Morgan Stanley has begun coverage on TD Synnex (SNX, Financial) with an Overweight rating and a price target set at $145. The investment firm highlights the robust long-term spending in the IT sector and the growing intricacies within the IT ecosystem as positive factors for TD Synnex, recognized as the largest IT distributor globally. Morgan Stanley emphasizes the company's advantages due to its size, investment in cloud infrastructure, strong operational execution, and efficient cost management. These elements are expected to foster growth rates and profit margins that surpass those of its peers, justifying a premium valuation.

Wall Street Analysts Forecast

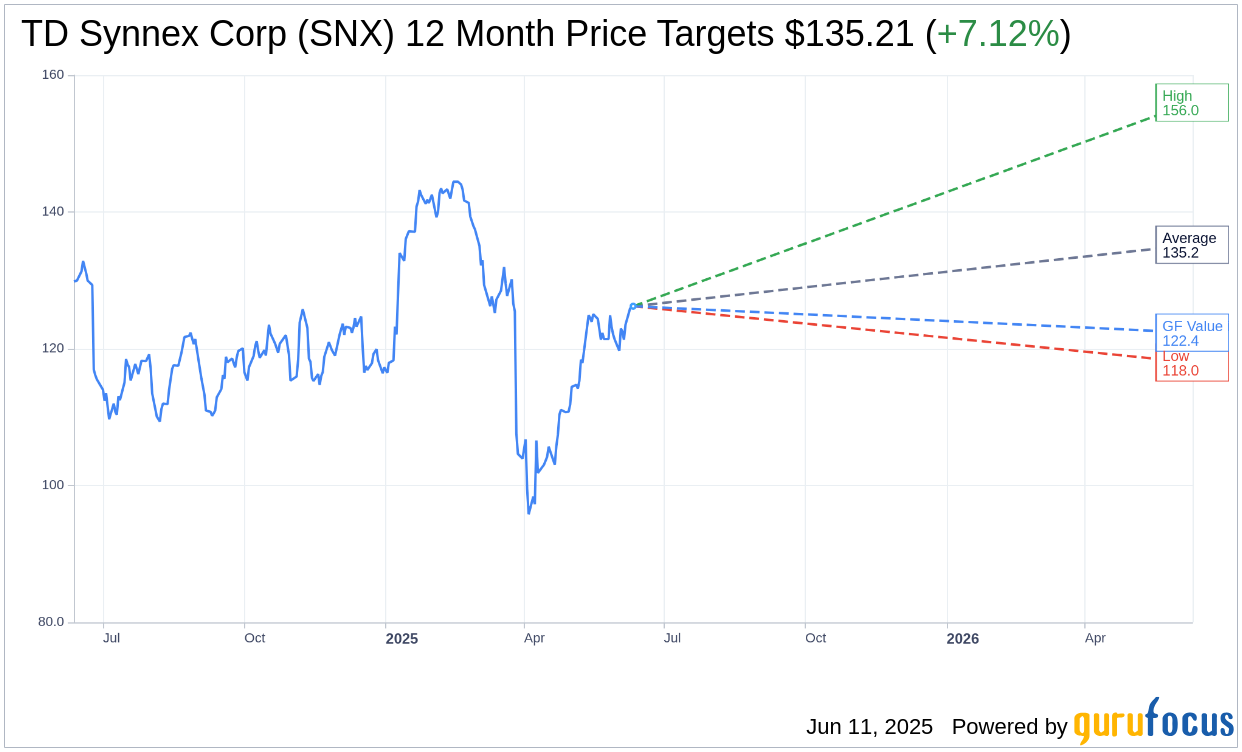

Based on the one-year price targets offered by 9 analysts, the average target price for TD Synnex Corp (SNX, Financial) is $135.21 with a high estimate of $156.00 and a low estimate of $118.00. The average target implies an upside of 7.12% from the current price of $126.22. More detailed estimate data can be found on the TD Synnex Corp (SNX) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, TD Synnex Corp's (SNX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for TD Synnex Corp (SNX, Financial) in one year is $122.36, suggesting a downside of 3.06% from the current price of $126.22. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the TD Synnex Corp (SNX) Summary page.

SNX Key Business Developments

Release Date: March 27, 2025

- Gross Billings: $20.7 billion, up 7.5% year-over-year, 9.5% in constant currency.

- Net Revenue: $14.5 billion, up 4% year-over-year.

- Gross Profit: $1 billion or 4.82% of gross billings.

- Non-GAAP SG&A Expense: $599 million or 2.89% of gross billings.

- Non-GAAP Operating Income: $399 million or 1.92% of gross billings.

- Non-GAAP Net Income: $237 million.

- Non-GAAP Diluted Earnings Per Share: $2.80.

- Free Cash Flow Usage: Approximately $800 million.

- Cash and Cash Equivalents: $542 million.

- Debt: $4.3 billion.

- Gross Leverage Ratio: 2.5 times.

- Net Leverage Ratio: 2.2 times.

- Dividend: $0.44 per common share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- TD Synnex Corp (SNX, Financial) reported a strong start to fiscal year 2025 with gross billings growing by 7.5% year-over-year and 9.5% in constant currency.

- Advanced Solutions and Endpoint Solutions both showed significant growth, with Advanced Solutions growing by 7% and Endpoint Solutions by 8% year-over-year.

- The company expanded its reach to 30,000 active partners and 500,000 end users transacting through its cloud marketplace.

- TD Synnex Corp (SNX) was recognized as a distribution partner of the year by multiple industry leaders, including AWS, Palo Alto Networks, Insight Enterprises, and NVIDIA.

- The company maintained a strong cash position with $542 million in cash and cash equivalents and continued to return value to shareholders through $138 million in share repurchases and dividends in Q1.

Negative Points

- Hyve's performance was below expectations due to a component shipment delay and demand shortfalls, which may persist for a few quarters.

- Gross profit margin declined by 40 basis points year-over-year, primarily due to challenges in the Hyve business.

- Free cash flow usage was approximately $800 million, driven by higher working capital needs, particularly in Hyve.

- Interest expenses were higher than expected at $88 million, due to increased working capital requirements.

- The company faces challenges in the peripherals market, including a decline in printing and the loss of a large, unprofitable business in North America.