Key Highlights:

- J.M. Smucker (SJM, Financial) experiences a 13% drop in share value following a decrease in net sales.

- The company's fiscal 2026 earnings forecast misses expectations, influenced by inventory reductions and impairment charges.

- Analysts express concerns over coffee elasticity and rising marketing expenses.

J.M. Smucker's Current Financial Outlook

J.M. Smucker (SJM) has recently experienced a notable 13% decline in its share price, largely due to a reported decrease in net sales. Further compounding investor concerns, the company's fiscal 2026 earnings forecast failed to meet market expectations. This outlook was negatively affected by significant inventory reductions and impairment charges, raising questions about future revenue streams.

Wall Street Analysts' Forecast & Recommendations

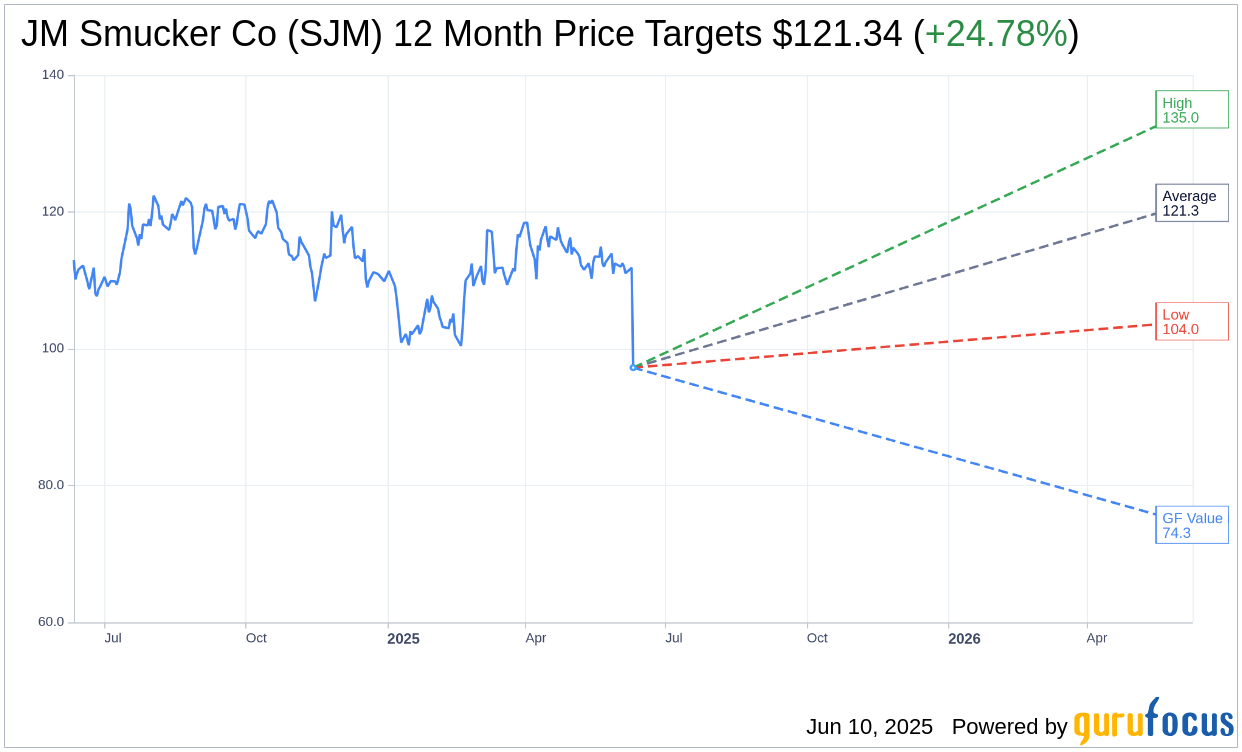

According to price targets provided by a group of 16 analysts, the average target price for JM Smucker Co (SJM, Financial) is pegged at $121.34. The forecasts range from a high of $135.00 to a low of $104.00. This average target suggests a potential upside of 24.78% from the current trading price of $97.24. Investors interested in a more detailed breakdown can visit the JM Smucker Co (SJM) Forecast page.

In terms of brokerage recommendations, the consensus from 20 brokerage firms positions JM Smucker Co's (SJM, Financial) average brokerage recommendation at 2.7, categorizing it as a "Hold." The ranking system ranges from 1, indicating a Strong Buy, to 5, suggesting a Sell.

GuruFocus Valuation Insights

Utilizing GuruFocus estimates, the projected GF Value for JM Smucker Co (SJM, Financial) one year from now is estimated at $74.27. This figure suggests a potential downside of 23.62% relative to the current price of $97.24. The GF Value is a proprietary metric that approximates the fair trading value of a stock, derived from historical trading multiples, past business growth, and anticipated future performance. For those seeking extensive data, the JM Smucker Co (SJM) Summary page offers further insights.