Summit Therapeutics (SMMT, Financial) recently caught the attention of Leerink, which has initiated coverage on the company with an Underperform rating and set a price target of $12. The focus is on Ivonescimab, a VEGF-A/PD-1 bispecific developed by Summit, lauded as a promising advancement. Summit's management has been commended for securing the rights to this drug outside of China from Akeso before clinical results were evidently persuasive.

Despite the potential of Ivonescimab, Leerink remains skeptical about its potential to rival well-known treatments like Keytruda. The firm notes that current market expectations might be overly optimistic concerning its potential share in the competitive anti-PD(L)1 market. Leerink points out challenges such as a saturated market, higher clinical success benchmarks, and tougher regulatory demands that could hinder the drug's uptake and approval.

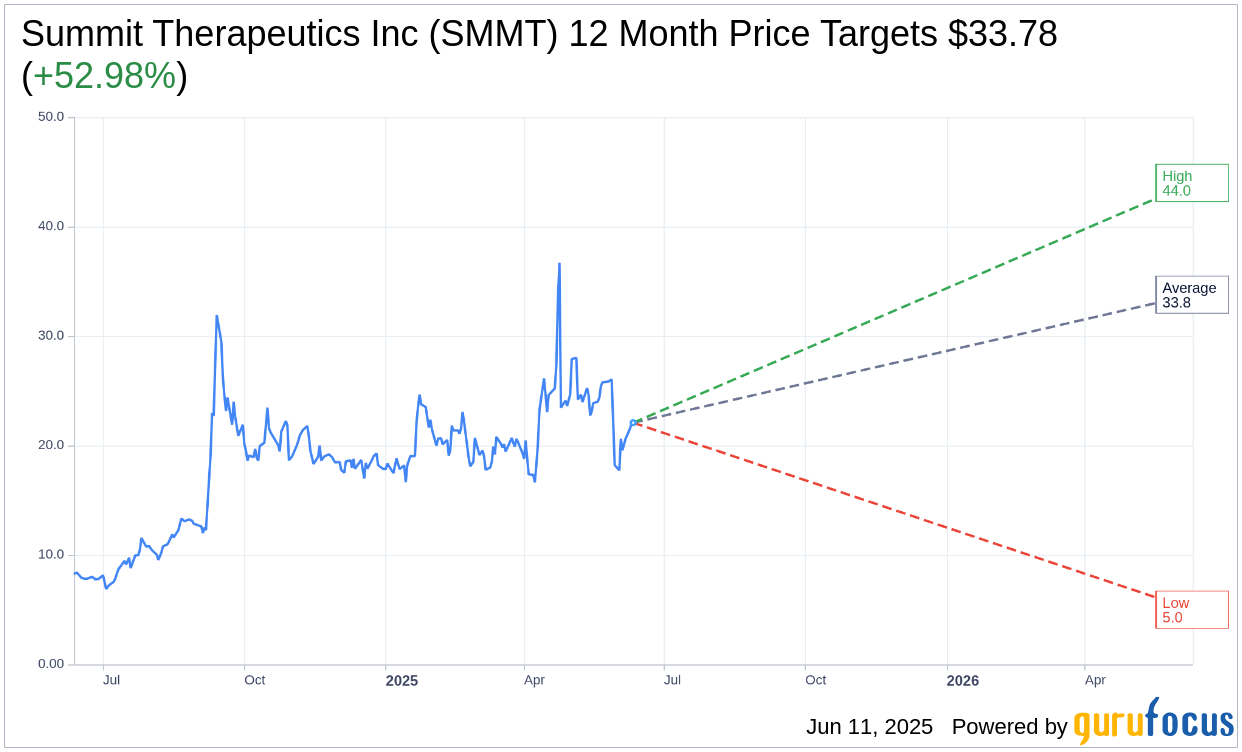

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Summit Therapeutics Inc (SMMT, Financial) is $33.78 with a high estimate of $44.00 and a low estimate of $5.00. The average target implies an upside of 52.98% from the current price of $22.08. More detailed estimate data can be found on the Summit Therapeutics Inc (SMMT) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Summit Therapeutics Inc's (SMMT, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.