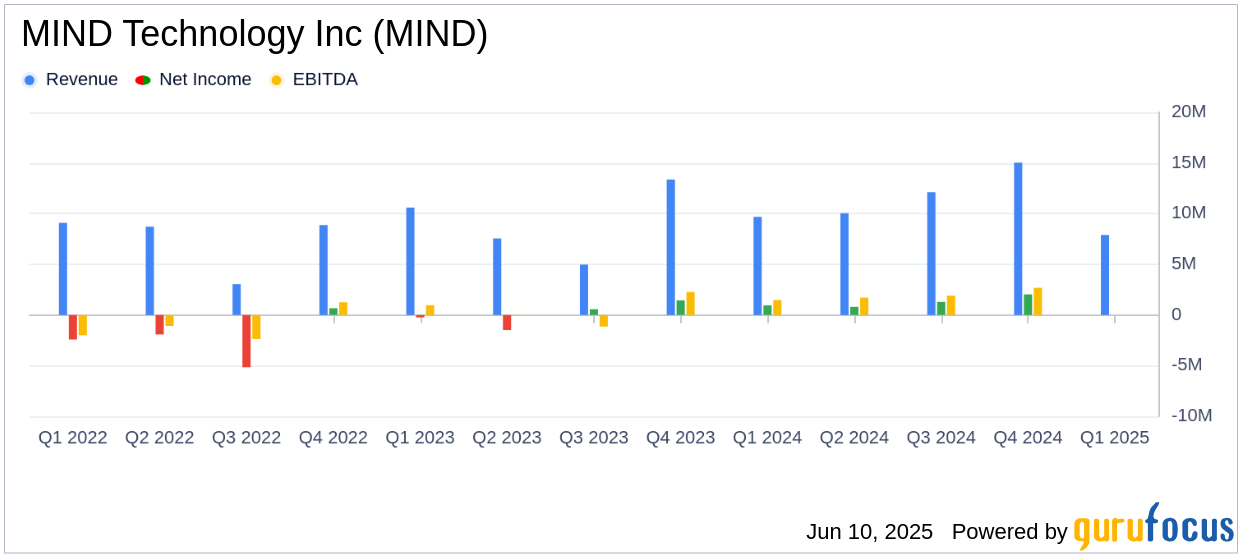

MIND Technology Inc (MIND, Financial) released its 8-K filing on June 10, 2025, detailing its financial performance for the first quarter of fiscal 2026, which ended on April 30, 2025. The company, known for providing technology solutions for exploration, survey, and defense applications, reported revenues of $7.9 million, falling short of the analyst estimate of $10.10 million. This represents a decrease from $15.0 million in the previous quarter and $9.7 million in the same quarter last year.

Company Overview

MIND Technology Inc operates in the oceanographic, hydrographic, defense, seismic, and security industries, with its primary revenue generated from the Seamap Marine Products segment. The company has a global presence, including operations in the United States, China, Norway, Turkey, Singapore, and Canada.

Performance and Challenges

The company reported an operating loss of $658,000 for the quarter, a significant decline from the operating income of $2.8 million in the previous quarter and $730,000 in the same quarter last year. The net loss for the quarter was $970,000, compared to a net income of $2.0 million in the previous quarter and $954,000 in the same quarter last year. The net loss per share was $0.12, a stark contrast to the $0.25 earnings per share in the previous quarter.

Rob Capps, MIND’s President and CEO, stated, “As expected, MIND’s results for the first quarter were down sequentially after a record fourth quarter. This revenue decline was further driven by approximately $5.5 million of orders that, while completed, were not shipped prior to quarter end because either the delivery of third-party components was delayed, or the customers were unable to arrange delivery.”

Financial Achievements and Industry Context

Despite the challenges, MIND Technology reported a cash flow from operations of $4.1 million, resulting in a quarter-end cash balance of approximately $9.2 million, indicating improved liquidity. The backlog for Marine Technology Products related to the Seamap segment was approximately $21.1 million, up from $16.2 million at the end of January 2025.

Key Financial Metrics

The company's adjusted EBITDA from continuing operations was a loss of $179,000, compared to an income of $3.0 million in the previous quarter and $1.5 million in the same quarter last year. This metric is crucial as it provides insight into the company's operational efficiency and cash flow generation capabilities.

| Metric | Q1 Fiscal 2026 | Q4 Fiscal 2025 | Q1 Fiscal 2025 |

|---|---|---|---|

| Revenue | $7.9 million | $15.0 million | $9.7 million |

| Operating Income (Loss) | $(658,000) | $2.8 million | $730,000 |

| Net Income (Loss) | $(970,000) | $2.0 million | $954,000 |

| Adjusted EBITDA | $(179,000) | $3.0 million | $1.5 million |

Analysis and Outlook

The decline in revenue and operating income highlights the challenges MIND Technology faces, particularly with delays in order shipments. However, the increase in backlog and cash flow from operations suggests potential for recovery in the upcoming quarters. The company's focus on optimizing operations and its strong balance sheet position it to pursue strategic opportunities for growth.

Rob Capps further commented, “We are confident that our long-term positive trajectory remains intact. Our focus continues to be on positioning MIND to achieve its full potential.”

Overall, while MIND Technology Inc faces short-term challenges, its strategic initiatives and financial resilience provide a foundation for future growth in the competitive hardware industry.

Explore the complete 8-K earnings release (here) from MIND Technology Inc for further details.