Summary:

- Rolls-Royce (RYCEY, Financial) set to boost its nuclear sector with the development of small modular reactors.

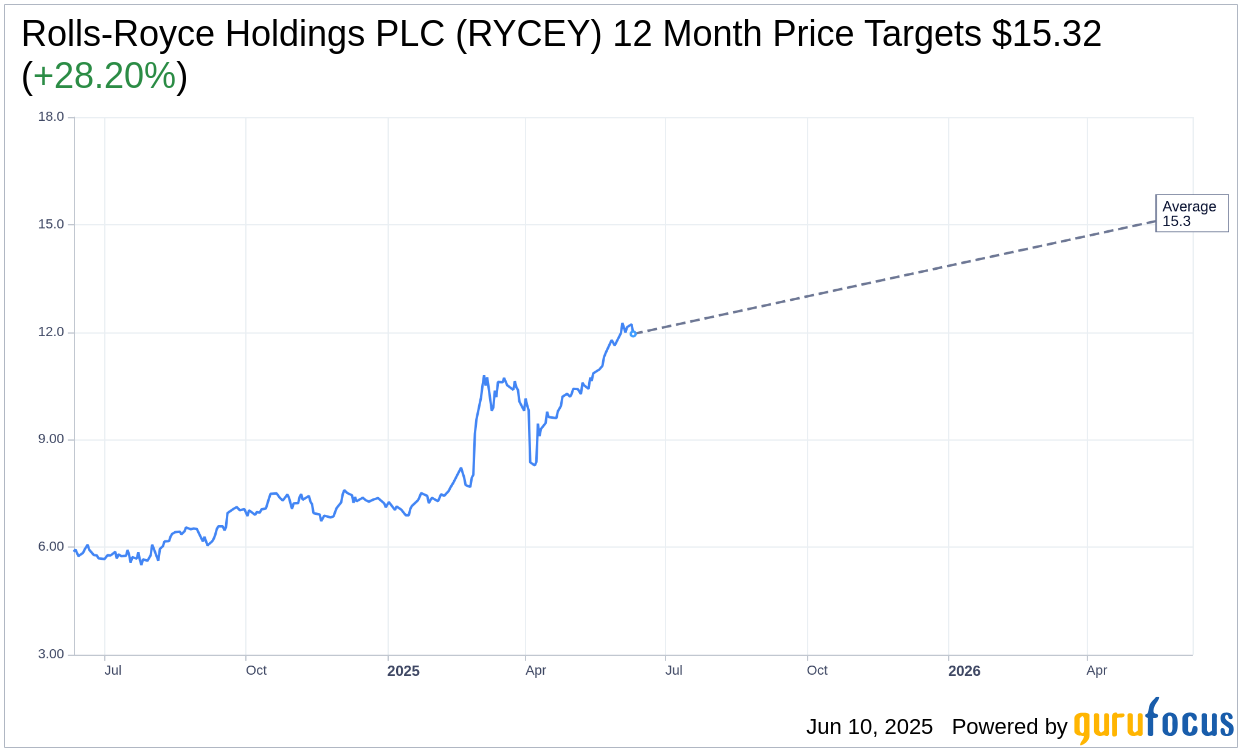

- Analysts predict a potential upside of 28.20% for Rolls-Royce shares.

- Despite a current "Buy" recommendation, GF Value indicates a possible downside.

The United Kingdom has strategically selected Rolls-Royce (RYCEY) to spearhead its inaugural small modular reactor projects. This venture could significantly elevate Rolls-Royce’s nuclear business from its current valuation of approximately £1 billion to an impressive £10 billion. While substantial profit margins may remain on the horizon until the 2030s, securing contracts for these projects could positively influence market perceptions in the shorter term.

Analyst Forecasts for Rolls-Royce

The projections from a single financial analyst envisage Rolls-Royce Holdings PLC (RYCEY, Financial) attaining an average target price of $15.32 over the next year. This forecast aligns both the high and low estimates at $15.32, signifying a potential upside of 28.20% compared to the current share price of $11.95. Investors seeking more comprehensive estimates can find further information on the Rolls-Royce Holdings PLC (RYCEY) Forecast page.

At present, the average recommendation from one brokerage firm for Rolls-Royce Holdings PLC (RYCEY, Financial) stands at 1.0, equating to a "Buy" rating on their scale. This scale ranges from 1 to 5, with 1 implying a Strong Buy and 5 indicating a Sell.

Understanding the GF Value for Rolls-Royce

According to GuruFocus assessments, the estimated GF Value for Rolls-Royce Holdings PLC (RYCEY, Financial) in the coming year is anticipated to be $3.99. This suggests a possible downside of 66.61% from its current trading price of $11.95. The GF Value represents GuruFocus’ fair value estimate, calculated using historical trading multiples, past business growth, and future performance projections. Investors can explore more detailed evaluations via the Rolls-Royce Holdings PLC (RYCEY) Summary page.