Clearwater Analytics (CWAN, Financial) has been chosen by Pool Re, the UK's terrorism reinsurer, to upgrade its investment operations, accounting, and risk management systems. Pool Re manages assets exceeding GBP 7.2 billion, and this collaboration aims to enhance its financial infrastructure.

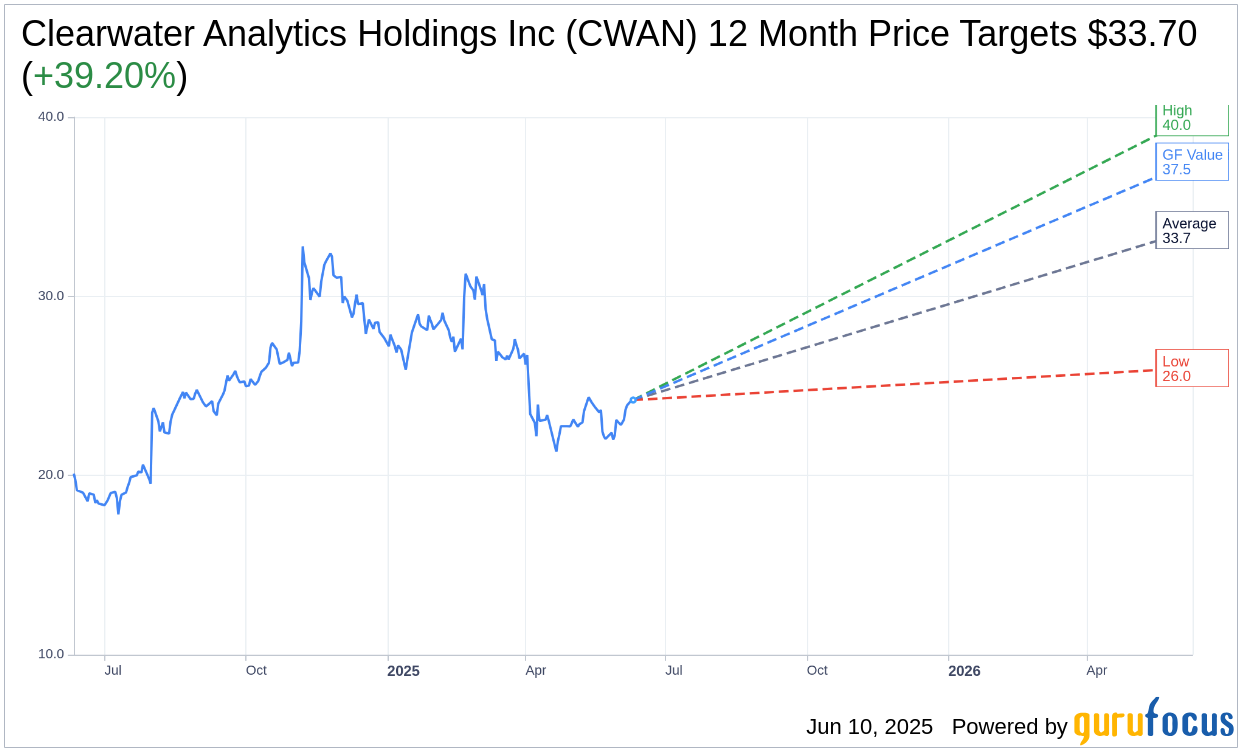

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Clearwater Analytics Holdings Inc (CWAN, Financial) is $33.70 with a high estimate of $40.00 and a low estimate of $26.00. The average target implies an upside of 39.20% from the current price of $24.21. More detailed estimate data can be found on the Clearwater Analytics Holdings Inc (CWAN) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Clearwater Analytics Holdings Inc's (CWAN, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Clearwater Analytics Holdings Inc (CWAN, Financial) in one year is $37.52, suggesting a upside of 54.98% from the current price of $24.21. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Clearwater Analytics Holdings Inc (CWAN) Summary page.

CWAN Key Business Developments

Release Date: April 30, 2025

- Revenue: $126.9 million, up 23.5% year-over-year.

- Annualized Recurring Revenue (ARR): $493.9 million, up 22.7% year-over-year.

- Adjusted EBITDA: $45.1 million, representing 35.5% of revenue, up 40% year-over-year.

- Gross Margin: 78.9%, a 370 basis point improvement from fiscal year 2022.

- GAAP Net Income: $6.9 million.

- Free Cash Flow: $23 million, up 168% year-over-year.

- Total Cash and Cash Equivalents: $282.9 million.

- Net Revenue Retention Rate: 114%.

- Equity-Based Compensation: $27.6 million, 21.7% of Q1 revenue.

- R&D Expense: $37.4 million, 21.6% of revenue on a non-GAAP basis.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Clearwater Analytics Holdings Inc (CWAN, Financial) reported strong revenue growth of 23.5% year-over-year, reaching $126.9 million for Q1 2025.

- The company achieved a record high gross margin of 78.9%, showing significant improvement from previous years.

- Adjusted EBITDA for Q1 2025 was $45.1 million, representing a 35.5% margin and a 40% increase year-over-year.

- The company has a high client retention rate with a gross revenue retention rate of 98% and a net revenue retention rate of 114%.

- Strategic acquisitions of Enfusion, Beacon, and Bistro are expected to enhance Clearwater's platform, offering a comprehensive cloud-native investment management solution.

Negative Points

- The net revenue retention rate decreased slightly from 116% in the previous quarter to 114% in Q1 2025, indicating a slight reduction in client expansion.

- Equity-based compensation expenses remain high, representing 21.7% of Q1 revenue.

- The integration of recent acquisitions may pose challenges and could take time to realize expected synergies and growth acceleration.

- The company faces potential macroeconomic risks that could impact future growth, as indicated by the cautious guidance provided.

- There is a 15% dilution in shares due to recent acquisitions, which may affect shareholder value in the short term.