AllianceBernstein (AB, Financial) disclosed that its assets under management (AUM) reached $803 billion by the end of May, marking an increase from the $781 billion recorded at the close of April. This 2.8% rise in AUM was primarily fueled by market gains, although partially offset by net outflows. In terms of channels, private wealth saw minor inflows, which were counterbalanced by outflows from both institutional and retail sectors.

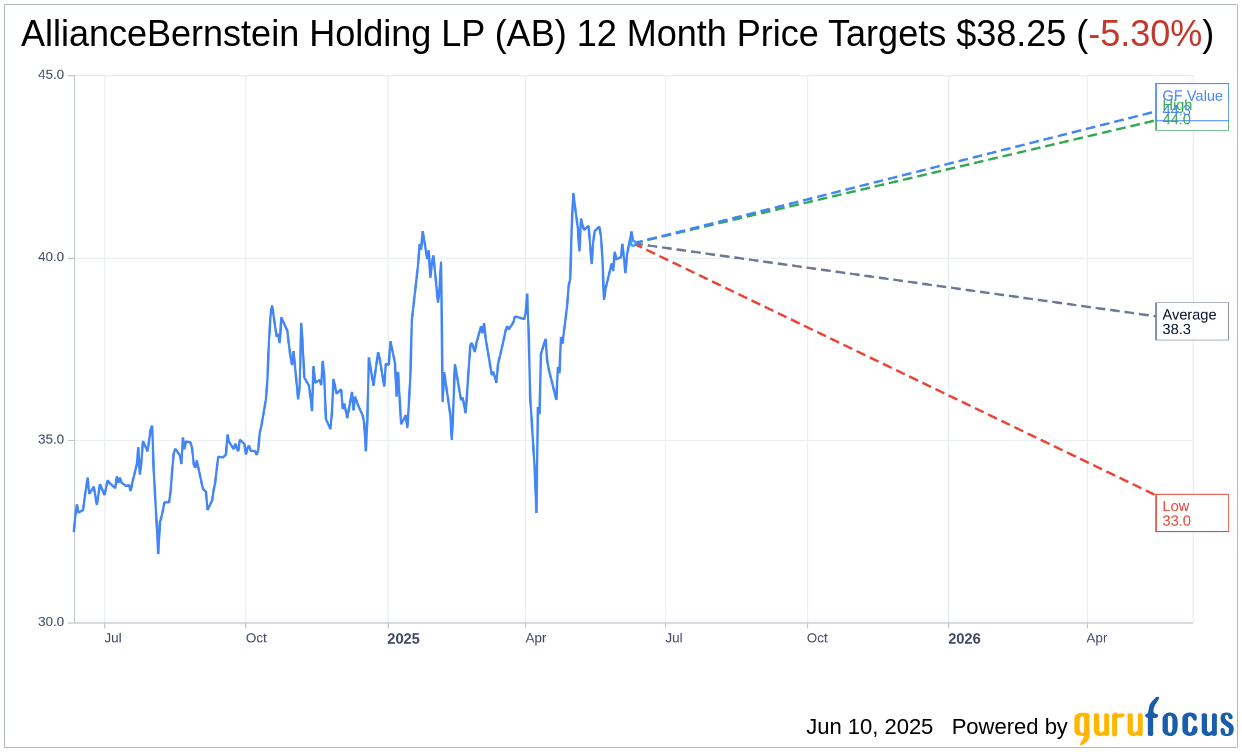

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for AllianceBernstein Holding LP (AB, Financial) is $38.25 with a high estimate of $44.00 and a low estimate of $33.00. The average target implies an downside of 5.30% from the current price of $40.39. More detailed estimate data can be found on the AllianceBernstein Holding LP (AB) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, AllianceBernstein Holding LP's (AB, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for AllianceBernstein Holding LP (AB, Financial) in one year is $44.26, suggesting a upside of 9.58% from the current price of $40.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the AllianceBernstein Holding LP (AB) Summary page.