Quick Insights:

- Microsoft maintains steady dividends, offering a forward yield of 0.71%.

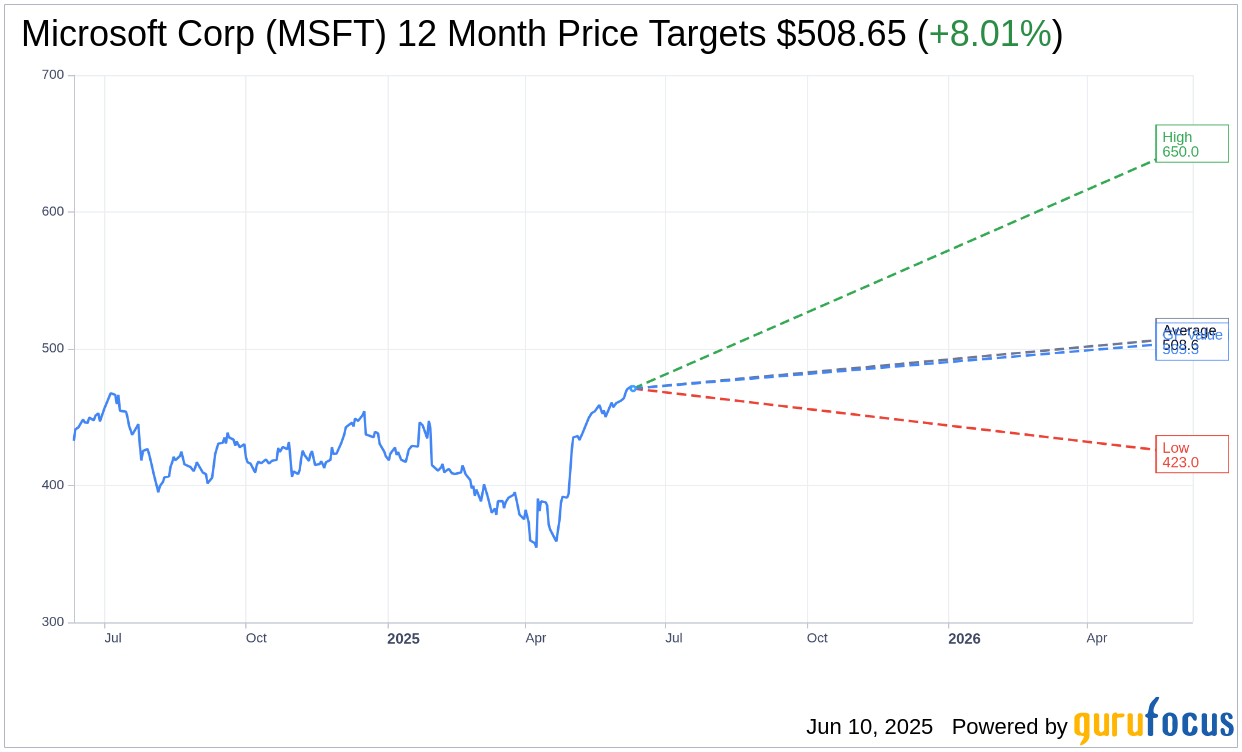

- Analyst forecasts suggest an 8.01% increase in Microsoft's stock price.

- GuruFocus estimates propose a 7.3% potential upside based on GF Value metrics.

Microsoft (MSFT, Financial) has declared a quarterly dividend of $0.83 per share, consistent with its prior payout. Investors eyeing dividends should note the forward yield of 0.71%. The dividend is set for distribution on September 11, with the critical record date on August 21, aligning with the ex-dividend date.

Wall Street Analysts' Projections

According to projections from 49 analysts, the average target price for Microsoft Corp (MSFT, Financial) over the next year is $508.65. Target estimates range from a high of $650.00 to a low of $423.00. The average target price hints at a potential upside of 8.01% compared to the current stock price of $470.92. For further details, visit the Microsoft Corp (MSFT) Forecast page.

With input from 62 brokerage firms, Microsoft's (MSFT, Financial) consensus recommendation currently scores an average of 1.8, marking it in the "Outperform" category. The recommendation scale spans from 1 (Strong Buy) to 5 (Sell).

GuruFocus Valuation Insights

GuruFocus places the GF Value for Microsoft Corp (MSFT, Financial) at $505.29 for the upcoming year. This estimation reflects a potential upside of 7.3% from the present price of $470.92. The GF Value is derived from the stock's historical trading multiples, its previous growth trajectory, and projected future performance. For more detailed data, please refer to the Microsoft Corp (MSFT) Summary page.

Also check out: (Free Trial)