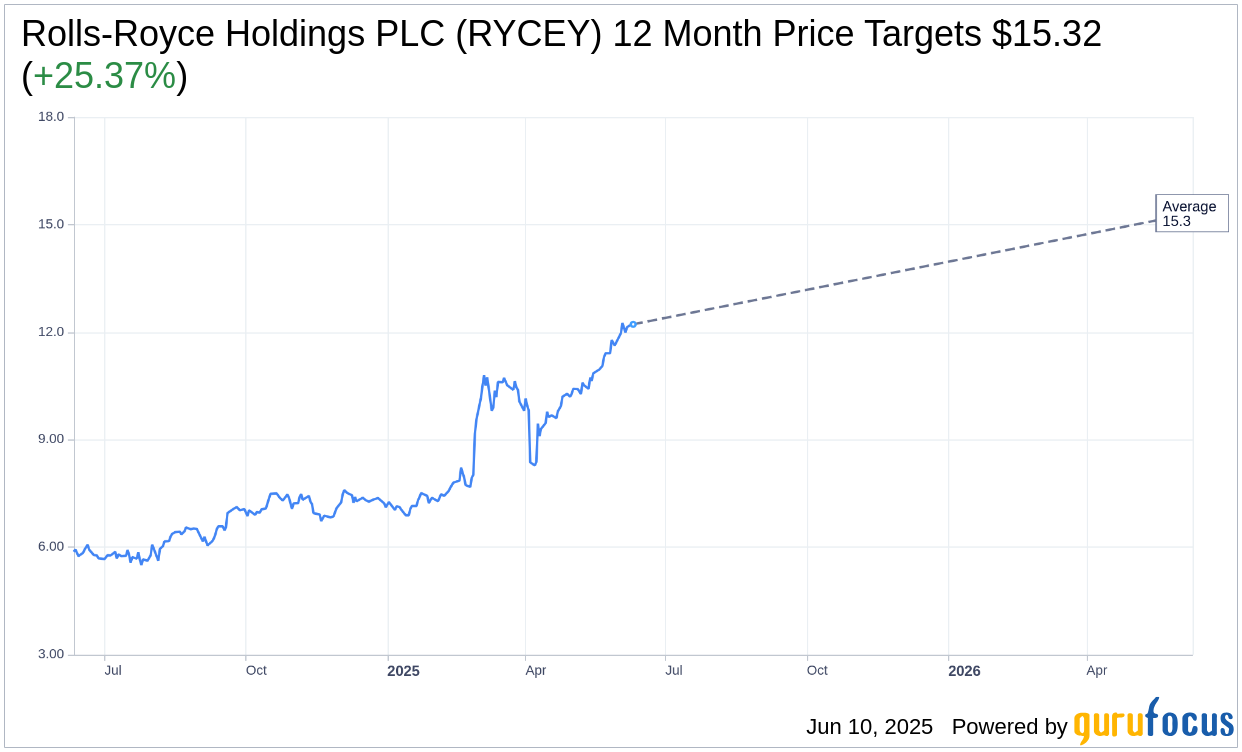

- Wall Street analysts suggest a potential 25.37% upside for Rolls-Royce shares.

- GuruFocus indicates a significant downside risk based on GF Value estimates.

Rolls-Royce’s Strategic Win in Nuclear Energy

Rolls-Royce Holdings PLC (RYCEY) shares rose by 2.6% in the London market, fueled by the company's selection to construct the United Kingdom's first small modular reactors. This major move is part of a comprehensive government-backed nuclear strategy, which allocates a substantial £2.5 billion ($3.4 billion) over the next four years. The company successfully surpassed rivals such as Westinghouse and a joint venture between GE and Hitachi, securing its position as a front-runner in the nuclear energy race.

Wall Street Analysts' Insights

According to projections from analysts, the average one-year price target for Rolls-Royce Holdings PLC (RYCEY, Financial) is set at $15.32. This price target, with both high and low estimates matching at $15.32, indicates a promising potential upside of 25.37% from the current trading price of $12.22. For a comprehensive breakdown of these estimations, visit the Rolls-Royce Holdings PLC (RYCEY) Forecast page.

The brokerage firm consensus firmly recommends Rolls-Royce Holdings PLC (RYCEY, Financial) as a "Buy," reflected by an average brokerage recommendation score of 1.0. This rating falls on a scale from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

Valuation Challenges Ahead

Despite the optimistic outlook from analysts, GuruFocus presents a contrasting valuation perspective. The estimated GF Value for Rolls-Royce Holdings PLC (RYCEY, Financial) in the next year is projected at $3.99, signaling a notable downside of 67.35% from the current price of $12.22. The GF Value provides an estimated fair trading price for the stock, derived from its historical trading multiples, past growth trends, and anticipated future performance. Detailed analysis and data are available on the Rolls-Royce Holdings PLC (RYCEY) Summary page.