Shares of Super Micro (SMCI, Financial) experienced a decline, falling by 66 cents to approximately $42.47. Despite the downturn, options trading activity for SMCI remained relatively light with approximately 59,000 contracts changing hands. Call options were more popular than puts, resulting in a put/call ratio of 0.44, slightly above the typical ratio of 0.39.

The stock's implied volatility (IV30) increased by 0.4 points to about 66.9, placing it within the lowest 10% of observations from the past year. This suggests an anticipated daily price movement of $1.79. Additionally, the put-call skew has become steeper, reflecting a heightened demand for downside protection among investors.

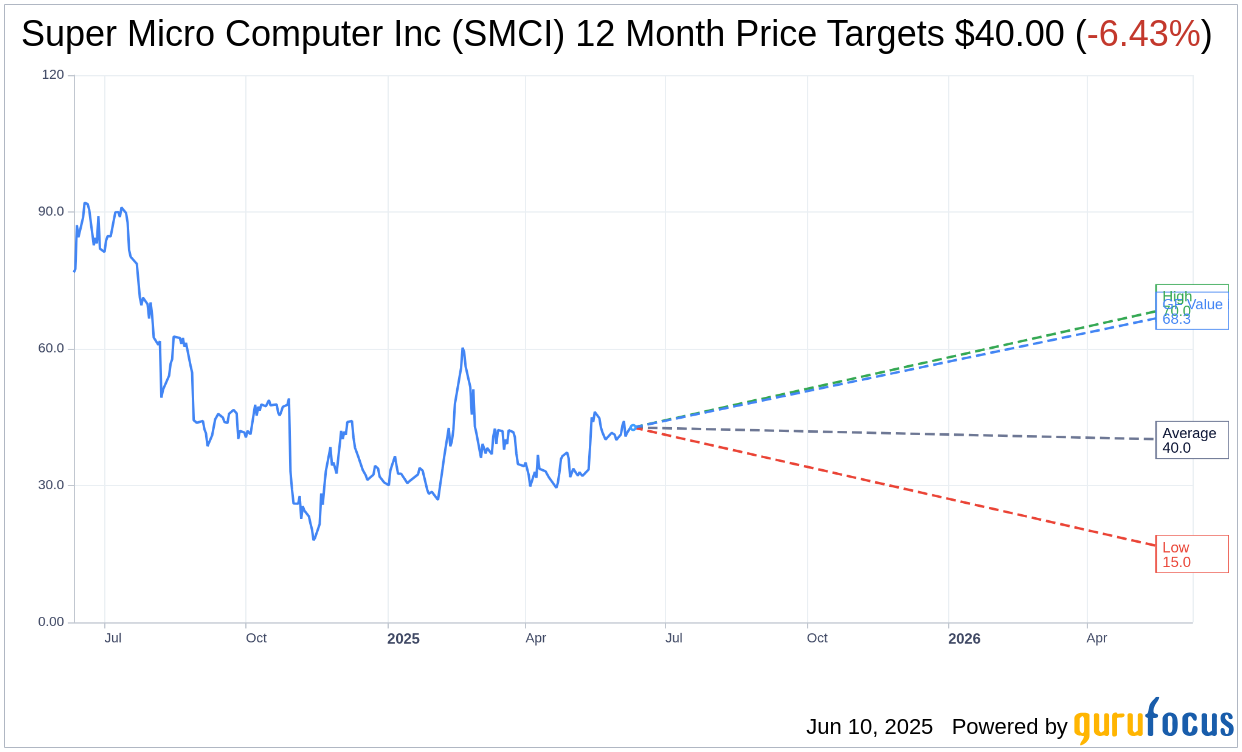

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Super Micro Computer Inc (SMCI, Financial) is $40.00 with a high estimate of $70.00 and a low estimate of $15.00. The average target implies an downside of 6.43% from the current price of $42.75. More detailed estimate data can be found on the Super Micro Computer Inc (SMCI) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Super Micro Computer Inc's (SMCI, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Super Micro Computer Inc (SMCI, Financial) in one year is $68.35, suggesting a upside of 59.9% from the current price of $42.745. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Super Micro Computer Inc (SMCI) Summary page.

SMCI Key Business Developments

Release Date: May 06, 2025

- Revenue: Fiscal Q3 net revenue totaled $4.6 billion, up 19% year over year, but down 19% quarter over quarter.

- Non-GAAP EPS: $0.31 per share, compared to $0.66 last year.

- Gross Margin: Non-GAAP gross margin was 9.7%, down from 11.9% in Q2.

- Operating Expenses: Non-GAAP operating expenses were $216 million, a decrease of 5% quarter over quarter and an increase of 30% year over year.

- Operating Margin: Non-GAAP operating margin was 5%, compared to 7.9% in Q2.

- Cash Flow from Operations: $627 million generated in Q3.

- Free Cash Flow: $594 million during the quarter.

- Inventory: Closing inventory was $3.9 billion, up 7.6% quarter over quarter.

- Net Cash Position: $44 million, compared to a negative net cash position of $479 million last quarter.

- Q4 Revenue Guidance: Expected net sales in the range of $5.6 billion to $6.4 billion.

- Q4 Non-GAAP EPS Guidance: $0.40 to $0.50 per share.

- CapEx: $33 million for Q3, with Q4 expected to be in the range of $45 million to $55 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Super Micro Computer Inc (SMCI, Financial) reported fiscal Q3 2025 revenues of $4.6 billion, up 19% year over year.

- The company achieved a volume shipment of new AI platforms, indicating strong demand and market leadership.

- Super Micro Computer Inc (SMCI) is expanding its global operations, including new facilities in Malaysia, Taiwan, and Europe.

- The company is launching its Data Center Building Block Solution (DCBBS), which promises to reduce power consumption and optimize space.

- Super Micro Computer Inc (SMCI) maintains a strong cash position with $2.54 billion in cash and a net cash position of $44 million.

Negative Points

- Fiscal Q3 net revenue of $4.6 billion was lower than the original forecast due to delayed customer commitments.

- Non-GAAP EPS for fiscal Q3 was $0.31 per share, down from $0.66 last year, impacted by inventory write-downs.

- The company's gross margin decreased to 9.7%, down from 11.9% in the previous quarter, due to higher inventory reserves and lower volume.

- Super Micro Computer Inc (SMCI) faces macroeconomic challenges and tariff impacts, creating uncertainty in forecasting.

- The company experienced a 19% quarter-over-quarter revenue decline, attributed to delayed platform decisions by customers.