Krispy Kreme (DNUT, Financial) has finalized the divestment of its remaining interest in Insomnia Cookies Holdings, LLC. The sale was concluded with Insomnia Cookies and several current shareholders who were part of the company's previous stake sale in July 2024. This transaction provided Krispy Kreme with a total cash return of $75 million. The funds are earmarked for debt reduction after addressing associated transaction costs.

Josh Charlesworth, CEO of Krispy Kreme, emphasized the company's ongoing efforts to strengthen its financial position while pursuing growth. The focus remains on expanding operations in the U.S. and enhancing international franchise development with a capital-light strategy. The company extends best wishes to Insomnia Cookies and its owners as they aim to maximize the brand's potential.

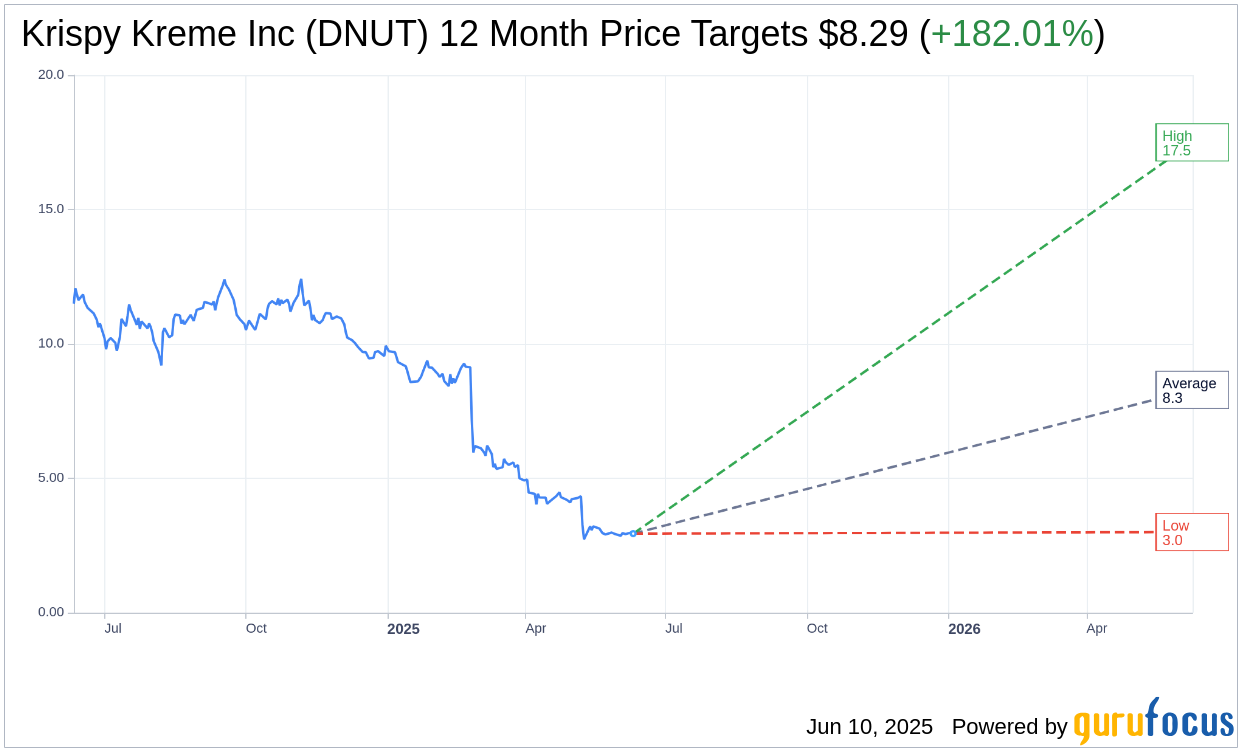

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Krispy Kreme Inc (DNUT, Financial) is $8.29 with a high estimate of $17.50 and a low estimate of $3.00. The average target implies an upside of 182.01% from the current price of $2.94. More detailed estimate data can be found on the Krispy Kreme Inc (DNUT) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Krispy Kreme Inc's (DNUT, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Krispy Kreme Inc (DNUT, Financial) in one year is $12.35, suggesting a upside of 320.07% from the current price of $2.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Krispy Kreme Inc (DNUT) Summary page.

DNUT Key Business Developments

Release Date: May 08, 2025

- Net Revenue: $375.2 million, within guidance, reflecting growth offset by the sale of Insomnia Cookies.

- Organic Revenue Decline: 1%, due to consumer softness in a challenging macro environment.

- Adjusted EBITDA: $24 million with a margin of 6.4%.

- US Segment Organic Revenue Decline: 2.6%, impacted by consumer softness and reduced discount days.

- Average Revenue per Door (APD): $587, down from the previous year.

- International Organic Revenue Growth: 1.5%, led by growth in Canada.

- Market Development Organic Revenue Growth: 2.7%, driven by franchise expansion.

- Adjusted Earnings Per Share: $0.05, a decline from the prior year.

- Cash Flow from Operating Activities: Used $20.8 million, expected to normalize throughout the year.

- Q2 Revenue Expectation: $370 to $385 million.

- Q2 Adjusted EBITDA Expectation: $30 to $35 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Krispy Kreme Inc (DNUT, Financial) is focused on profitable US expansion and international franchise growth, aiming for 100,000 points of access.

- The company is spotlighting its original-based doughnut, which appeals to value-conscious consumers and delivers higher margins.

- Krispy Kreme Inc (DNUT) is expanding its presence in club stores like Costco and Sam's Club, achieving high sales volumes.

- The company is outsourcing its fresh doughnut delivery to improve efficiency and reduce costs, with plans to fully outsource US logistics by mid-next year.

- International franchise partners are delivering strong results, with successful launches in markets like Brazil and France.

Negative Points

- Organic revenue declined by 1% due to consumer softness in a challenging macro environment.

- The company is experiencing a decline in adjusted EBITDA, impacted by the sale of Insomnia Cookies and cybersecurity issues.

- Krispy Kreme Inc (DNUT) is pausing its expansion with McDonald's due to lower-than-expected demand after initial marketing efforts.

- The company is discontinuing quarterly dividends to focus on paying down debt and improving financial flexibility.

- There is a planned reduction in discount days, which contributed to a decline in organic revenue in the US segment.