Designer Brands Inc (DBI, Financial) released its 8-K filing on June 10, 2025, reporting financial results for the first quarter ended May 3, 2025. The company, a leading designer, producer, and retailer of footwear and accessories, operates through three segments: U.S. Retail, Canada Retail, and Brand Portfolio. Despite efforts to navigate a volatile market, the company faced significant challenges, resulting in a net sales decline and a reported net loss.

Financial Performance and Challenges

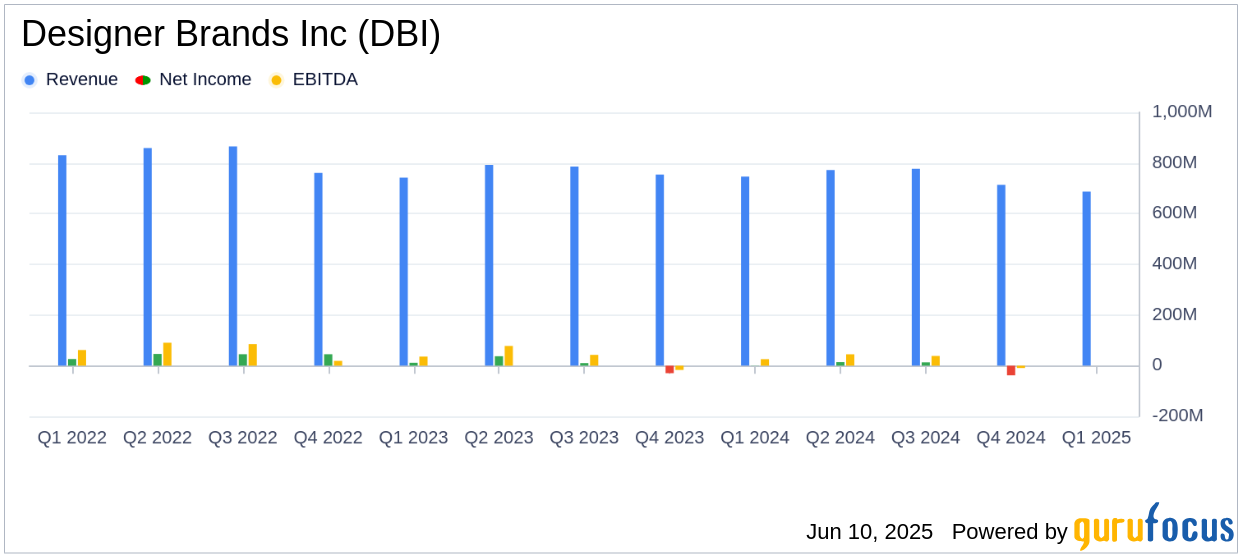

Designer Brands Inc (DBI, Financial) reported a net sales decrease of 8.0% to $686.9 million, falling short of the analyst estimate of $732.81 million. The total comparable sales also declined by 7.8%. The company reported a net loss attributable to Designer Brands Inc of $17.4 million, or a diluted loss per share of $0.36, which is significantly below the estimated earnings per share of $0.04. The adjusted net loss was $12.5 million, or an adjusted diluted loss per share of $0.26.

Doug Howe, Chief Executive Officer, commented on the challenging environment:

We experienced a soft start to 2025 amid an unpredictable macro environment and deteriorating consumer sentiment. We have shifted our near-term focus to amplifying value in our retail channels, preserving margins, controlling costs, and mitigating the impact of tariffs as part of our response to this volatility."

Financial Achievements and Industry Context

Despite the challenges, Designer Brands Inc (DBI, Financial) managed to maintain liquidity with cash and cash equivalents totaling $46.0 million, compared to $43.4 million at the end of the same period last year. The company also has $125.5 million available for borrowings under its senior secured asset-based revolving credit facility. Inventory levels remained stable at $623.6 million compared to $620.5 million last year.

In the apparel and accessories manufacturing industry, maintaining liquidity and inventory levels is crucial for operational stability and meeting consumer demand. The company's focus on cost control and margin preservation is essential in navigating the current economic landscape.

Income Statement and Key Metrics

The gross profit for the first quarter decreased to $295.1 million from $330.0 million in the previous year, with a gross margin of 43.0% compared to 44.2% last year. The operating loss was $7.3 million, a significant decline from an operating profit of $9.4 million in the first quarter of 2024.

Key metrics such as the decline in comparable sales across all segments highlight the challenges faced by the company. The U.S. Retail segment saw a 7.3% decrease in comparable sales, while the Canada Retail segment experienced a 9.2% decline. The Brand Portfolio segment's direct-to-consumer channel reported a 27.0% decrease in comparable sales.

Analysis and Outlook

The first quarter results reflect the impact of macroeconomic uncertainties and changing consumer behaviors on Designer Brands Inc (DBI, Financial). The company's decision to withdraw its 2025 guidance underscores the unpredictability of the current market environment. However, the focus on cost savings and strategic initiatives aimed at long-term value creation may provide a foundation for recovery.

As the company navigates these challenges, its ability to adapt to consumer trends and manage operational efficiencies will be critical. Investors and stakeholders will be closely monitoring the company's performance in the coming quarters to assess its resilience and strategic direction.

Explore the complete 8-K earnings release (here) from Designer Brands Inc for further details.