- Discover the latest dividend announcement and earnings forecast from TJX Companies (TJX, Financial).

- Understand Wall Street analysts' projections and price targets for TJX Companies Inc.

- Explore GuruFocus's insights on the GF Value and its implications for investors.

The TJX Companies (TJX) has announced a quarterly dividend of $0.425 per share, a continuation of previous payments, providing a forward yield of 1.35%. The retailer maintains its earnings per share (EPS) forecast in the range of $4.34 to $4.43, alongside an expected comparable sales growth of 2% to 3%, despite challenges related to tariffs.

Wall Street Analysts Forecast

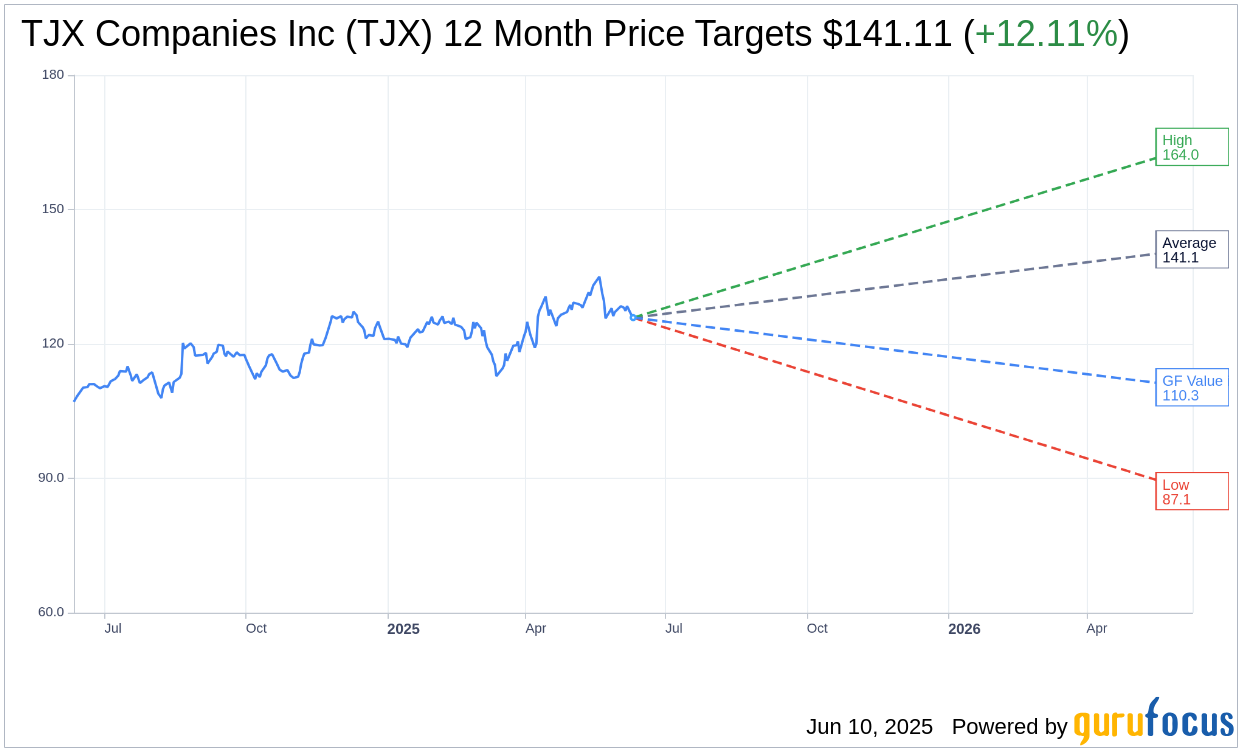

According to price targets from 19 analysts over the next year, TJX Companies Inc (TJX, Financial) has an average price target of $141.11. Forecasts range from a high of $164.00 to a low of $87.12. This average target indicates a potential upside of 12.11% from the current trading price of $125.87. For a deeper dive into these projections, visit the TJX Companies Inc (TJX) Forecast page.

The consensus recommendation among 23 brokerage firms currently positions TJX Companies Inc's (TJX, Financial) average brokerage recommendation at 1.8, reflecting an "Outperform" status. This rating scale spans from 1, which denotes a Strong Buy, to 5, indicating a Sell.

GuruFocus's GF Value Analysis

Based on GuruFocus estimates, the projected GF Value for TJX Companies Inc (TJX, Financial) in a year's time is $110.31, suggesting a potential downside of 12.36% from the current market price of $125.87. The GF Value represents GuruFocus's assessment of the stock's fair trading value, calculated using historical trading multiples, past business growth, and projected future performance. For more comprehensive data, explore the TJX Companies Inc (TJX) Summary page.

Also check out: (Free Trial)